Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

Recap of Kesko’s key events in Q3/2025

Kesko will publish its results for the third quarter of 2025 on Thursday, 30 October 2025, at around 8.00 am Finnish time. An English-language audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time. Below is recap of main news and events in Q3.

|

|

NEWS, FINANCIALS AND SHARES

|

|||

|

|

SALES DEVELOPMENTSales figures for September will be released in mid-October. |

|||

DIGITALISATION

|

||||

GROCERY TRADE

|

"Kesko’s sales and result were at a good level in the first half of 2025 considering the fact that consumer confidence remained low in all our operating countries. Our Q2 net sales totalled €3,189 million, up by 3.1% year-on-year. In comparable terms, net sales increased by 1.3%. Our comparable Q2 operating profit stood at €177 million. The comparable operating profit increased when excluding the impact from the share of result from Kesko Senukai. As planned, we completed the three acquisitions of Roslev Trælasthandel, CF Petersen & Søn and Tømmergaarden in Denmark during the first year-half. Following the acquisitions, Kesko’s position in the Danish building and home improvement trade market will strengthen considerably, and our market share will rise to nearly 20%, thus supporting overall growth for Kesko.

In the grocery trade division, net sales amounted to €1,606 million, and comparable operating profit to €111 million. Comparable operating profit improved in grocery store chain operations, but decreased in Kespro and K-Citymarket’s non-food trade. The price programme we launched in January has proceeded according to plans and both the average purchase and customer flows have grown. The loss of market share in grocery trade has become less pronounced, and in the hypermarket segment, K-Citymarket won over market share in Q2. K Group grocery sales increased by 2.0%, impacted by the timing of Easter, which fell on April this year versus March last year. Online grocery sales grew by 10.1%. Sales for the foodservice business decreased by 0.7%, but the business still once again outperformed the market. Grocery price inflation was at 2.3%. Our objective in grocery trade is to strengthen our market position by focusing on quality, prices and our store network while still maintaining good profitability.

In the building and technical trade division, net sales increased and totalled €1,237 million, while the comparable operating profit stood at €51 million. Excluding the impact of the share of result from Kesko Senukai, the division’s comparable operating profit improved slightly. Kesko Senukai did not report its financial figures for the first half of the year as scheduled, which is why in Kesko's reporting the share of result from Kesko Senukai is €0.0 million, versus €6.3 million in the comparison period. The gradual recovery in building and home improvement trade and acquisitions in Denmark lent support to net sales and profit. Gradual recovery in the construction cycle has continued, but the pace has been slower than previously anticipated in all Kesko operating countries, especially in new building construction.

In the car trade division, both net sales and profit increased notably in the second quarter, especially thanks to good performance in new car sales. We also outperformed the market in used car sales, while service sales were down. Net sales for the division totalled €352 million and comparable operating profit €22 million. Sales and profit in sports trade increased.

We are specifying our profit guidance, and now estimate that the comparable operating profit for 2025 will be in the range of €640 – 700 million, while the previous guidance was €640-740 million."

KESKO KEY FIGURES IN APRIL-JUNE 2025:

-

Group net sales in April-June totalled €3,188.8 million (€3,093.4 million); reported net sales grew by 3.1% while comparable net sales grew by 1.3%

-

Comparable operating profit totalled €176.7 million (€178.3 million); comparable operating profit excluding the share of result from Kesko Senukai increased (4-6/2024: €171.9 million excl. Kesko Senukai)

-

Operating profit totalled €177.9 million (€159.2 million)

-

Cash flow from operating activities totalled €323.9 million (€309.0 million)

-

Comparable earnings per share €0.29 (€0.30); reported earnings per share €0.29 (€0.26)

KESKO KEY FIGURES IN JANUARY-JUNE 2025:

-

Group net sales in January-June totalled €6,016.5 million (€5,852.9 million); reported net sales grew by 2.8%, while comparable net sales grew by 1.2%

-

Comparable operating profit totalled €272.3 million (€277.7 million); comparable operating profit excluding the share of result from Kesko Senukai increased

-

Operating profit totalled €267.2 million (€256.4 million)

-

Cash flow from operating activities totalled €299.5 million (€421.6 million)

-

Comparable earnings per share €0.42 (€0.46); reported earnings per share €0.42 (€0.42)

Recap of Kesko's key events on Q2/2015

Kesko will publish its results for the second quarter of 2025 on Tuesday, 22 July, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time, and can be accessed here.

