Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

IR blog: Recap of Q4/2021

Kesko will publish its Q4 report and financial statements release for 2021 on Thursday, 3 February 2022, at around 8.00 am Finnish time. An English audiocast/teleconference for analysts and investors will be held at 9.00 am Finnish time.

Below is recap of Kesko's key events and news in Q4/2021.

NEWS, FINANCIALS AND SHARES

-

Investor blog with CFO Jukka Erlund:“Our strong transformation has increased sales, market shares, profitability and dividends - and the number of shareholders" (blog post)

-

Latest change in the holding of Kesko Corporation's treasury shares (release 2 Nov.)

SALES DEVELOPMENT

Sales figures for December will be released in mid-January.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

Kesko Digital Hour: the recording and materials of our virtual, digital-themed investor event on 1 Dec. (event page)

SUSTAINABILITY

-

Kesko’s new 1.5°C climate targets were approved by the international Science Based Targets initiative (release)

-

Kesko once again included in the Dow Jones Sustainability Index the DJSI World, with industry-best scores for climate targets, eco-efficiency, emissions, packaging commitment, human rights assessment, and codes of conduct (release)

-

Kesko one of the 200 companies globally to make the CDP climate change A list for leading companies on environmental transparency and action (release)

-

Kesko’s sustainability reporting deemed the best in Finland in the Biodiversity category by Fibs (release)

GROCERY TRADE

-

IR blog: Finland’s leading food wholesaler Kespro sees great growth potential as people return to restaurants and cafeterias - with Mika Halmesmäki, Managing Director of Kesko’s foodservice company Kespro (blog post)

BUILDING AND TECHNICAL TRADE

-

Kesko strengthens its position in the Swedish building and home improvement trade market by acquiring Kungälvs Trävaruaktiebolag (release)

CAR TRADE

-

‘Taking car trade to the next level’ – division President Matti Virtanen at SEB investor event on 22 Nov. (presentation)

Chief Financial Officer Jukka Erlund is responsible not only for Kesko’s financial operations, but also for M&A, IT and risk management. Digitalisation is a key theme in Kesko’s strategy, and Erlund is overseeing various IT projects that aim to improve customer experiences and increase operational efficiency with the help of automation, for example. Sustainability and efforts to combat climate change are also issues a CFO must tackle these days, especially in the form of EU taxonomy and related reporting.

After a busy budgeting season for 2022, Erlund sat down with Kesko’s Vice President of Investor Relations Hanna Jaakkola to discuss, among other things, how the pandemic has impacted Kesko’s operations and will shape them going forward, how the company strives to improve the efficiency of its operations, where investments will be focused, and how Kesko can meet and maintain the financial targets set earlier this year.

(The discussion is available in Finnish as a podcast here).

Kesko’s strong transformation has attracted a record-number of shareholders

The number of Finnish households owning shares in Kesko has grown significantly over the past few years. Kesko currently has some 65,000 shareholders, and the number has risen by more than 57% since the beginning of 2020. What does Jukka Erlund consider to be the main factors behind the rise in popularity?

Erlund stresses the importance of the large-scale transformation Kesko has underwent over the past six years. This transformation has resulted in growth in sales, market shares, profitability –and consequently also dividends. Kesko shares have offered good returns for investors. The transformation has also caused Kesko’s brand to become stronger, and Erlund believes this has not gone unnoticed by consumers and private investors.

Strong strategy execution and technology help in achieving financial targets

To ensure success and good performance also going forward, in May 2021, Kesko’s Board of Directors confirmed an updated version of the company’s strategy and set new medium-term financial targets. Kesko now targets a comparable operating margin of over 6.0% (previously 5.5%) and a comparable return on capital employed of over 14.5% (previously 12.5%).

Erlund considers three factors crucial for achieving and maintaining the levels set in the financial targets: the continued execution of Kesko’s growth strategy, further improvement of operational efficiency, and successful capital allocation.

The execution of the updated growth strategy will continue in all three divisions both organically and in some operations also possibly via acquisitions. Operational efficiency can be improved by updating processes and increasing the use of automation. As Erlund notes, Kesko is a more than 80-year-old company, and there are consequently various legacy processes that continue to involve manual work. With the help of technology and process automation, these processes can be made much more efficient.

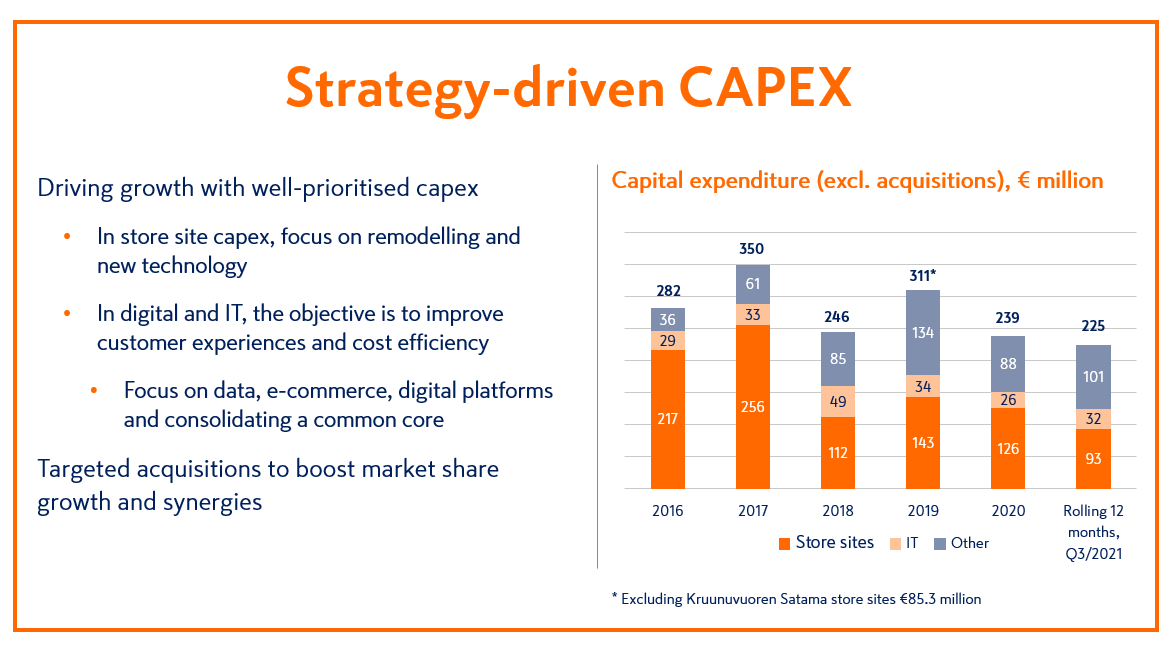

Capital expenditure driven by strategy – major investments in digitalisation and better customer experience in all three divisions

Kesko’s balance sheet is strong and in practice, the company is free of debt. Thus it is able to make investments, but how are those investments prioritised?

Erlund stresses that Kesko’s capital expenditure is driven by its strategy. Capital is allocated where it can be expected to provide the best returns. The main focus in investments varies between the divisions, but in all three there is an emphasis on two key strategic focus areas: digitalisation and improving customer experiences. This means a very strong focus on digital services and online sales in all three divisions. In grocery trade, investments are also made in remodelling and updating existing physical stores and on further developing online grocery operations. In car trade, investments are made also in growing the used cars business and leasing services.  In building and technical trade, Kesko has expressed an interest in further sector consolidation via acquisitions in Northern Europe. According to Erlund, the best potential for increasing market share through acquisitions can be found in Sweden and Norway. The strategic focus is on B2B operations, which already account for some 70% of the building and technical trade division’s business.

