Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

Kesko will publish its financial statements release for 2023 on Tuesday, 30 January 2024, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time, and can be accessed here.

Below is a recap of key events and investor materials for the quarter.

Below is a recap of key events and investor materials for the quarter.

NEWS, FINANCIALS AND SHARES

-

Jorma Rauhala has been appointed as Kesko’s new President and CEO as of 1 February 2024. Rauhala currently acts as President of Kesko’s building and technical trade division and Deputy CEO, and prior to that he was the President of the grocery trade division. (release).

The current President and CEO Mikko Helander announced in early December that he would be retiring in 2024. (release) -

The number registered Kesko shareholders rose above 100,000 for the first time ever in October. At the end of the 2023, Kesko had over 105,500 registered shareholders.

-

Kesko conducted an investor roadshow to US and Canada – see the blog post for recurring questions from North American investors. (blog post)

-

Kesko’s Q4 roadshow presentation for investors (presentation)

SALES DEVELOPMENT

Sales figures for December will be released in mid-January.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

Kesko’s K-Hyvinvointi service – which offers K Group grocery store customers nutritional data and advice based on their purchases – was named as one of “Finland’s most interesting data economy solutions” by the Finnish Innovation Fund Sitra (release in Finnish)

SUSTAINABILITY

-

Kesko was ranked the best sector company in Europe in the Dow Jones Sustainability Index the DJSI Europe. In the global DJSI World, Kesko ranked fourth highest in its sector (Consumer Staples Distribution & Retail). (release)

-

Kesko commits to setting new long-term emission reduction targets, aiming for net-zero emissions throughout its value chain by 2050. (release)

GROCERY TRADE

-

Kesko estimates that it is once again the market leader in Finnish online grocery. Kesko’s operating model – which marries online operations with those of traditional grocery stores – has proven effective and profitable. (investor blog post)

-

Kesko continues investments in its grocery store network by purchasing a plot in the city of Lahti for a new K-Citymarket hypermarket. (release)

An increasing number of Finns now do their Christmas food shopping online. The online grocery business is developing and growing at a steady pace. The operating model chosen by Kesko – which marries online grocery sales with K Group’s physical grocery stores – has proven effective and profitable. Kesko estimates that it is currently the market leader in the Finnish online grocery business. Positive performance in online sales supports Kesko’s overall market share in grocery trade. Online grocery also plays an important part in winning over and retaining customers, as people who shop in multiple Kesko channels tend to buy more and be more committed.

Last year, K Group (i.e. Kesko and the K-retailers) sold groceries to consumers online for a total sum of 236 million euros (incl. VAT). If we include the sales of Kesko’s B2B foodservice arm Kespro – where 70% of sales come through digital channels – the sum for online food sales in 2022 rose above 950 million euros.

K Group hosts the most comprehensive network of stores offering online grocery services in Finland, comprising nearly 700 grocery stores across the country. The number of weekly deliveries is approximately 90,000. In 2021, we piloted fast deliveries with Wolt, and the service has grown rapidly over the past few years.

Kesko estimates that it is currently the market leader in Finnish online grocery with a market share of some 41%. This is in comparison to Kesko’s overall share of 35.2% of the total Finnish grocery trade market (source: Finnish Grocery Trade Association PTY). The overall market shares in Finnish grocery trade have been fairly stable over the past 10 years, with only minor changes, while online, the situation continues to evolve at a more rapid pace.

Profitable online grocery business through the combination of online sales and physical stores

Many players internationally have come to discover that it is much more difficult to make a profit in selling food online than in selling, say, electronics or clothing: there are all kinds of concerns related to product freshness, “sell by” dates and cold storage, not to mention that the orders comprise a multitude of items priced at just a few euros. Some operators have chosen to forgo physical stores and instead operate dark stores, where items are collected and delivered to customers. Kesko, in turn, has chosen a different model, in which products are collected at local K Group grocery stores (with one store, K-Citymarket Ruoholahti in Helsinki, also hosting a micro fulfilment centre with robots).