NEWS, FINANCIALS AND SHARES

-

Kesko once again published a Data Balance Sheet report, detailing the ways in which it uses the massive amounts of data at its disposal to create value to customers, businesses and shareholders in innovative and sustainable manners. (report)

-

Kesko issued a voluntary report on its tax footprint and other country-specific tax information in compliance with the recommendations of the GRI 207 standard. (report)

-

Shares:

-

Presentation for Kesko’s Q2 investor roadshow meetings. (presentation)

SALES DEVELOPMENT

Sales figures for June will be released in mid-July.

SUSTAINABILITY

-

Kesko ranked as the most sustainable company in its sector in Europe on the ‘Europe 50’ listing. The sustainability media and research organisation Corporate Knights ranked 50 of Europe’s most sustainable companies for the first time ever. On the overall list, Kesko ranked 19th. (release)

-

Kesko has taken further measures to reduce both the use of plastic packaging and the sugar, salt and saturated fat content of its grocery trade private label products. (release, release)

-

Kesko accelerates the electrification of its transports in grocery trade. The number of electric trucks and vans used in Kesko’s grocery logistics is set to rise to 70 by the end of 2026. By 2030, electric vehicles are estimated to make up some 30% of the transport fleet in Kesko’s grocery trade. (release)

BUILDING AND TECHNICAL TRADE

-

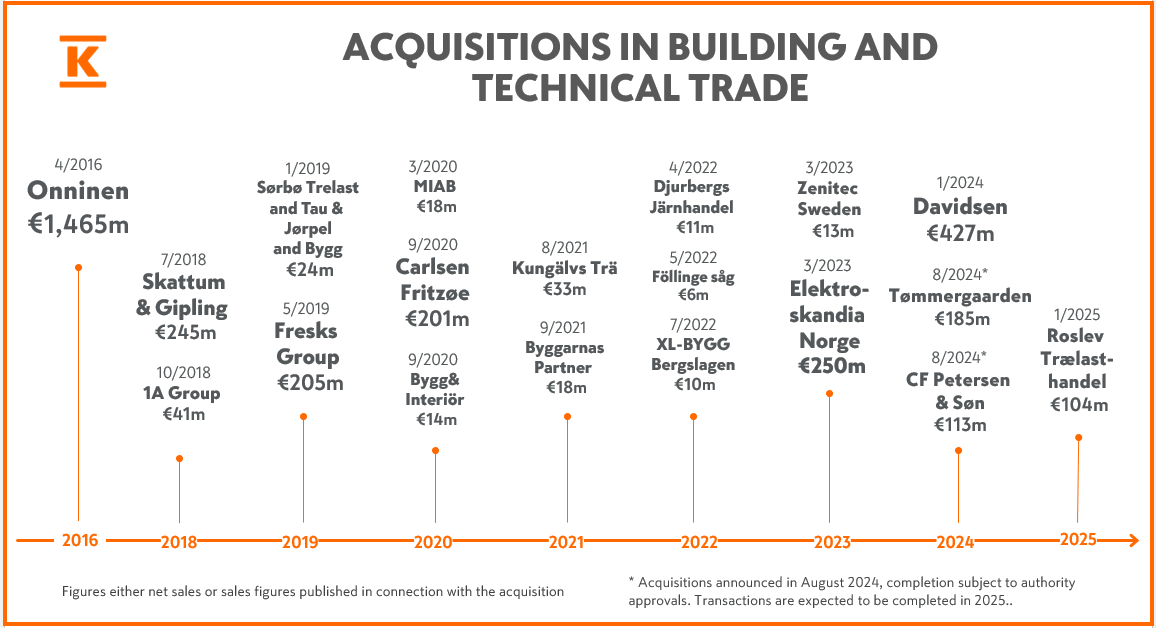

Acquisitions in Denmark:

-

Kesko completed the acquisition of CF Petersen & Søn A/S on 30 April 2025. The acquired company is a B2B-focused builders’ merchant that holds a market share of some 6% in the Zealand area. Its figures have been consolidated into Kesko Group’s reporting as of 1 May 2025. (release)

-

Kesko completed the acquisition of Tømmergaarden A/S on 28 May 2025. The acquired company is a B2B-focused builders’ merchant that holds a market share of some 10% in Northern and Central Jutland. Its figures have been consolidated into Kesko Group’s reporting as of 1 June 2025.(release)

-

Following the two acquisitions as well as the acquisition of Roslev Trælasthandel A/S in January, Kesko’s Danish subsidiary Davidsen now hosts an extensive network of building and home improvement trade stores across the country.