In building and technical trade, Kesko has expressed an interest in further sector consolidation via acquisitions in Northern Europe. According to Erlund, the best potential for increasing market share through acquisitions can be found in Sweden and Norway. The strategic focus is on B2B operations, which already account for some 70% of the building and technical trade division’s business.

The pandemic has accelerated digitalisation, changes brought on by the pandemic will impact Kesko’s business going forward

When asked how Covid-19 has impacted Kesko, Erlund notes that obviously the pandemic has affected everything in our lives over the past few years. Kesko has enjoyed the positive boost experienced in the retail sector as consumers have focused on the domestic markets and spent less on services. On the other hand, the pandemic has negatively impacted, for example, Kesko’s foodservice wholesale company Kespro, and caused issues with production and supply chains.

Erlund believes the pandemic has accelerated the digitalisation trends already underway before the pandemic, and does not think it is likely that we will return to the way things were. For one thing: “People are likely to continue working from home to a significant extent, and this will have an impact on Kesko’s business, as it changes the way people buy their food and the way they want to live and arrange their homes,” Erlund notes.

See also: Jukka Erlund’s views on the utilisation of technology and digitalisation and future capital expenditure at the Kesko Digital Hour investor event earlier this month

IR Blog: #KeskoDigitalHour offered a deep dive into our digital strategy and data utilisation

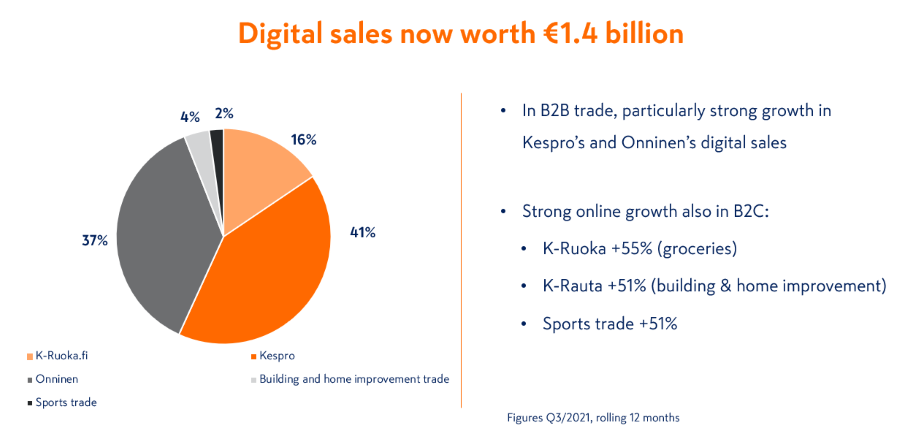

Digitalisation has played a key role in Kesko’s transformation in recent years. Our digital sales currently value some 1.4 billion euros, but we see plenty of further untapped potential for all three business divisions. On 1 December 2021, we held Kesko Digital Hour, a virtual investor event that focused on digitalisation and data utilisation, with presentations by Kesko’s Chief Digital Officer Anni Ronkainen and Chief Financial Officer Jukka Erlund and a Q&A session hosted by Vice President of Investor Relations Hanna Jaakkola.

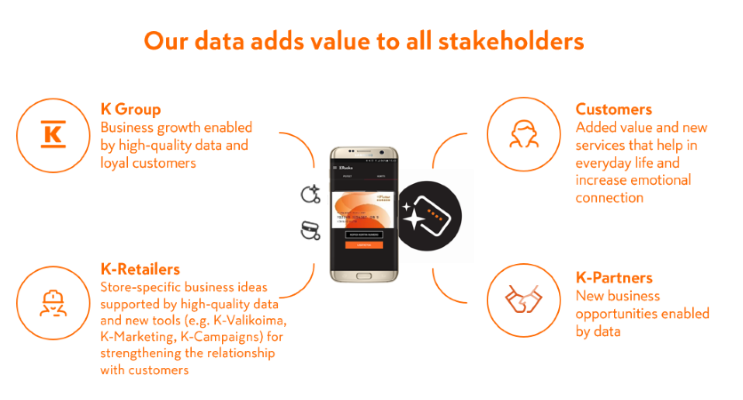

At the Kesko Digital Hour investor event, CFO Jukka Erlund and CDO Anni Ronkainen explained how data and digitalisation are used at Kesko to make internal processes more efficient and customer experiences increasingly better.

At the Kesko Digital Hour investor event, CFO Jukka Erlund and CDO Anni Ronkainen explained how data and digitalisation are used at Kesko to make internal processes more efficient and customer experiences increasingly better.

Digitalisation and customer experience are two complementary central themes in Kesko’s strategy. In many areas, Kesko can be considered a forerunner in trading sector digitalisation, but we can still identify plenty of further untapped potential in digitalisation and data usage. Kesko’s two key objectives in utilising digitalisation are to improve customer experiences and to increase the efficiency of our operations, and consequently bring costs down.

Kesko’s CDO Anni Ronkainen emphasised the role of data in any discussion concerning digitalisation. Data is central to everything we do, and Kesko and K Group aim to become a truly data-driven organisation, where data, analytics and AI support our business at both strategic and operative levels and also create value for our customers. Ronkainen estimated that Kesko currently uses about 25% of its data, and said she expects the figure to rise to some 50% in upcoming few years, while at the same time data assets get better and opportunities to use data become more versatile.

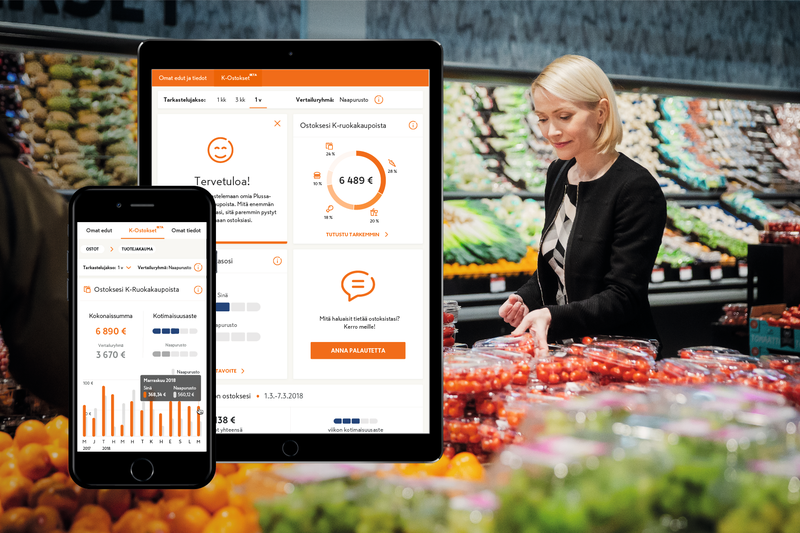

Kesko obtains data from various sources. In terms of customer data, in Finland we have at our disposal the vast data asset of our K-Plussa customer loyalty programme, which is in use in all three divisions. In a country of 5.5 million people, the K-Plussa programme has 3.3 million active customer members. In addition to using that data to formulate better selections and tailored store-specific business ideas, Kesko also returns the data to its customers in the form of various personalised services and recommendations.

CFO Jukka Erlund noted that digitalisation, data utilisation and technology have contributed significantly to Kesko’s operations and performance – not just top-line driven sales growth, but also margins and cost efficiency. Our cost ratio has also come down substantially over the past few years.