Kesko has chosen an operating model in which online orders are collected at the customer’s K Group grocery store and delivered locally

Kesko has chosen an operating model in which online orders are collected at the customer’s K Group grocery store and delivered locally

Why exactly has Kesko chosen a model that combines online grocery sales with those of its brick-and-mortar stores? There are several reasons:

-

Extensive selections:

For Kesko, extensive product selections offer a competitive advantage in grocery trade, and this applies also to online operations, where our customers may access as many as 40,000 product items. In the past, we have also tested offering a more limited range, but the feedback was less than flattering: it is clearly important for our customers to be able to get their favourite products regardless of where they shop. We also want to provide online the same local products, service counter items, private label products and personal offers that customers get at our brick-and-mortar stores.

-

Efficient processes:

K Group’s online grocery can utilise the same efficient logistics, order systems and procurement services as the physical stores. The sales volumes in physical stores help to ensure good product availability and options for replacement products when necessary. We have also managed to make in-store collection considerably more efficient with the help of AI. -

Local service:

Each K Group grocery store has a unique data-based business idea, and the services and selections of the stores are tailored to the store’s own local customer base. Combining physical and online operations enables us to stick to the business idea also online.

Many leading grocery operators around the world have also adopted a model that in some way combines online grocery operations with those of brick-and-mortar stores:

Agile development and services that meet different customer needs

Kesko is constantly striving to improve the customer experience of shopping for food online. One part of this is ensuring we offer not only products our customers want but also order and delivery options that best serve them.

The K-Ruoka service comprises both a website and mobile app that allow the customer not only to shop online but to also search for products and recipes, see the latest offers, save electric receipts and view their purchase history and various personal trackers (for e.g. the carbon footprint and nutritional values of purchases made). The K-Ruoka.fi service has some 1 million active weekly users, and the K-Ruoka mobile app some 506,000.

Meanwhile, smaller K Group grocery stores offer a selection of some 5,000 products with fast delivery via Wolt. The service covers all major cities in Finland, and delivery on average takes only 24 minutes (in some cases, just 10). K Group began piloting these fast deliveries in 2021, and their popularity has since skyrocketed.

The services reflect the differing needs of different types of customers:

-

The K-Ruoka service tends to be used by families with children to carry out their big weekly shopping, with either order pick up or home delivery.

-

Products bought tend to be the basics also commonly purchased at physical stores: milk, vegetables, bread, coffee

-

The average purchase is approx. 140 euros

-

The customers tend to be more price conscious and plan their shopping more carefully

-

-

Fast deliveries are favoured by smaller households

-

Frequently purchased items include ready meals, frozen goods, soft drinks, sweets and snacks

-

The average purchase is approx. 25 euros

-

The customers tend to be less price conscious and prone to impulse buy

-

Bigger households use fast deliveries to complement their weekly shop

-

Although the online grocery as a business is growing and developing steadily, it is worth noting that in 2022, it still accounted for just 3% of Kesko’s total B2C grocery sales. Although online sales volumes are still fairly moderate compared to those of traditional grocery stores, the rise has been significant considering the pre-pandemic figure of just 1%. For Kesko, online grocery plays an important part in winning over and retaining customers, as people who shop in multiple channels tend to buy more and be more committed.

Kesko’s Chief Financial Officer Jukka Erlund and Vice President of Investor Relations Hanna Jaakkola went on an investor roadshow to North America in early November. This gave the Kesko team a chance to meet investors in Toronto, Boston and New York face-to-face and answer a wide range of questions concerning the company.

Kesko's CFO Jukka Erlund, DNB analyst Miika Ihamäki, and Kesko's VP of Investor Relations Hanna Jaakkola in between meetings in New York

Roadshows are typically organised in collaboration with banks, which handle practical arrangements and the agenda. This roadshow was organised with the Norwegian DNB, with the bank’s analyst taking part in most meetings. As is typically the case with investor roadshows, the timetable was packed, with five to six meetings per day and daily changing locations.

Is there another company Kesko could be compared to? As it turns out, not really

Investors in North America were clearly pleased to meet with the Kesko team face-to-face, and it was evident that interest towards Kesko has grown. Most meetings were with institutional investors with a long-term value approach, and consequently discussion focused more on the company’s long-term plans and potential rather than financials for the next quarter.

The investors were very well prepared and clearly already knew a lot about Kesko. Nonetheless, Kesko is such a unique company on a global scale that its combination of businesses raised many questions. Investors often ask us which companies Kesko could be compared to, but no other company in the world really combines grocery trade, building and technical trade, and car trade operations to the same extent as Kesko. Thus our team went over the changes in Kesko’s structure over the years, and especially the tightened business focus since the current growth strategy was adopted in 2015, which has seen Kesko divest non-core operations while at the same time engaging in acquisitions that have boosted the company’s growth and market shares.