CAR TRADE

-

Investor presentation by Iiro Määttänen, the Director in charge of Kesko’s K-Lataus EV charging network. (presentation)

Kesko offers a wealth of sustainability information for investors

Sustainability is a crucial aspect for investors and other stakeholders, and sustainability reporting reflects a company's commitment to transparency and responsible business practices. Kesko has a decades long history in providing information on its sustainability work, its objectives, and its results. The new EU Corporate Sustainability Reporting Directive enhances the consistency and comparability of sustainability reporting among large European listed companies such as Kesko. Beyond regulated reporting, Kesko also offers a wide range of additional sustainability information for investors.

Those interested in Kesko’s sustainability efforts should definitely visit the dedicated sustainability section on our website, which offers information on, for example, our sustainability strategy and its four focus areas, as presented below:

The focus areas for Kesko’s sustainability strategy, last updated in autumn 2024, are climate and nature, value chain, people, and good governance

Each strategic focus area has its own subsite that digs deeper into the theme. For example, on the climate and nature subsite, you can read more about Kesko’s emissions targets and efforts towards biodiversity, while the value chain subsite provides information on sustainable selections and the policies guiding Kesko’s sourcing.

Our sustainability pages also provide information on the international sustainability indices and assessments Kesko is included in, which indicate that Kesko has proven it can meet an extensive and varied range of sustainability criteria.

Throughout the year, we also provide information on current sustainability themes in our news and releases. Last year, for example, we published news items on ways to reduce energy consumption in our stores by updating refrigerating systems and shared our plans for increasing the number of electric vehicles used in our logistics. You can subscribe to our sustainability-themed news to be sent directly to your email. We also post sustainability-related updates on our social media channels.

From voluntary to a common EU-regulated sustainability reporting

Kesko published its first sustainability statement in line with the EU Corporate Sustainability Reporting Directive (CSRD) in spring 2025, as part of the Report by the Board of Directors in the 2024 financial statements. The sustainability statement can be found in Kesko’s 2024 Annual Report.

Kesko published its first sustainability statement in compliance with the EU Corporate Sustainability Reporting Directive in spring 2025

The new regulations aim to standardise sustainability reporting by large European listed companies such as Kesko, making the data reported by the companies more comparable. Our sustainability statement offers information on, for example, Kesko’s double materiality assessment and the risks and opportunities related to sustainability.

Even before the introduction of new regulations, Kesko’s history in voluntary sustainability reporting goes back decades: our first Corporate Responsibility report was published in 2000, and from 2002 onwards data in the report was assured by an independent body. All past corporate responsibility and sustainability reports can be found on our annual report page.

President and CEO Rauhala: Kesko’s Q1 sales and profit were stable in the slowest quarter of the year

Kesko’s sales and profit were at a good level in the first quarter of 2025 considering the fact that it is typically the slowest quarter for the company, and our operating environment continued to be challenging. Our net sales for the quarter totalled €2,827.7 million, up by 2.5% on the previous year, or by 1.1% in comparable terms. Kesko’s comparable operating profit totalled €95.6 million.

At the end of January, we completed the acquisition of the Danish Roslev Trælasthandel, and the company’s figures have been consolidated into Kesko’s reporting as of 1 February 2025. At the end of March, the Danish competition authorities also approved the acquisition of CF Petersen & Søn with no conditions, and that acquisition is expected to be completed on 30 April 2025. The third acquisition – Tømmergaarden – is estimated to be completed during the first half of 2025. The three acquisitions will significantly strengthen Kesko’s position in the Danish building and home improvement trade market.

In the grocery trade division, net sales totalled €1,486.5 million and comparable operating profit €72.8 million. Net sales and profit decreased year-on-year partly due to the timing of Easter, which fell on April this year, while in 2024 its impact was seen in March. At the start of January 2025, we responded to consumer demand by launching an extensive price programme, which has strengthened our customer flows. Results from the price programme have been promising, but as expected, the programme did have a negative impact on profit. K Group grocery sales decreased by 1.4%. Online grocery sales grew by 5.6%. Sales in the foodservice business decreased by 0.5%, still outperforming the market. Price inflation for groceries stood at 1.8%. Our objective in grocery trade is to strengthen our market position by investing in quality, price, and our store network while maintaining a good level of profitability.

In the building and technical trade division, net sales increased and totalled €1,033.1 million, with a comparable operating profit of €11.7 million. Net sales and profit were underpinned by a pick-up in building and home improvement trade and acquisitions in Denmark. The construction cycle is turning, and sales have picked up especially in the B2B segment in building and home improvement trade. In Finland, sales in building and home improvement trade have grown especially in heavy building materials such as timber. Sales typically tend to pick up in other product categories, such as interior decoration, a little later. Technical trade is post-cyclical, and typically grows stronger some 6 months after a turnaround in building and home improvement trade B2B sales. In Denmark and Norway, building and home improvement trade sales grew markedly, and technical trade sales in Norway were also up. Sales development in Sweden and Poland was muted.