IT and digitalisation drive efficiency on three fronts: realising synergies (common architecture, platforms and systems), increasing process efficiency and process automation, and utilising data analytics (data-driven business processes and decision-making).

In terms of capital expenditure, while investments in store sites remain the biggest CAPEX item, the importance of investments in digital and IT is constantly growing, with focus on building capabilities for data use, e-commerce, digital platforms, and a common core such as ERP systems. Marketing is also increasingly directed towards digital.

Digitalisation is a central part of the growth strategy of all Kesko’s three business divisions. In the grocery trade division, there is a strong focus on further developing online grocery, where we expect sales to continue to grow and stay above pre-pandemic levels. Data is used to create tools and support decision-making regarding e.g. store selection planning and pricing as well as to help establish individual store-specific business ideas. Digital marketing screens increase the efficiency of in-store advertising.

In the building and technical trade division, the key issue is to tailor digital and online services and solutions for three customer segments with differing needs – technical professionals, professional builders and consumers. While professionals tend to value wide selections, enriched product information and reliable deliveries, DIY builders seek inspiration, clear instructions and competitive prices. Actions in building and technical trade are country specific, but synergies are sought between countries in IT and technology.

In the car trade division, the digitalisation journey is in its early stages and will play a vital role in the division’s ongoing transformation process. Digitalisation will have a remarkable impact on all business areas, from booking servicing to new car sales and the purchase and sale of used cars, while also supporting back-office functions such as finance and IT. Digital is also an important customer acquisition channel for the car trade.

It is worth noting that B2B is a very important part of Kesko’s digital sales, especially when it comes to Onninen’s technical trade, where digital sales total €520 million, and the foodservice wholesaler Kespro, where over 80% of sales come from digital channels.

Kespro is the foodservice arm of Kesko’s grocery trade division. Like Kesko’s grocery stores, Kespro sells food and food-related products, but as the name suggests, instead of consumers, the focus is on professionals: restaurants, cafés, hotels, service stations and other establishments within the foodservice sector that prepare and offer meals and services to people. The pandemic hit most of Kespro’s customers hard, but in the long term, the popularity of eating out is expected to continue to grow in Finland. As the market leader in foodservice wholesale, Kespro is set to gain significantly from this.

Kesko’s grocery stores and Kespro’s foodservice wholesale form a unique, winning combination in Finnish food trade. While grocery stores have been thriving during the pandemic, through Kespro, Kesko is set to gain also from consumers’ growing interest in outsourcing their cooking and eating out.

Kesko’s Vice President of Investor Relations Hanna Jaakkola sat down with Kespro’s Managing Director Mika Halmesmäki to discuss the big post-pandemic growth potential in the foodservice market, and Kespro’s role in enabling the success of its customers.

(The discussion is available in Finnish as a podcast here).

A market worth some 4 billion euros

According to Mika Halmesmäki, the foodservice wholesale market in Finland is estimated to be worth some 4 billion euros. Professional kitchens prepare and serve nearly 750 million meals per year. They represent a wide and varied customer base that comprises, for example, restaurants, cafés, hotels, school and workplace cafeterias, hospitals, service stations and grocery stores.

Kespro serves all these operators, offering a wide range of products and services related to food and drink as well as supplies for kitchens and dining areas. Furthermore, Kespro offers its customers services that can help the customers develop their business further. Kespro strives to work together with its customers to make eating out not only more popular but also more sustainable.

At Kespro’s Foodsteri test kitchens, customers and Kespro experts come together to innovate and develop commercially viable solutions for the customer, from menus to entire business concepts.

In 2020, Kespro’s market share in foodservice wholesale was 42.5%. Halmesmäki notes that Kespro does not only compete against other general wholesale companies, but also certain manufacturers and producers that sell their products directly to restaurants and cafés, as well as specialty wholesalers that focus on specific product categories. General wholesalers such as Kespro control approximately half of the market.

With such a varied and diverse customer base, Halmesmäki sees great growth potential for Kespro in offering the best services to the whole foodservice market, while tailoring its services for each customer segment: “For example, Kespro has a strong foothold in both fine dining and with customers in the public sector – these are two very different customer segments with very few overlapping needs.”

In-depth customer insight and agility are competitive advantages that allow Kespro to help its customers in both good times and bad

Kespro’s in-depth understanding of its customers became particularly crucial when the Covid-19 pandemic hit the foodservice sector and brought about changes in consumer behaviour as well as restrictions imposed on restaurants and events. By supporting and helping its customers Kespro has been able to grow its market share also during the pandemic.

“Although Covid-19 put a temporary halt on the market, we never stopped moving forward.”

Halmesmäki stresses the role of Kespro’s skilled personnel and its agile culture, which have enabled it to stay on top of and respond to the changing needs of its customers also under exceptional circumstances, while constantly ensuring the availability of products and services. Kespro has also been supporting its customers in creating new take away solutions, while also providing them with masks and various hygiene solutions and even small greenhouses for outdoor dining.

From a traditional wholesale company to a platform-based business

Before the pandemic, the popularity of eating out was growing at a significant pace in Finland. Mika Halmesmäki expects this trend to continue also going forward, as Finland is still behind many of its European peers when it comes to eating out. Eating out was a growing trend in Finland before the pandemic. The growth is expected to continue in a post-pandemic world, and as the market leader in foodservice sales, Kespro is expected to benefit from this.

Eating out was a growing trend in Finland before the pandemic. The growth is expected to continue in a post-pandemic world, and as the market leader in foodservice sales, Kespro is expected to benefit from this.

Of course no one can say for certain when we can enter a truly post-pandemic world. According to Halmesmäki, Kespro mitigates risks through continuous development of operations and investments in growth and innovation: “Although Covid-19 put a temporary halt on the market, we never stopped moving forward.” The diversity of Kespro’s customer base also helps mitigate risks.

Digitalisation is central to all Kesko’s operations, and this applies to Kespro, too. Going forward, Kespro sees further potential in adopting a more platform-based approach to its services: “One could argue that as a traditional wholesaler, we are already a platform: we offer customers a wide range of products and services, and suppliers and product manufacturers the best sales and logistics channels on the Finnish foodservice market. However, we are interested in examining what a wholesale platform of the future could entail, and how we could expand that platform through innovation,” concludes Halmesmäki.

President and CEO Mikko Helander: Kesko posted the best result in its history in Q3/2021

The results we have achieved act as proof that our strategy is working and we have made the right choices. We will continue our efforts to grow our sales and improve profitability, says President and CEO Mikko Helander of Kesko’s Q3 result.

Kesko posted its best-ever result in Q3. Sales grew and profitability improved in all divisions. Net sales grew by 7.8% in comparable terms, totalling €2,902.4 million. Our comparable operating profit totalled €236.4 million, representing an increase of €54.5 million. The grocery trade division and the building and technical trade division both recorded their all-time best profitability. Profit for the car trade division improved markedly. Profitability in both grocery trade and building and technical trade has risen to the level of the best European operators. The strong growth is based on the successful execution of our growth strategy and a favourable market situation.

Strong development continued in food trade. Our strength there lies in our extensive network of well-placed stores combined with efficient online grocery operations and our foodservice business, as well as our well-functioning retailer business model. Our strategic goal is to constantly improve customer experiences. Sales grew in all our grocery store chains. The division’s comparable operating profit totalled €122.2 million. Online grocery sales grew by 17.3% despite the strong comparison figures. Our market share in food trade grew. K Group’s grocery sales grew by 3.3% and net sales for Kespro’s foodservice business by 8.9%.