The investor meetings took place in Toronto, Boston and New York

The investor meetings took place in Toronto, Boston and New York

How would you describe the culture in Kesko? How is the company able to retain people for such long careers? What is the most exciting aspect of your job? What keeps you up at night? Such questions are typical for North American investors, who want to get to really know the management and understand the company beyond its reported financials. On the other hand, Kesko’s representatives need to be able to provide insight on aspects that investors back home in Finland already know: What are Kesko’s grocery stores like? How about the building and home improvement stores? What exactly is the role of K-retailers and what is the division of labour between them and Kesko when it comes to running stores in K Group store chains.

Investors were also interested in Kesko’s capital allocation, including dividend distribution, acquisition targets and other investments and motives behind them. There were also questions regarding share buy-backs, a typically North American approach to profit distribution. Two of the investors our team met in Boston were fully ESG-focused: their questions were related to topics such as Kesko’s climate targets and circular economy efforts.

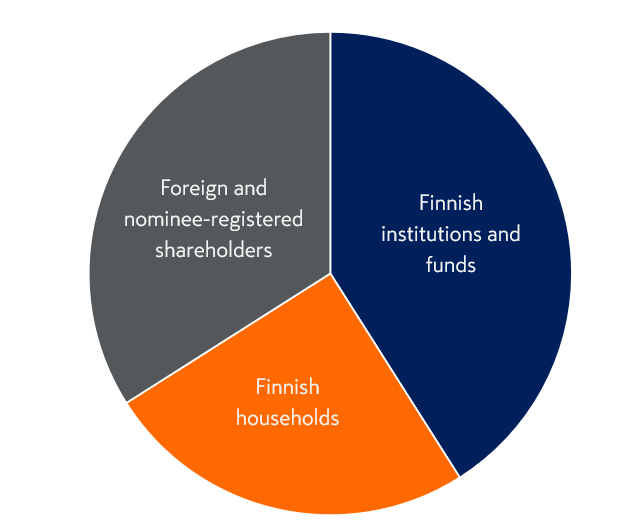

Kesko’s has a well-balanced ownership structure

Kesko has a versatile, well-balanced ownership structure. At the end of October, Finnish institutions and funds held some 41% of all shares in Kesko, and Finnish households some 25%. Foreign and nominee-registered investors held some 34% of all shares and 49% of Kesko B shares.

Breakdown of Kesko ownership at the end of October 2023

Like many Finnish listed companies, Kesko has seen its foreign ownership decrease slightly this year. Foreign ownership is important for Kesko, as it supports the stock.

Foreign investors tend to appreciate both Kesko’s free float as well as the stable anchor investor the company has in K-Retailers’ Association. During the roadshow, we were also happy to be able to inform the investors that, for the first time ever, the number of Finnish retail investors owning shares in Kesko rose above 100,000 in October, proving that the people who shop at Kesko stores also have faith in the company’s success.

See the roadshow presentation!

President and CEO: A fine Q3 performance in a weak market

Kesko managed a fine performance in a challenging market in the third quarter of 2023. We recorded net sales of €2,949.1 million, down by 2.0% year-on-year. Our comparable operating profit totalled €208.1 million, and was thus at the same level as in the second quarter, but fell short of the level seen a year ago. Our cost-efficiency has improved further thanks to measures implemented. Our cash flow in the third quarter stood strong at €395 million. In August, we announced Kesko would be acquiring Davidsen Koncernen A/S, a leading Danish builders’ merchant, thus expanding our operations to Denmark and gaining a solid foothold on the local building and home improvement market. Kesko’s objective is to take part in the consolidation of Northern European building and technical trade on the B2B side also going forward, and to be a leading operator in the sector not only in Finland and Norway, but also in Sweden and Denmark. In technical trade, growth will also be important in Poland and the Baltics.

"Kesko managed a fine performance in a challenging market in the third quarter of 2023. Kesko’s outlook for the remainder of 2023 continues to be positive. Kesko’s operating profit is expected to remain at a good level also in 2024 despite the challenges in the operating environment."