In the car trade division, both net sales and profit increased in the first quarter, thanks in particular to good new car sales. Sales also grew in used cars and services. Net sales for the division totalled €313.9 million, and comparable operating profit €17.9 million. The balanced and comprehensive product and service portfolio underpins the division’s good performance through varying market conditions.

We repeat the profit guidance issued in February, and expect Kesko’s comparable operating profit to improve and be in the range of €640–740 million in 2025.

KESKO KEY FIGURES IN JANUARY-MARCH 2025:

-

Group net sales in January-March totalled €2,827.7 million (€2,759.5 million); reported net sales grew by 2.5% while comparable net sales grew by 1.1%

-

Comparable operating profit totalled €95.6 million (€99.5 million)

-

Operating profit totalled €89.4 million (€97.2 million)

-

Cash flow from operating activities totalled €-24.5 million (€112.6 million)

-

Comparable earnings per share €0.13 (€0.16); reported earnings per share €0.12 (€0.15)

Recap of Kesko’s key events in Q1/2025

Kesko will publish its results for the first quarter of 2025 on Tuesday, 29 April 2025, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time and can be accessed here.

NEWS, FINANCIALS AND SHARES

-

Kesko’s Annual General Meeting was held on 24 March 2025. The AGM resolved, among other things, to distribute a dividend of €0.90/share for 2024, and elected 7 members to Kesko’s Board of Directors for a one-year term of office. (release)

-

Kesko’s Annual Report for 2024 was published in March. The report comprises a general review of the company’s strategy and businesses, a Corporate Governance Statement and Remuneration Report, as well as the financial statements section, which for the first time also includes a Sustainability Statement compliant with the new EU Corporate Sustainability Reporting Directive. (release)

-

Shares:

-

Share-based commitment and incentive plans for Kesko President and CEO 2025-2028. (release)

-

Share-based commitment and incentive plans for top management and key persons 2025-2028. (release)

-

Realisation of the share-based commitment and incentive plans PSP 2023-2026, KPSP 2022, and RSP 2022 (release) and RSP 2024 (release).

-

Change in the holding of Kesko’s treasury shares. (release)

-

-

Presentation for Kesko’s Q1 investor roadshow meetings. (presentation)

-

Kesko’s Investor Relations work receives recognition in both Finland and abroad. (release)

SALES DEVELOPMENT

Sales figures for March will be released in mid-April.

SUSTAINABILITY

-

Kesko was ranked the best company in the world in the “Consumer Staples” sector and 36th overall on the ‘Global 100 Most Sustainable Corporations in the World’ listing published annually at the World Economic Forum in Davos. Kesko is the only company in the world to have made the list every year since its inception in 2005. The ranking is based on a sustainability assessment of over 8,300 listed companies, measured using 25 indicators related to environmental and social responsibility and good corporate governance. (release)

GROCERY TRADE

-

K Group cuts prices for over 1,200 everyday staples in its grocery stores as part of a long-term price programme. Price reductions on branded products average 4–6%, but can amount to as much as 15–20%, while price cuts for K Group’s own Pirkka products average 9-12%. Kesko and K Group grocery retailers will jointly invest nearly €50 million in the price programme during 2025. (release and IR blog post)

-

K Group’s share of the Finnish grocery trade market in 2024 was 33.7% according to statistics published by Nielsen. Market share decreased on 2023, but the decrease in 2024 was less pronounced than the year before. Kesko and K Group continue to focus on quality, improving price competitiveness, and updating the grocery store network in order to turn around the market share trend. (IR blog post)

BUILDING AND TECHNICAL TRADE

-

Kesko seeks international growth in building and technical trade, says division President Sami Kiiski. Despite the difficult construction market of recent years, Kesko has managed to maintain good profitability, conduct acquisitions and make notable investments in logistics, which all position the company favourably for future growth. In our investor blog interview, Kiiski says that building and technical trade could eventually become Kesko’s biggest division. (IR blog post)

-

Acquisitions in Denmark:

-

Kesko completed the acquisition of Roslelv Trælasthandel A/S on 31 January 2025. This is the first of the three Danish acquisitions announced by Kesko in August 2024 to have been completed. Roslev has been consolidated into Kesko Group’s financial reporting as of 1 February 2025. (release)

-

Kesko also received approvals from Danish competition authorities for the acquisition of CF Petersen & Søn A/S on 30 March 2025. The acquisitions of both CF Petersen & Søn and Tømmergaarden A/S are expected to be completed in Q2. Combined, the three acquisitions are set to significantly expand Kesko’s building and home improvement trade operations in Denmark. (release)