In the building and technical trade division, growth continued strong in all operating countries, driven by B2B trade. The successful execution of country-specific strategies and strong demand resulted in a record third quarter. Strong development continued for Onninen and K-Rauta in Finland. Sales and profitability development was good also in Norway and Sweden both in building and home improvement trade and technical trade. Profitability was also supported by the changes made in recent years and the acquisitions completed and their successful integration. The division’s net sales grew by 14.6% in comparable terms, and its comparable operating profit rose to €104.5 million. The growth has been underpinned by strong construction market performance and the continued rise in raw material prices.

Our transformation process in the car trade division is proceeding well and yielding results. The division’s net sales grew by 6.7%, and its comparable operating profit rose to €18.2 million. The division’s profitability was underpinned by sales margin growth and cost adjustment measures. Demand was strong for both new and used cars, although availability issues related to component shortages have slowed down new car deliveries and hindered used car availability. The planned exemption of all-electric vehicles from car tax in Finland as of 1 October impacted the timing of car deliveries.

The importance of sustainability continues to grow. Concrete efforts to stop climate change will be in the forefront in upcoming years. In mitigating climate change, the role of the trading sector extends clearly beyond reducing emissions from its own operations. In all our business divisions, we provide our customers with information on their choices and encourage them to adopt more sustainable lifestyles. We also challenge our suppliers and the whole supply chain to cut emissions and set their own tangible emission reduction targets.

The Nordic countries are among the most stable and well-functioning societies globally. Good overall economic development is estimated to continue in our operating countries. Household savings have grown and people have money to spend. Domestic demand is expected to continue to stay high. The so-called green transition will also increase public and private investment and offer growth opportunities for all our divisions.

We will continue the execution of our growth strategy. Our strong food trade operations form a foundation for ongoing profitable growth in the grocery trade division. Our grocery stores together with Kespro’s foodservice business form a strong, unique combination. In the building and technical trade division, our strong country-specific actions will support growth. Over 75% of the division’s net sales now come from B2B trade and demand in B2B trade is growing forcefully. In the car trade division, wider sector transformation and our own transformation efforts support sales growth. We will continue our efforts to grow our sales and improve profitability. The results we have achieved act as proof that our strategy is working and we have made the right choices.

7-9/2021 FINANCIAL PERFORMANCE IN BRIEF:

-

Group net sales in July-September totalled €2,902.4 million (€2,651.9 million), an increase of 7.8% in comparable terms, reported net sales grew by 9.4%

-

Comparable operating profit totalled €236.4 million (€181.8 million), up by €54.5 million

-

Operating profit totalled €236.5 million (€224.6 million)

-

Comparable earnings per share €0.43 (€0.33

-

Reported Group earnings per share €0.43 (€0.48)

Find out more:

Kesko's Q3/2021 interim report and result presentation

IR blog: Q3 recap

Kesko will publish its Q3 interim report on Friday, 29 October 2021, at around 9.00 am Finnish time. There is a Finnish-language webcast at 11.00 am the same day, and an English audiocast/teleconference at 12.30 noon (see details here).

Below is recap of Kesko's key events and news in Q3/2021.

Group and shares

* Composition of Kesko's Shareholders' Nomination Committee (release 13 Sept.)

* Latest change in the holding of Kesko Corporation's treasury shares (release 17 Sept.)

* Disclosure in compliance with Chapter 9, Section 10 of the Finnish Securities Markets Act, Ilmarinen Mutual Pension Insurance Company (release 9 Sept.)

Sales development

* Kesko’s sales grew in July (release)

* Kesko’s sales grew in August (release)

Sales figures for September will be released in mid-October.

Other materials

Investor presentations

* Roadshow, SEB Nordic Large Caps, 26 Aug. (presentation)

Investor blogs

* Is there further potential for growth in Kesko’s grocery trade going forward?

With President of the grocery trade division Ari Akseli

* We have great potential to continue profitable growth

President of building and technical trade division Jorma Rauhala

* Electrification of cars will affect the whole car trade business

With President of the car trade division Matti Virtanen

* Tailored store-specific business ideas

With Ari Akseli and Chief Digital Officer Anni Ronkainen

Grocery trade news

* Kesko invests heavily in developing click&collect services to enable further growth in online grocery (blog)

Building and technical trade news

* Kesko to acquire Byggarnas Partner, a company serving professional builders in Sweden, thus further strengthening its position in Swedish building and home improvement trade (release 23 July)

Sustainability news

* Kesko meets the objective of its Cocoa Policy - all cocoa and chocolate in Kesko's own brand Pirkka and K-Menu products now 100% of sustainable origin (release)

* K Group ready for the implementation of the Single Use Plastic (SUP) directive (release)

The whole automotive sector has been undergoing a major transformation in recent years, with the introduction of new technologies and the electrification of cars. Kesko’s car trade division does not want to be left behind, and is therefore also carrying out large-scale transformation in order to be more efficient, accelerate digitalisation and offer a better customer experience.

As of April 2021, this transformation process has been steered by Matti Virtanen, who has had a long career in leadership positions in the technology sector with companies such as Nokia, Compaq and Hewlett-Packard in Finland, Europe and the US. He was also Chairman of the Board of Kamux, a Finnish listed company specialising in used car sales, for four years. Here, Matti and Kesko’s Vice President of Investor Relations Hanna Jaakkola discuss the measures taken by Kesko’s car trade to meet the challenges posed by the changing car sector landscape and ways to raise market share further and bring the customer experience in car sales to a whole new level.

(The discussion is available in Finnish as a podcast here).

Car trade at Kesko – market leader with a strong focus on the future

Car trade has been part of Kesko since 1978. A key element for the division is the collaboration with Volkswagen Group, one of the biggest car manufacturers in the world. Kesko’s K-Auto imports and sells Volkswagen Group brands, namely Volkswagen, Audi, SEAT, CUPRA, Porsche and Bentley passenger cars and Volkswagen Commercial Vehicles and MAN trucks in Finland. K-Auto and independent dealers sell new and used vehicles and offer servicing and after-sales services at some 70 outlets across Finland as well as online.

Kesko’s K-Auto imports and sells Volkswagen Group car brands, sells used vehicles and offers servicing and after-sales services at some 70 outlets across Finland as well as online.

In new car sales, Kesko is the market leader in Finland. In Q2/2021, the market share of the models represented by Kesko was 19.3%, while our market share in all-electric cars was close to 50%. Strategically, the division aims to strengthen its market share further above 20%.

The division also wants to increase its sales of used cars and services. Matti Virtanen notes that over the past decade, used car sales have become a proper business in Finland, with a very different dynamic. This is why earlier this year the two businesses were separated from each other at Kesko. New web pages for used car sales, meeting modern requirements, will also be launched this autumn.

In the service business, the electrification of cars will impact the need for servicing and car accessories going forward, which is why Kesko is currently updating its logistics. Investments are also made to better meet customer expectations in the repair business, which is seen as a growing business area.

Transforming operations to ensure the best customer experience in the business

Kesko’s strategy focuses on profitable growth in the company’s three divisions. To better enable profitable growth in the car trade division, the division has launched a significant wide-scale transformation scheme, aiming for better competitiveness and cost structure while improving margins and profit levels and consequently the division’s profitability.

According to Virtanen, the transformation programme is motivated by two main underlying changes impacting the car trade business: 1) a marked shift in customer behaviour, with customers increasingly using digital channels to examine the offering and even to purchase cars; and 2) the growing importance of customer experience in car sales, car servicing and car deliveries.