In the grocery trade division, net sales totalled €1,593.5 million, and comparable operating profit amounted to €118.2 million. K Group's grocery sales grew by 3.6%. Sales also grew in the foodservice business: Kespro’s net sales increased by 4.7% and profitability stood at 7.3%. Price continues to be an important factor in grocery trade, but demand for premium products has started to recover. Customer flows have grown stronger thanks to campaigns and other marketing efforts. Kesko continues to update its existing stores, and will be opening many new grocery stores in Finnish growth centres in the near future. Sales of Kesko’s K-Citymarket hypermarket stores in particular have been growing considerably, and they have a crucial impact on the profitability and market share of Kesko’s grocery store business. In the food trade market, Kesko’s annual retail and B2B sales total over €8 billion, and the company holds a market share of approximately 37%. In contrast to many other European operators, Kesko holds a strong position in all areas of food trade.

In the building and technical trade division, net sales amounted to €1,050.3 million, with a comparable operating profit of €69.8 million. Profitability weakened, but stayed at a good level of 6.6%. In our biggest market Finland, the operating margin for building and home improvement trade was 7.2% and the margin for Onninen 8.6%. Inflation and rising interest rates have seen construction activity decline in 2023. Cyclical fluctuations are natural for the construction sector, and the down-cycle is currently impacting new residential building in particular, which accounts for 20-30% of all construction. However, in the long term, the outlook for building and technical trade is positive. Urbanisation, renovation and investment debt, infrastructure projects and the green transition sustain construction over cycles. Kesko is a leading operator in building and technical trade in Northern Europe, and has great potential to grow further.

In the car trade division, sales grew clearly in all car trade business segments. The division’s net sales grew by 7.2% in comparable terms and totalled €310.8 million, and its comparable operating profit was €24.3 million. New car deliveries grew markedly year-on-year. Used car sales grew clearly, and our market share strengthened. Service sales also developed well. The order book for new cars continues to be at a good level, but demand and orders are clearly below normal levels.

Kesko’s outlook for the remainder of 2023 continues to be positive. Kesko specifies its profit guidance and now estimates that its comparable operating profit in 2023 will be in the range of €680–730 million. Kesko’s operating profit is expected to remain at a good level also in 2024 despite the challenges in our operating environment.

KEY FIGURES IN JULY-SEPTEMBER 2023:

-

Group net sales in July-September totalled €2,949.1 million (€3,009.8 million). Reported net sales were down by 2.0%, in comparable terms net sales decreased by 2.7%

-

Comparable operating profit totalled €208.1 million (€242.8 million)

-

Operating profit totalled €206.6 million (€242.4 million)

-

Cash flow from operating activities totalled €394.9 million (€318.8 million)

-

Comparable earnings per share €0.38 (€0.47), reported earnings per share €0.37 (€0.47)

See all Q3 reporting materials

Kesko will publish its Q3 interim report on Thursday, 26 October 2023, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time.

Below is a recap of key events and investor materials for the quarter.

NEWS, FINANCIALS AND SHARES

-

Kesko’s Q3 roadshow presentation for investors (presentation)

SALES DEVELOPMENT

Sales figures for September will be released in mid-October.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

Kesko launched K-Citymarket.fi, a new online store for home and speciality goods that focuses on providing a great customer experience with a multichannel approach. (release)

SUSTAINABILITY

-

Ribbons sold in K Group stores helped raise over 264,000 euros for Ukrainian families that have fled the war in Ukraine to Finland. (release)

GROCERY TRADE

-

Kesko continues investing in updating its network of grocery store sites, upgrading existing stores and opening new ones. Hypermarkets have a crucial impact on the profitability and market share of Kesko’s grocery store business, and the company is set to open multiple new K-Citymarket hypermarkets in Finnish growth centres in upcoming years. (release)

-

One of the new hypermarkets will be located in Finland’s fourth largest city Vantaa in the Helsinki metropolitan area. The new 7,000 square-metre K-Citymarket is set to open in early spring 2026. (release)

BUILDING AND TECHNICAL TRADE

-

Kesko will expand building and home improvement trade operations to Denmark by acquiring 90% of Davidsen, the third biggest operator in the Danish building materials market. The total Danish market is estimated to amount to €5.7 billion, and Kesko aims to grow in Denmark both organically and via further acquisitions. (materials related to the acquisition and investor blog post with Q&A)

-

Kesko also acquired Geitanger Bygg AS in Norway’s second biggest city Bergen. (list of acquisitions and divestments)