-

-

Building and home improvement trade operations in Sweden are now concentrated under the K-Bygg brand, which serves both building professionals and consumers. (release in Swedish)

CAR TRADE

-

K-Auto is now the fourth biggest seller of used cars in Finland. K-Auto's used car business continued to grow faster than the market in 2024, with the number of used cars sold increasing by nearly half over the past three years. The company plans to expand its store network and focus on used car leasing services and increasing the selection of used vans in 2025. (release in Finnish)

Market share decline for K Group grocery stores slowed down in 2024

According to statistics published by Nielsen this week, K Group’s share of the Finnish grocery trade market totalled 33.7% in 2024 (34.3% in 2023). Although the market share declined by 0.6 ppt year-on-year, the decrease was less prominent than in 2023 (-0.9%).

In online grocery trade, K Group’s market share exceeded 40%. Total market growth for online grocery was 10.8%, while K Group outpaced this with a growth rate of 13.5 %.

Reversing the market share trend is an important objective for Kesko's grocery trade. In line with the division’s strategy, we continue to focus on three specific areas:

Updating and expanding our store network: Finnish customers are concentrating their grocery shopping increasingly in bigger stores – hypermarkets and supermarkets – where sales have grown. The trend in K Group market share continued to be impacted by the significant investments made by competitors to open new larger stores, while the impact of K Group investments in its store network will become visible gradually. Kesko is set open several new hypermarket-sized stores over the next few years.

The total number of K Group grocery stores decreased by 80 in 2024, partly because Kesko withdrew from the grocery operations at Neste K service stations during the year, which had a negative impact of 0.2 percentage points on the overall market share.

Improving price competitiveness: Grocery customers continue to be very price-driven. Kesko and K Group launched an extensive price programme in January, cutting prices on more than 1,200 everyday staples across the three grocery store chains. The programme has been positively received by customers, and is proceeding according to plans. At the same time, we have continued to focus on the great offers K Group stores are known for.

Further elevating quality in the stores: K Group is the quality leader in Finnish grocery trade, with competitive advantages that include extensive selections and a unique retailer-run business model that enables high-quality service and the development of store-specific business ideas based on local customer data. Digitally-assisted services enable an increasingly individual customer experience, and relevant personalised benefits are very important.

The measures related to the price programme and changes to the store network have a long-term focus. The investments in store sites will be reflected in K Group sales more towards the end of the ongoing strategy period (2024-2026). The investments in store sites and price levels will have a slight effect on the division’s profitability over the next few years, but operating profit development is expected to be stable. The operating margin target for the ongoing strategy period is clearly above 6% in grocery trade.

Sami Kiiski has headed Kesko's second-largest and most international division, building and technical trade, for almost a year. It has not been an easy start, as the construction market has been very challenging in all of the division’s eight operating countries. However, profitability for the division has stayed at a good level, and Kesko has continued to invest in the division despite the weak market. Kiiski believes that as the market improves, Kesko's position in building and technical trade will be good, and in the long term, it could become Kesko's largest division.

Antti Järvenpää from Inderes interviewed Sami Kiiski, the President of Kesko’s building and technical trade division, in early March 2025

Antti Järvenpää from Inderes interviewed Sami Kiiski, the President of Kesko’s building and technical trade division, in early March 2025

Sami Kiiski was appointed as the President of Kesko's building and technical trade division in April 2024. Prior to this, Kiiski served as the President of Kesko’s car trade division, and prior to that, as the head of leisure trade. Kiiski sat down for a video interview with Inderes to discuss, among other things, how the division has pursued growth both organically and through acquisitions, how to succeed in international acquisitions, and the growth opportunities the division has in Northern Europe going forward. The key topics discussed can are summarised in this blog post. The original Finnish-language interview can be found on Youtube here.

Growth opportunities in eight countries

Kesko’s building and technical trade division operates in eight countries: Finland, Sweden, Norway, Poland, Estonia, Latvia, Lithuania, and as of the beginning of last year, Denmark.

The division consists of technical trade – which is aimed solely at B2B customers – and building and home improvement trade, aimed at both consumers and B2B customers. In recent years, focus has shifted notably towards B2B, which already accounts for over 80% of the division's sales. According to Kiiski, the motivation behind the shift is that building and renovation work is becoming increasingly technical and professional, partly due to regulation.

Currently, Kesko operates in both building and home improvement trade and technical trade in nearly all its operating countries. According to Kiiski, Kesko will continue to focus solely on its strong technical trade business in Poland, while in the other operating countries, interesting growth opportunities are scanned in both building and home improvement trade and technical trade.