So how does Kesko’s car trade intend to create and offer the “best customer experience in Finland”? For one thing, digitalisation will be utilised more extensively to shift resources from administrative tasks to customer service. Virtanen also notes that better customer service requires a new kind of attitude and business culture. “We are currently recruiting 160 new people for car sales, and will train them to master good customer service and positive customer experiences – this will enable a better response to customer needs and wishes,” says Virtanen.

To ensure the best customer experience in the business, Kesko’s car trade division is utilising digitalisation to free up more time for customer service, while also ensuring effective digital services.

Strong collaboration with Volkswagen Group lends Kesko a considerable advantage

Kesko’s strong, long-standing collaboration with Volkswagen Group is one central element of the car trade division's strategy. Matti Virtanen sees many advantages for Kesko in this: “Thanks to the collaboration, we have a good vision of where the car sector is going, also with a long-term perspective. In this current situation, where e-mobility is surging ahead at a great pace, this lends us a considerable advantage.”

The collaboration also means Kesko has been able to develop world-class expertise in sales, servicing, marketing and other support functions.

Kesko’s long-standing collaboration with one the world’s leading car manufacturers Volkswagen Group enables insight into the future of the car industry and ensures K-Auto can offer products that are excellently suited for the rapidly changing market.

The future is electric – and here sooner than we think

Speaking of Volkswagen Group, the company announced in its new strategy this summer that it intends to invest 16 billion euros in e-mobility, hybridisation and digitalisation by 2025. How does this fit the business and strategy of Kesko’s car trade division?

“Our strategic decisions and investments are very much aligned with those of Volkswagen Group and we share their vision of the future direction of cars. K-Auto is the undisputed market leader in electric cars in Finland, and we can already see that the electrification of cars in Finland is moving ahead even faster than fairly recent predictions would suggest. For us, the massive investments by Volkswagen Group mean that we will be able to offer products that are excellently suited for this rapidly changing market. Volkswagen Group is able to offer competitive electric cars irrespective of brand,” says Matti Virtanen.

Virtanen also mentions Kesko’s own significant investments in building an extensive EV charging network in Finland to prevent charging capacity from becoming a bottleneck for progress. Investments in the K Charge network will continue next year, with emphasis in particular on fast and high-power charging (HPC).

The K Charge network currently consists of over 80 charging stations for electric vehicles, found at K Group store locations across the country. In July 2021 alone, charging at these stations was up by 137% year-on-year, reflecting the growing popularity of EVs.

The downside of modern hi-tech cars is how the current global component shortage is causing issues with car availability, as the car industry is not first in line when it comes to access to scarce components. Virtanen says that it is likely that the impact of the component shortage will be felt for the remainder of the year and may pose some challenges also at the start of next year. There is also some uncertainty related to the development of new technologies and how they will impact the car sector going forward.

Overall, Virtanen trusts that Kesko’s strong position and track-record form a good basis for the further growth of its car trade division.

This has been a successful year for Kesko’s building and technical trade division. “Our growth has continued strong and all our chains in all our operating countries are making a profit,” says division President Jorma Rauhala.

In the first year-half, net sales for Kesko’s building and technical trade division grew by 13.2% in comparable terms, while the division’s comparable operating profit grew by €69.5 million. “We have reached our previously set operating profit target levels and are now among the best in Europe. All our chains in eight countries are making a profit,” says Jorma Rauhala.

In Finland, both K-Rauta and Onninen continued to perform strongly in H1, as reflected by their market share, sales and profit figures.

In Norway, the first half of the year was very strong for both Byggmakker and Onninen, and profitability rose to a whole new level. In Sweden, there has been a marked turnaround and Rauhala considers the current situation good: “We will continue to grow the sales and improve the profit of K-Bygg, K-Rauta and Onninen in Sweden. The acquisition of Byggarnas Partner, announced in July, further strengthens our position in the country.”

Sales and profit have also been growing in the Baltics and Poland, and Rauhala sees good growth potential in all four countries

“We have a clear growth strategy that is yielding results. We have fared very well under exceptional circumstances, often outpacing the market. We have every opportunity to exploit possibilities also going forward, as we operate in a strongly growing sector. The renovation needs of homes and other properties, the growing infrastructure investment debt, and energy-efficiency related requirements in construction will see our market grow further.”

More than half of the building and technical trade division’s sales today come from outside Finland. Strong country-specific focus has proven to be the key to success: “It is crucial for our division, as circumstances vary significantly from one country to another. It is therefore important to have a clear individual strategy for each country and business. Our K-Rauta and Intersport chains in Finland operate under the retailer business model, while elsewhere we employ other business models.”

The division is constantly looking to share good examples in all countries and businesses, and also seeks synergies both within and between operating countries.

Most recently, global availability issues have made life more difficult for building and home improvement stores and sports stores. In building and home improvement, this has been particularly evident in product categories related to wood, metal and plastic. How are we prepared for future challenges and what have we learnt?

“For one thing, the role of pre-orders has become significantly more important, especially with imported goods. Advances on purchases need to be made somewhat earlier, and it is important to commit to them,” says Rauhala.

The division’s strategy continues to emphasise growth, profitability and synergies. As new strategic focus areas, Rauhala mentions proactive sales and sales management and improving digital customer experiences further: “During the autumn, we will also establish a division-specific sustainability strategy, which will define our future sustainability targets and actions for each country and each chain.”

Heavy investments will be made in digital services: “Our division is already strongly present in digital trade, where our sales amount to nearly €560 million,” explains Rauhala. However, there is a need to make digital purchases even easier for customers and digital operations more efficient: “We must offer digital services for all customer segments and in all chains to ensure a competitive advantage.”

The division’s outlook has improved compared to last year’s forecasts, although there is still uncertainty related to upcoming years: “Forecasts suggest that the trend in construction will continue moderately strong in all our operating countries. We expect good activity in construction and consequently busy times for our B2B trade in particular,” says Rauhala.

Meanwhile, he expects the B2C business to stabilise following the pandemic surge, as people begin to travel and spend more money outside their homes again: “Already this year, our growth has come especially from B2B trade, which now accounts for over 70% of the division’s net sales, and that percentage is constantly growing.”

The leisure trade business at Kesko operates under the building and technical trade division. Going forward, it will focus on sports trade: “We updated the strategy for leisure trade and decided to focus solely on sports trade. As a result, we decided to discontinue our shoe store chains The Athlete’s Foot, Kookenkä and Kenkäexpertti, and focus on the Intersport and Budget Sport chains,” says Rauhala.

He admits the decision was not easy: “Nonetheless, under the circumstances we were able to handle the situation as well as possible, emphasising a store-specific approach and close communication with the retailers.”

According to Rauhala, the sports trade business will be developed in accordance with Kesko’s growth strategy: “We are excellently positioned to do so. The new focus on sports trade is reflected in our figures, as our sports trade operations performed very strongly in the first half of the year and we won over market share to a significant extent.”

The current situation, in which each country and business is stable and in profit, increases the division’s possibilities of developing operations and raising the bar further, Rauhala believes. It also offers great possibilities for targeted acquisitions: “We have great potential to continue profitable growth in Northern Europe – currently our market shares in Norway and Sweden, for example, are still fairly low.”

“We have a clear growth strategy that is yielding results. We have fared very well under exceptional circumstances, often outpacing the market. We have every opportunity to exploit possibilities also going forward, as we operate in a strongly growing sector. The renovation needs of homes and other properties, the growing infrastructure investment debt, and energy-efficiency related requirements in construction will see our market grow further.”