-

Kesko will concentrate its building and home improvement trade operations in Sweden under the K-Bygg chain, and will increasingly focus on serving building professionals alongside consumers. (release)

CAR TRADE

-

Kesko expands its K-Lataus EV charging network further, focusing on high-power charging (HPC). The number of K-Lataus charging stations will grow to 300 by the end of this year, with 400 new HPC points. In the first half of 2023, the K-Lataus customer base grew by over 70%, and the amount of electricity charged was more than double that of full-year 2021. (release)

Kesko announced on 23 August 2023 that it will acquire 90% of Davidsen, a leading builders’ merchant in Denmark, thus expanding its building and technical trade business into Denmark. Below we provide more details regarding the acquisition as well as answers to investor questions concerning the Davidsen acquisition and the Danish market overall.

Update on 31 January 2024:

The Davidsen acquisition has been completed and Davidsen will be consolidated into Kesko Group’s financial reporting from 1 February 2024 onwards - see release

Davidsen Koncernen A/S

-

Third biggest builders’ merchant operator in Denmark, serves primarily B2B customers

-

23 stores, most of which are located in Southern Denmark; some 850 employees

-

2022 key figures: net sales €560 million, EBITDA €27 million, EBIT €23 million (excl. IFRS 16 impact)

Transaction

-

Kesko will acquire 90% of the company, and the founding Davidsen family will maintain a 10% ownership

-

The debt-free acquisition price for the 90% is approximately €170 million

-

Davidsen will continue to operate under its existing brand and its current local management

-

The completion of the acquisition is subject to EU Commission’s merger approval and fulfilment of certain other conditions. The transaction is expected to be completed in Q1/2024 at the latest.

Q&A: THE DANISH MARKET

Q: Why does Kesko want to expand its operations to Denmark?

A: As stated in Kesko’s strategy, we seek growth in building and technical trade in Northern Europe both organically and via acquisitions. In Finland, we are the market leader in both building and home improvement trade and technical wholesale, and in Norway and Sweden, we have conducted many acquisitions in recent years.

Denmark is a wealthy country and one of the most stable nations in the world both politically and economically. The Danish market is attractive to Kesko: although the population size (5.8 million inhabitants) is similar to that of Finland, the Danish building and home improvement market is 1.5 times the size of the Finnish market. This offers a lot of potential.

The Danish building and home improvement market:

-

Valued at some €5.7 billion in 2022

-

The three biggest operators – Stark, Bygma and Davidsen – together control 50% of the market

-

Some 30 independent retailers form the XL-BYG chain, which controls 20% of the market

-

Also a large number of small, local builders’ merchant companies

The Danish building and home improvement market is currently very fragmented. The megatrend in recent years has been sector consolidation, and Kesko wants to actively take part in the consolidation of the Danish market.

Q: Construction volumes in the Nordic countries have come down. Is it wise for Kesko to expand its building and home improvement trade operations right now?

A: Kesko has established a growth strategy for its building and technical trade division, and the company executes this strategy regardless of economic cycles. We believe that there will always be a need for building and renovation. The Davidsen acquisition is a long-term strategic investment for Kesko, and we see plenty of potential in the Danish market in years to come. The current weaker business cycle partly enabled Kesko to acquire Denmark’s third biggest building and home improvement trade operator, and therefore the timing can be considered advantageous. The downturn is affecting business, but at the same time it offers consolidation opportunities for an industrial player such as Kesko.

Q: Some outside operators have found it challenging to expand their operations to Denmark – how does Kesko intend to tackle any such challenges?

A: Kesko’s building and technical trade division employs country-specific strategies in all of its seven current operating countries. This means that we adjust our operations to the specifics of each country, and utilise the insight and expertise of our local representatives. We rely on local expertise also in Denmark, with the Davidsen family staying on as a minority shareholder and the current operational management remaining at the helm, with operations continuing under the established Davidsen brand.

Q: Does Kesko have further plans in Denmark? Does it intend to acquire more companies in the country?

A: Kesko is seeking growth in Denmark both organically and via acquisitions. Developing Davidsen’s operations further is a priority for us. We expect to see more consolidation in the Danish building and home improvement trade market, and we are very interested in the opportunities this development can offer. Kesko sees plenty of growth potential in Denmark.

Q&A: THE DAVIDSEN ACQUISITION

Q: Why did Kesko want to acquire Davidsen?