How to succeed in international acquisitions

Kesko has significantly grown its building and technical trade business through acquisitions across Northern Europe. According to Sami Kiiski, several factors contribute to a successful acquisition: first, it is essential to know what you are looking for. For example, Kesko has decided to focus on companies that primarily deal in B2B trade. Preparation is vital: it is important to thoroughly understand the market and its players.

Once an acquisition is completed, Kiiski emphasises the importance of appreciating the acquired company's proven concepts and corporate culture, instead of forcibly imposing Kesko's operating models on the company. This is why the division has country-specific strategies for each operating country, which take into account the unique characteristics of that particular market. Kesko-level synergies can be found, e.g. in negotiations with large global product suppliers, but local purchase organisations are also important.

Kiiski also stresses the importance of committing local management and other key personnel post-acquisition, noting that in the case of family-owned companies, an industrial player such as Kesko – which is committed to developing the acquired company in the long term – can often be seen as a more attractive buyer than, for example, a private equity investor.

Strong market positions in Finland – additional growth sought organically

In Finland, K-Rauta and Onninen are both market leaders in their respective fields: K-Rauta holds a 52% market share in building and home improvement trade, while Onninen has a 44% share in technical trade.

Kiiski contributes much of the success of K-Rauta in Finland to K Group's retailer business model and store-specific business ideas, which allow retailer entrepreneurs in the K-Rauta chain to tailor their stores to meet the needs of their local customer base. Kesko lends support through investments and development efforts. Meanwhile, Onninen offers its customers a wide selection of technical trade products, efficient logistics, and reliable deliveries. Onninen is also very strong in digital services, with 80% of its product sales lines already coming through digital channels.

Due to the strong market positions, growth in Finland is not sought through acquisitions. Instead, says Kiiski, further organic growth is not only possible but also targeted. K-Rauta, for example, has more to gain in B2B trade, while Onninen will benefit from its new logistics centre Onnela, currently under construction in Hyvinkää, which will centralise warehousing and enable a higher degree of automation as well as deliveries of customised products to customers. According to Kiiski, operations in both chains can also be made more efficient.

Good profitability despite the challenging operating environment – Kesko’s position strong when the market turns

The market for building and technical trade has been very challenging in all of Kesko’s eight operating countries for a couple of years now. However, the division has managed to maintain a profitability level that can be considered good even in international comparison. According to Sami Kiiski, profitability has been underpinned by the good customer relationships and customer insight, as well as the division’s ability to carry out demanding projects. Cost control and increased operational efficiency have also been contributing factors. In the long term, the division targets an operating margin of 6-8%.

Kiiski notes that despite the weak market, Kesko has continued to develop the division, making acquisitions in line with the growth strategy and notable investments in e.g. logistics in various operating countries. Kiiski sees Kesko’s position strong when the market takes an upturn. Kesko’s vision is to be a leading player in the building and technical trade in Northern Europe, and the objective is to grow businesses outside Finland and be amongst the largest market players in each operating country. Kiiski believes that building and technical trade could even one day become Kesko's biggest division.

Kesko’s sales and profitability were at a good level in 2024 despite the challenges in our operating environment. Towards the end of the year, we witnessed a turnaround, as our quarterly result improved for the first time in eight quarters in Q4. Full-year net sales totalled €11,920.1 million, while our comparable operating profit amounted to €650.1 million. The successful execution of our updated growth strategy in all three divisions has yielded results also in a challenging operating environment. Our cash flow from operating activities amounted to €1,008.2 million. We have also been successful in managing costs. Kesko’s good ability to generate profits and our strong financial position enable investments in growth as well as good dividend capacity. Kesko’s Board proposes to the Annual General Meeting a dividend of €0.90 per share – in total, €358 million – to be paid in four instalments.

In the grocery trade division, sales grew in 2024 in both our grocery stores and the foodservice business. Net sales for the division totalled €6,381.4 million, up by 0.5%. The comparable operating profit for the division was €438.0 million. Kespro performed particularly well in 2024, and we aim to continue the good performance in the foodservice business. The popularity of online grocery persisted, and sales grew by 13.5% thanks to express deliveries.

Campaigns and other marketing measures strengthened our customer flows and sales during the year, but the market share for our grocery stores came down as average purchase decreased. Price competition in Finnish grocery trade remained tight, and price continues to be a significant factor for grocery customers. At the beginning of 2025, we responded to customer wishes by launching an extensive price programme, reducing prices of more than 1,200 grocery products. The investment in this strategic programme amounts to nearly €50 million, shared between Kesko and the retailers. Our focus in grocery trade is to strengthen our market position while maintaining good profitability.