TEXT: Kirsi Suurnäkki-Vuorinen

Originally published in the Kehittyvä kauppa magazine of K-Retailers' Association on 23 Sept. 2021

Ari Akseli began his sales career selling wooden ladles door-to-door at the age of six. He has been at Kesko for 26 years, and has headed the biggest of Kesko’s three divisions, grocery trade, for nearly four. Here, Ari and Kesko’s Vice President of Investor Relations Hanna Jaakkola discuss the competitive advantages Kesko has on the fiercely competitive Finnish grocery trade market, from an extensive store network to store-specific business ideas tailored to meet local demand, as well as the challenges related to grocery trade going forward.

(The discussion is available in Finnish as a podcast here).

Kesko’s grocery trade division has performed very well in recent years, especially during the pandemic. Many investors are now wondering if there is still room for further growth. Ari Akseli sees further growth potential, as Kesko’s strategy has proven effective, and people have shown that they want to buy better, high-quality food. Kesko’s grocery trade has been able to upgrade the level of products sold, for example, selling Roman-style pizza instead of flour and tomato sauce.

Adjusting to the pandemic and implementing store-specific business ideas

Akseli is not ready to give the pandemic all the credit for Kesko’s excellent performance in recent years, noting that in the short term, it actually had a negative impact on his division’s performance, as Kespro’s foodservice operations were hit by the restrictions imposed on restaurants and events, and the rapid surge in online grocery sales – which grew by a whopping 1,000% in spring 2020 – required heavy investments to ensure K Group’s grocery stores could meet the enormous increase in demand.

“We were able to adapt to the situation quickly and successfully adjust our selections and operations and create safe shopping environments. However, the biggest thanks for our excellent performance goes out to our staff and customers, who enabled the successful execution of our long-term strategy,” says Akseli.

There is also further potential in store-specific business ideas, which help each store to tailor their selections and services to meet local customer needs. This is not a simple task, as K Group’s grocery stores serve some 1.2 million customers daily and have more than 2,000 active suppliers with new products that can total as many as 30,000. However, the successful implementation of these business ideas has seen sales of existing stores grow significantly.

(For a more detailed discussion on store-specific business ideas, see our recent IR blog post)

Extensive online selections and a wide network of local stores offering online services

Following the surge in demand during the pandemic, Kesko now controls over 50% of the Finnish online grocery market, with high online customer satisfaction (NPS above 80). Compared to 2017, Kesko’s online grocery sales are 20 times higher. However, competition is tightening, with new operators entering the market – will Kesko be able to hold onto its No. 1 position in online grocery?

Ari Akseli insists that Kesko sees the tightening competition in the online grocery business as positive, spurring it on to develop its own operations further. He does, however, believe that Kesko has certain competitive advantages in its favour, namely the wide network of local stores offering online services – which helps to resolve the issue of the costly “last mile” – and the extensive selections K Group can offer its customers online.

Unlike online-only operators, K Group can provide people everything they want from a grocery store in one go: “A customer may write in their order form ‘I’d like some sushi, preferably nigiri’ and we’ll put together a nice fresh plate for them. That is not something you can easily do in a dark store,” Akseli explains.

Fresh sushi has been a huge trend in Finnish grocery stores in recent years. Sushi is also part of the extensive online selections offered by many K Group grocery stores.

Kesko thus sees the seamless combination of its online and physical stores as a winning concept, enabling it to meet all customer expectations and offer extensive selections while keeping costs of delivery from local stores lower. Over 50% of customers also say that they want to collect their online shopping from their local grocery store when it best suits them – K Group’s model also enables this.

(Read the new Trademaker blog post to find out more about K Group’s efforts to develop its click & collect grocery services)

Grocery store + restaurant = grocerant

The aspect of grocery trade that excites Ari Akseli most at the moment is the rise of grocerant solutions:

“The line between restaurants and grocery stores is becoming increasingly blurred, and we are constantly seeing exciting new examples of this in our stores. There are both our own innovations as well as collaboration with a with a wide variety of restaurants, and demand in this area is constantly growing.”

The line between grocery stores and restaurants is becoming increasingly blurred. K-Supermarket Mustapekka in Helsinki hosts “the smallest wine bar in Finland” inside the store, where customers can sit down for some sushi or tapas and wine while grocery shopping.

There are solutions for stores of all sizes: many bigger stores make traditional Roman-style pizza from scratch, while smaller stores reheat premade frozen pizza. Some stores make their own sushi from authentic Japanese sushi rice using secret recipes, others have in-store partners preparing the sushi, while smaller stores sell boxed sushi made fresh at an outside factory.

Sushi has been a huge hit in Finnish grocery trade. What does Ari Akseli think will be the next big thing?

“That is the question we have been trying to figure out. It could Japanese food beyondsushi – we’ve piloted this at K-Citymarket Järvenpää. Another contender is ‘next level Tex-Mex’: like pizza in the 80s, Tex-Mex has become a staple at Finnish dinner tables, yet there is untapped potential in taking Tex-Mex to a whole new level in terms of variety and authenticity.”

Kespro has stayed in profit despite the challenges in foodservice sector

The business area where the pandemic has hit Kesko’s grocery trade the hardest is the division’s foodservice company Kespro. Despite significant challenges related to restrictions imposed on restaurants, cafés and events, Kespro has managed to stay in profit and grow its market-leading position more forcefully than ever.

Kespro has also been able to help its struggling customers in many ways, and has acted as a bridge between restaurants and grocery stores, enabling restaurants to sell their meals in stores during times when restrictions have prevented normal restaurant operations.

Akseli also says that the intent is to turn Kespro increasingly into a platform, offering more services than simply traditional wholesale. Kespro is already a significant operator online: “Kesko is not only the market leader in selling food online to consumers, but our market-leading position is even more dominant when it comes to online food sales to B2B customers,” says Akseli.

A three-pronged approach to tackling future challenges

When it comes to challenges facing grocery trade going forward, Ari Akseli says it is vital Kesko can keep upping its game faster than its competitors and adjust to changes in the operating environment whilst holding onto its key competitive advantages.

“Again, we rely on our three-pronged approach: our strategy, store-specific business ideas, and our retailer business model,” Akseli concludes.

When it comes to grocery stores, Kesko does not believe that one size – or indeed type – fits all. Each K Group store is unique, thanks to independent K-retailers who run the stores and store-specific business ideas that allow the retailers to tailor their store to local demand and expectations utilising comprehensive data.

In between 2015 and 2020, K Group invested nearly €1 billion in its store network and will invest an additional €120 million this year, with the main focus on redesigning stores to better implement store-specific business ideas.

What exactly are store-specific business ideas, how are they formulated, and if they are so great, what stops others from straight-out copying them? Kesko’s Vice President of Investor Relations Hanna Jaakkola discussed store-specific business ideas with the President of Kesko’s grocery trade division Ari Akseli and Kesko’s Chief Digital Officer Anni Ronkainen in a recent investor podcast (available in Finnish here). Below is a summary of their discussion in English.

Big untapped potential in grocery stores tailormade to fit local demand and expectations

‘Store-specific business ideas’ are mentioned in Kesko’s strategy as something that lends Kesko a competitive advantage. But what exactly are they?

“A store that operates under a store-specific business idea is a store that has been tailored to fit its unique location and the needs of its local clientele,” explains Ari Akseli.

For the retailers, store-specific business ideas provide a framework that binds together the different aspects of the store.