In building and technical trade, profitability remained good even though it declined year-on-year due to weak construction activity. Net sales for the division totalled €4,351.6 million, up by 3.8% thanks to the Davidsen acquisition in Denmark. The division’s comparable operating profit totalled €169.1 million. In 2024, demand decreased in both building and home improvement trade and technical trade in all our operating countries as construction volumes came down, but sales picked up in the latter half of the year.

In the longer term, the outlook for building and technical trade is positive. Urbanisation, renovation and infrastructure investment debt, infrastructure projects, and the green transition underpin construction over cycles. During the year, we expanded operations to Denmark by completing the acquisition of Davidsen Koncernen A/S, one of the leading operators in Danish building and home improvement trade, at the beginning of February. In August, we announced the acquisitions of three other Danish operators: Roslev, Tømmergaarden and CF Petersen & Søn. Strategic focus areas for the division are securing profitability and improving cash flow with a country and business focus.

The car trade market in Finland was weak in 2024, but profitability for Kesko’s car trade division stayed at a good level. The market showed some signs of picking up, but weak consumer confidence, continued high interest rates, and uncertainty regarding powertrain alternatives slowed down recovery. Development in the used car market was clearly better than in new cars, and sales also grew in car related services. Net sales for the division in 2024 totalled €1,209.4 million, representing a decrease of 4.0% in comparable terms. The division’s comparable operating profit totalled €69.3 million. The major transformation measures carried out within the division in recent years have improved its profitability. Kesko’s strategic focus is on outperforming the market in all car trade business areas, namely new cars, used cars, and services.

I took over as Kesko’s President and CEO at the beginning of February 2024. In June, we updated Kesko’s strategy, keeping the main pillars intact. In all business operations, we seek sales growth, better customer experiences, profitability and efficiency with the help of e.g. digital services and artificial intelligence. All three divisions have plenty of potential for growth and for further strengthening their business especially by listening to their customers and responding to customer needs. I see Kesko’s future bright also in upcoming years. I want to thank all our customers, the people of K Group, our shareholders, and our partners for their trust and good collaboration over the past year.

KEY FIGURES IN OCTOBER-DECEMBER 2024:

-

Group net sales in October-December totalled €3,040.6 million (€2,902.0 million); reported net sales grew by 4.8% while comparable net sales grew by 1.1%

-

Comparable operating profit totalled €170.8 million (€170.5 million)

-

Operating profit totalled €121.0 million (€159.8 million)

-

Cash flow from operating activities totalled €301.0 million (€342.4 million)

-

Comparable earnings per share €0.31 (€0.31); reported earnings per share €0.19 (€0.28)

KEY FIGURES IN JANUARY-DECEMBER 2024:

-

Group net sales in January-December totalled €11,920.1 million (€11,783.8 million); reported net sales grew by 1.2%, while comparable net sales decreased by 2.3%

-

Comparable operating profit totalled €650.1 million (€712.0 million)

-

Operating profit totalled €579.5 million (€695.4 million)

-

Cash flow from operating activities totalled €1,008.2 million (€1,049.5 million)

-

Comparable earnings per share €1.11 (€1.28); reported earnings per share €0.95 (€1.25)

-

The Board proposes a dividend of €0.90 per share, proposed to be paid in four instalments

Kesko's Vice President of Investor Relations Hanna Jaakkola was named the best Investment Relations Officer in both Finland and all of Nordics

Kesko's investor relations (IR) efforts have received recognition both on a Finnish and international scale recently.

The IR Nordic Markets (IRNM), conducted by the Swedish company Regi, is the largest study concerning IR work conducted by listed companies in the Nordic countries. Over 1,000 financial analysts from the Nordic countries, the EU, the UK, and the US annually evaluate the IR work of listed companies based on 21 criteria.

In this year’s IRNM:

-

Kesko’s Vice President of Investor Relations Hanna Jaakkola was named the best Investor Relations Officer in Finland and all of the Nordics

-

Kesko's overall investor relations work was rated the second best in both Finland and the Nordics

In addition, at the annual gala organised by the Finnish Foundation for Share Promotion, Kesko's investor webpages were rated third best among Finnish large cap companies.

”I am thrilled for such recognition, and would especially want to thank my amazing team and great colleagues. IR is definitely a team sport!” says Kesko’s Vice President of Investor Relations Hanna Jaakkola.

Jaakkola notes: ”My work is made easier by the fact that Kesko is a company I’m proud to talk about, and we have a lot going on at all times. Kesko is also a very sustainable company, and we have intentionally aimed at high-quality investor relations work. Everyone in Finland knows the K brand, and the number of Finnish households owning Kesko shares has grown steadily in recent years.”