“Traditionally, when you opened a new store, the focus was on counting square metres and euros. Today, the process is much more nuanced: you must consider which services the store will offer – are theere additional services, is there a service counter, does the store make its own sushi, hamburgers or pizza – how extensive the product selection should be, and what price level suits the local market,” explains Akseli. Data-based store-specific business ideas help to determine what the right concept for each store would be.

Anni Ronkainen notes that the store-specific business ideas should also be replicated online, with each store’s online selections reflecting the in-store selections.

At the moment, over 90% of K Group’s grocery stores have a defined individual store-specific business idea. However, according to Akseli, only half of the stores are currently fully utilising the tremendous potential that these business ideas offer, which is why he sees big untapped growth potential in them.

The role of data is crucial in formulating store-specific business ideas

Both Anni Ronkainen and Ari Akseli stress the importance of data in the formulation of store-specific business ideas.

“The role of data is crucial, as it allows each K-retailer to examine both the local competition as well at the local customer base: are there lots of families with children in the area, or perhaps pensioners? What is the local purchasing power? All this obviously informs the retailer’s decisions on what products to put on the shelves,“ Ronkainen explains.

“Customers are happy to provide their data when they know that the data helps make their local store better or that they will get products and offers that best suit them,” says Ari Akseli.

Kesko obtains data from various sources. When it comes to customer data, K Group’s K-Plussa customer loyalty programme in Finland is one of the main data sources. Says Ronkainen: “We are very happy that our customers are committed to the K-Plussa scheme and of course want to maintain their trust in this regard also going forward. What we’ve decided to do is to open up the data to the customers, thus increasing transparency and building trust.”

Kesko provides its customers access to their own purchase data, also helping them make healthier or more sustainable choices when buying groceries.

Anni Ronkainen notes that in many rural areas, stores have to adjust their selections seasonally when people from cities flock to their summer houses: “Essentially, these retailers have to establish two sets of selections for two sets of customers – one for the local winter customers and one for the summer dwellers. Again, here we can offer the retailers data that makes this task much easier than it was in the past. The data helps the retailers to prepare and anticipate and thus enables a better customer experience.”

In addition to customer data, the stores themselves have various systems that generate other types of useful data. Data also tells retailers how their stores are performing compared to other similar stores, thus helping them to develop their operations further.

Sustainable selections that meet local demand

Kesko has been ranked the most sustainable grocery trade company in the world for seven years in a row. Store-specific business ideas play a role also when it comes to sustainable selections.

“Sustainability is a wide concept and people have various different approaches to it – we must be able to serve them all,” says Anni Ronkainen.

Ari Akseli concurs, noting that different aspects of sustainability are important to different customers: some prefer organic products, some locally-produced products, some FairTrade products. Emphasis also tends to vary between people living in the centre of Helsinki and people living in the countryside: “Store-specific business ideas also can take into account which sustainability aspects are important to the customers of each store,” says Akseli.

Overall, the sales growth of all types of sustainable products is currently exceeding overall growth, and K Group will continue to strive to make sustainable choices easy for customers across the country.

Store-specific business ideas in practice: individuality and innovation

Ari Akseli mentions K-Citymarket Järvenpää as an excellent example of a store that is implementing its store-specific business idea well. The store offers, for example, world-class sushi and Roman-style pizza.

Meanwhile, the recently renovated K-Citymarket Tammisto in Vantaa is the first European hypermarket to house its own in-store brewery, soon making its own store beer. Some stores have their own coffee roasteries, one is considering making its own store liquorice.

K-Citymarket Tammisto in Vantaa houses the first in-store hypermarket microbrewery in Europe. Craft beers have grown in popularity over recent years, and the hypermarket’s own beer is part of its store-specific business idea.

Customers clearly respond to locally crafted selections: “In the store closest to Kesko’s headquarters in Helsinki’s Kalasatama, K-Supermarket Redi, the best-selling long drink is not the national favourite, but one that is made locally in Kalasatama,” notes Akseli.

You can’t copy great retailers and customer experiences

Hanna Jaakkola wonders what stops K Group’s competitors from copying the winning business ideas we come up with. Ari Akseli admits that external elements can easily be copied, from colours to fittings. However, K Group has a unique advantage in its K-retailers, who are independent entrepreneurs: they put their own money on the line, often entire families working for the store, and this makes them very responsive to customer needs.

K-retailers who want to offer their customers the best possible stores and service lend a crucial competitive advantage to K Group.

“K-retailers truly want to be part of the local community and solve any problems and needs their customers might have,” Akseli notes.

The K Group concept where Kesko and the K-retailers work together to ensure fresh products and fast and agile response is also quite unique.

For Anni Ronkainen, the most difficult element to copy is the customer experience, which takes a long time to construct. “Maybe you can copy product selections and the look & feel, but customer experience is the magic dust that cannot be easily copied, and I believe that is our strength,” says Ronkainen.

Ari Akseli concurs, noting that we get customer feedback from people who say they choose K Group stores because their retailer has responded to a customer request for a specific product.

“We even have cases where the retailer has jumped on a boat to personally deliver a missing product to a customer spending their summer on an island – that is something that is difficult to copy,” says Akseli.

Data enables stores to be both customer-oriented and efficient

Customer satisfaction is one thing, but surely maintaining a network of 1,200 grocery stores that are all different from each other cannot be very efficient? Ari Akseli disagrees, noting that thanks to data and modern tools, these days you don’t have to choose between being customer-oriented and being efficient.

“We utilise data to make each store’s offering fit local demand and customers. Data also helps us find the common core where we can utilise centralised logistics, purchasing and IT solutions – without compromising customer focus. We use customer feedback to improve the processes further for the customers, and we use feedback from the retailers to make Kesko’s processes better for them,” says Akseli.

Luckily, these days retailers reach out to Kesko at an early stage to detail exactly they need for a winning store-specific business idea. The better Kesko is able to respond to the needs of K-retailers, the bigger the wholesale for Kesko. Everybody wins.

IR blog: Q2 recap

Kesko will publish its half-year financial report for January-June 2021 on Friday, 23 July 2021, at around 9.00 am Finnish time. There is a Finnish-language webcast at 11.00 am the same day, and an English audiocast/teleconference at 12.30 noon (see details here).

Below is recap of Kesko's key events and news in Q2/2021.

Group and shares

* On 14 June 2021, Kesko issued a positive profit warning based in particular on stronger-than-anticipated development in building and technical trade (see release)

* On 27 May 2021, Kesko updated its financial targets, stating it will continue the implementation of its successful growth strategy (see release)

* The latest change in the holding of Kesko Corporation's treasury shares on 29 April 2021 (see release)

* Kesko managed to defend its position in the top five most valuable Finnish brands at 4th place (up 3% to €1.2bn) in the Brand Finance ranking (see release)

* Kesko’s investor pages were ranked second best in Finland by the Finnish Foundation for Share Promotion, the Finnish Society of Financial Analysts and financial media. Kesko has been among the top 2 in the competition for four years in a row (more information in Finnish)

Sales development

* Kesko’s sales in April (see release)

* Kesko’s sales in May (see release)

Other materials

* A strategy update by Kesko's President and CEO Mikko Helander (see video)

* Our latest road show presentation (see presentation)

* Our latest IR blog with CDO Anni Ronkainen discussing the use of data in developing customer experiences can be found here

Grocery trade news

* K Group strengthens its market-leading position in Finnish online grocery by investing tens of millions of euros in collection automation and builds the first partially-automated collection system in Finland (see release)

* K Group revamps its grocery stores based on tailored store-specific business ideas, investing €120 million in store network this year (see release)

Car trade news

* Kesko conducted codetermination negotiations in its car trade division as part of larger effort to make changes in the division (see releases here and here)

Sustainability news

* K Group increases the use of Finnish wind power substantially – share of K Group’s electricity purchases to rise to 20% (see release)

* The K Charge network will expand in 2021 with 20 new charging stations – fast charging up by over 130% (see release)

* Food waste in K-food stores down by a record 9% in 2020 (see release)

* Riikka Joukio begins work as Kesko’s new EVP of Corporate Responsibility and Public Affairs (see release)

* More than €5 million raised with the ‘Thank the Producer' model for Finnish food producers (release)

* Finns favour domestic products at a level that is exceptional on a global scale (see release)

* All Pirkka and K-Menu tuna cans to have QR codes that enable customers to access information on the products’ origin (see release)

Anni Ronkainen joined Kesko’s Group Management Board as the company’s Chief Digital Officer in 2015, having previously worked as Google’s Country Manager in Finland. During her extensive career, she has witnessed first-hand the digital evolution from the first primitive corporate websites to the modern use of analytics and AI to predict future customer behaviour.

Ronkainen sat down with Kesko’s Vice President of Investor Relations Hanna Jaakkola to discuss how Kesko uses data to create excellent customer experiences and how Kesko intends to maintain its No. 1 position in Finnish online grocery trade.

(The discussion is available in Finnish as a podcast here).

K-retailers crucial in making Kesko No. 1 in Finnish online grocery trade

The popularity of buying groceries online has exploded in Finland over the past year, naturally boosted in part by the pandemic. Understandably, developing Kesko’s online grocery sales solutions has also kept the CDO very busy. The hard work has paid off, with Kesko currently being the undisputed market leader in online grocery in Finland with an over 50% market share.

Ronkainen notes that the top position is the result of long-term efforts on Kesko’s part. Kesko had been developing its online capabilities long before the pandemic, though for years online only accounted for a very small share of grocery sales in Finland for both Kesko and its competitors: in 2019, the figure still stood at just 0.6%, jumping to 2.5% in 2020.

“When the pandemic hit, we had the basics for online grocery operations in place. What enabled us to quickly scale up operations is our retailer business model: our grocery stores are run by independent retailer entrepreneurs, who do everything they can to best serve their local customers. The retailers have also played a crucial role in driving growth online, while Kesko has provided the platform and enabled smooth online operations for the retailers,” says Ronkainen.

Anni Ronkainen expects online grocery shopping to become a lasting, slightly growing trend in Finland. But can Kesko maintain its market-leading position also going forward? The CDO acknowledges that it is a constantly moving target. Customer expectations are growing, and it is crucial to pay close attention to what the customers want.

“We must review new service options while simultaneously also examining new delivery alternatives. We must also constantly keep operational efficiency in mind. It's important for Kesko to make the combination of physical stores and online shopping a competitive advantage for itself, and to offer a seamless solution to customers.”

Utilising customer data responsibly to offer more personalised service in the stores

Ronkainen believes that the possibilities of utilising data and digitalisation in K Group's physical stores extend far beyond the current use of electronic price displays and marketing screens. New solutions entail more extensive use of customer data, respecting of course all regulatory guidelines on the matter. Ronkainen notes that Kesko is collaborating closely with authorities on this to ensure that it will continue to be able to utilise data to both serve customers and inform its own business development.

“I’m sure every retailer dreams of the day when they are automatically alerted to the arrival of their best customers to the store, so that they can, for example, offer personalised benefits to those customers. We have a long way to go, and of course need to first resolve all regulatory aspects.“

The basics of a good customer experience are the same whether buying groceries or a car

Providing positive customer experiences is part of Kesko’s strategy. Good customer experiences are crucial for Kesko’s all three divisions, that is grocery trade, car trade, and building and technical trade. According to Ronkainen, Kesko is able to leverage the experiences obtained in one division in the other two.

“When it comes to creating a positive customer experience, the same principles apply in all our divisions. However, there are also division-specific critical factors that we must be able to identify. NPS is a good tool for measuring customer satisfaction, but it does not tell us why customers are happy. This is why we need lots of additional data to find out where the magic comes from.”

One area of retail where customer experience has not, perhaps, been so central, is car trade.

“We’ve all heard some stories, and there is plenty of room for improvement in the car sales business in general, especially perhaps in the treatment of female customers. Consumers expect good service regardless of whether they are buying groceries or a car. This applies to online shopping and digital services as well as visiting a car dealership in person.”

When adopting new technologies, timing is everything

The world is changing fast, with new technologies constantly being introduced. Ronkainen emphasises the importance of identifying the technologies that are crucial for customers on the one hand, and for Kesko’s business on the other.

“It’s a constant race, and timing is also crucial: we must determine the right time to adopt new technologies so that we are not too early and not too late. We must stay alert to see the changes in people’s online shopping behaviour, so that we will be ready to move to the next stage when it’s the right time,” says Ronkainen.

Anni Ronkainen firmly believes that a business can’t go wrong as long as it keeps the customer at the centre of everything it does: “It’s when you concentrate on optimising internal processes that you lose focus, you forget about customer needs. When developing new solutions, it always essential to remember who they are for.”

Kesko held its 2021 Annual General Meeting on 12 April. In order to prevent the spread of the Covid-19 pandemic, special arrangements were in place, unfortunately preventing Kesko’s shareholders and their representatives from attending the meeting in person. Shareholders were instead given the opportunity to vote and submit counterproposals and questions in advance, and to follow the meeting as a live webcast. Naturally, we all hope that next year things are back to normal so that Kesko’s Annual General Meeting can once again bring together Kesko’s management and shareholders.

A total of 1,973 shareholders were presented at the meeting, representing some 183.5 million Kesko shares and 756.7 million votes. The Annual General Meeting was in favour of all proposals submitted by the Shareholders’ Nomination Committee and the Board of Directors. The meeting resolved, among other things, to distribute a dividend of €0.75 per share for the year 2020. It also authorised the Board to decide on the issuance of shares and elected an Auditor for the company. Click here for all resolutions of the 2021 Annual General Meeting.

Esa Kiiskinen, Kesko’s Board Chair, welcomed shareholders to watch the Annual General Meeting live webcast

The Annual General Meeting also elected seven members to form a new Board of Directors to serve the company for the next three years. Retailer Esa Kiiskinen, managing director Jannica Fagerholm, Board professional Peter Fagernäs, Metso Outotec's SVP, Business Development Piia Karhu, and retailer Toni Pokela will continue as Board members. New additions to the Board include long-time K-Rauta retailer Jussi Perälä and finance sector professional Timo Ritakallio. In the following videos, the two new members explain how they view Kesko’s current strategy, and what they think they can bring to the table.

All members of the Board are presented here. After the Annual General Meeting, the Board held an organisational meeting in which it elected from amongst its members the Board Chair, Deputy Chair and Audit and Remuneration Committee members.

Kesko also announced yesterday that Mikko Helander, who has been the company’s President and CEO since 2015, will not retire in June 2023 as originally agreed, but will instead continue to helm the company for the time being. Kesko’s Board Chair Esa Kiiskinen noted in his speech that Kesko has successfully undergone a strong transformation in recent years, and that the transformation and growth will continue under Mikko Helander also going forward.

Kiiskinen further expressed his thanks to the company’s management, retailers, K Group personnel, Kesko shareholders and all other partners for their contributions to Kesko’s success.

Visit the 2021 Annual General Meeting webpage to access all meeting materials.