“Working with investors and analysts – the discussions and feedback – is definitely one of the favourite parts of my work. I am the happiest if we can increase investors’ understanding of our company and operating environment. To me, this is a service profession,” concludes Jaakkola, who has previously been named ”IRO of the Year 2023” by the by the Finnish Foundation for Share Promotion.

More about IRNM: Results IR Nordic Markets 2025 | IR Nordic Markets

Strategy execution continues - price investments in grocery trade

One of the objectives for Kesko's strategy – which was updated last summer – is to profitably gain market share in grocery trade. Key measures taken to achieve this are:

-

Strengthening store-specific business ideas: focusing on strengthening our chosen competitive advantages and further improving the quality of K Group grocery stores

-

Developing our store network: making targeted investments in the store network, with an emphasis on growth centres; and

-

Improving our price competitiveness: strengthening the price competitiveness of our grocery stores and improving their price image.

Kesko is the quality leader in Finnish grocery, and we will not be compromising on quality at any point. At the start of January, we announced a new price programme that will cut prices on over 1,200 products in K Group grocery stores. K Group cuts the prices of some 1,000 everyday brand staples and some 200 popular Pirkka K Group private label products, in other words everyday staples that consumers buy often and that account for a significant portion of sales. Price reductions of branded products are on average 4–6 percent, but at best, the price cuts can be as much as 15–20 percent. For Pirkka private label products, the price reductions are on average 9-12 percent. Campaigns and offers are in our DNA, and we will continue them also in 2025, but the price programme is a more long-term effort, with significant investments in the basic price levels of our stores.

The price reductions have been made in close cooperation between Kesko, the K-retailers, and product suppliers. Kesko and K-retailers together will invest some €50 million in the programme during 2025. Reducing the price of popular branded products fits Kesko’s strategy better than, for example, adding cheap foreign products to our selections.

In addition to the investments made in basic price levels, K Group's grocery stores will continue to offer their popular OmaPlussa mobile benefits, the reasonably priced Pirkka private label range with over 2,600 products, and various other offers and campaigns.

As stated when we launched the updated strategy, investments in price and the store network will have a slight impact on the profitability of the grocery trade division in the coming years. However, despite the investments, the grocery trade division’s operating profit development will continue to be stable, and our aim is to keep the division’s profitability clearly above 6% during the 2024-2026 strategy period.

Kesko will publish its financial statements release for 2024 on Wednesday, 5 February 2025, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time, and can be accessed here.

NEWS, FINANCIALS AND SHARES

-

Presentation for Kesko’s Q4 investor roadshow meetings. (presentation)

SALES DEVELOPMENT

-

Kesko’s sales in October. (release)

-

Kesko’s sales in November. (release)

Sales figures for December will be released in mid-January.

SUSTAINABILITY

-

Kesko was once again included in the Dow Jones sustainability indices the DJSI World and the DJSI Europe. In the DJSI Europe index, Kesko ranked as the best company in its industry (Consumer Staples Distribution & Retail) for the third consecutive year. In the global DJSI World index, Kesko ranked fourth highest in its industry. (release)

-

Kesko updated its sustainability strategy: the four main strategic focus areas continue to be he climate and nature, value chain, people, and good governance, with increased focus now also placed on supply chain sustainability, water use and biodiversity. Kesko will be setting emission reduction targets for its own operations extending to year 2034. (release)

GROCERY TRADE

-

New K-Citymarket opened in Helsinki. In its continued effort to update its store network with focus on growth centres, Kesko opened the K-Citymarket Vuokki store in Eastern Helsinki in November. This was the first of the announced 7 new hypermarkets to be opened by Kesko in 2024-2028. In total, Kesko now has 82 K-Citymarket hypermarkets. (release in Finnish)

-

More K Group grocery stores received international recognition. The UK-based Institute of Grocery Distribution (IGD) named K-Citymarket Vantaa Jumbo as its ”Store of the month” in November 2024 (release in Finnish), while K-Market Iso Omena in Espoo made IGD’s list of "2025 Must-see stores" (release in Finnish).

CAR TRADE

-

"Profitability is central to all areas of Kesko’s car trade”, says the President of Kesko’s car trade division Johanna Ali in our investor blog interview, where she also expands on K-Auto’s competitive advantages as well as the changing landscape, growth opportunities and the division’s plans for the future. (blog post)

-

Kesko is set to renovate its largest K-Auto showroom complex in Helsinki, and build a new large-scale damage repair unit in Vantaa. The projects aim to improve customer experience for Kesko’s car trade customers and support K-Auto's strategic goal of building a nationwide multichannel service network for Finnish motorists. (release).