A: The acquisition of Davidsen is very much in line with Kesko’s growth strategy. By acquiring the third biggest operator in the country, we gain a foothold in the attractive Danish market, and can build future growth on that. We ensure continuity and local expertise with the continued involvement of the Davidsen family and the company’s management.

Davidsen holds a 9% market share overall, but in Southern Denmark, it controls some 30% of the market. This is positive for Kesko, as we have a strong position in the South, but no overlapping operations when it comes to potential future acquisitions in other parts of Denmark.

Q: Is Kesko able to obtain synergies from this acquisition?

A: The acquisition of Davidsen is primarily a strategic play for Kesko. Typically, we seek synergies both within and between our operating countries, but as Davidsen is our first entry into the Danish market, there are no synergies available within Denmark for now. There are, however, some synergies between Kesko and Davidsen in e.g. sourcing, selections, and best operating practices.

Q: Kesko has stated that it will increasingly focus on servicing the B2B customer segment in building and technical trade and that this also impacts its decisions when it comes to potential acquisitions. Why is Kesko focusing on serving building sector professionals rather than consumers, and how much of Davidsen’s business comes from B2B?

A: Building and renovation work are becoming increasingly technical, which means consumers are doing less and professionals more. This trend has led Kesko to decide to focus increasingly on serving professionals in the B2B segment. Davidsen has also made the strategic decision to focus more on B2B, which now brings in some 80% of its net sales. Davidsen serves consumers mostly online.

Q: In your release, you say that Davidsen’s sales and profitability are expected to temporarily be below the 2022 level due to the economic downturn and lower construction volumes. Are you concerned about Davidsen’s profitability?

A: The Davidsen management has already executed remarkable savings, and they are very capable of executing actions needed to boost sales also going forward.

Furthermore, Kesko has a strong track-record in improving the profitability of both its own and acquired operations.

Q: Are you pleased with the purchase price?

A: In our view, the agreed purchase price is good considering the opportunities this new market can offer Kesko. The acquisition of Davidsen is a long-term investment for Kesko. The transaction terms also take into account the current weaker business cycle.

Q: Kesko is now buying 90% of Davidsen, and the Davidsen family maintains 10 % of the shares. Has Kesko agreed to buy the remaining shares at a later date?

A: It is important for us that the Davidsen family stays on as a minority shareholder and is committed to growing and developing the company together with Kesko. We do not disclose the specifics of our agreement.

President and CEO: Kesko's Q2 result was a strong performance in a challenging market

Kesko’s performance in the second quarter of 2023 was strong in a challenging market. Our net sales totalled €3,104.7 million and were thus at the same level as the year before. Our comparable operating profit totalled €207.6 million. The Group’s cash flow from operating activities was good, and we continued investments in line with our growth strategy during the quarter. Kesko’s growth strategy and its successful execution in all divisions are yielding results also in a more challenging operating environment.

Kesko has a good strategy that focuses on its own strengths, the ability to respond quickly to changes in its operating environment and to constantly improve its efficiency, as well as a strong balance sheet that enables investments in growth

In the grocery trade division, net sales grew by 4.7% and profitability was at a good level. The division’s net sales totalled €1,624.0 million and its comparable operating profit €118.4 million. Grocery sales in K Group grocery stores were up by 4.6%: this fell short of the market, but less so than in the first months of the year. Campaigns and other marketing efforts have seen customer visits and sales in our grocery stores increase. K Group’s online grocery sales grew by 3.8%. The Norwegian Oda announced in the spring that it would be withdrawing from the Finnish online grocery market. Sales were also strong in Kespro’s foodservice business, where the 9.8% growth in net sales once again exceeded the market.

In the building and technical trade division, net sales decreased by 10.8% and totalled €1,148.8 million. The division’s comparable operating profit was €72.0 million. Profitability weakened, but still remained at a good level. Profit decreased in both building and home improvement trade and in technical wholesale as construction volumes weakened. Construction activity has clearly decreased in Northern Europe as a result of rising inflation and interest rates, especially in new construction. In technical wholesale, Onninen’s sales were at a good level. In Onninen’s biggest market – Finland – the operating margin remained at a good level of 8.2%. Our market share has continued to strengthen in our biggest markets Finland and Norway.

New car deliveries increased significantly on the comparison period, which caused the net sales and operating profit for the car trade division to increase. Net sales for the division grew by 24.9% in comparable terms, totalling €337.6 million. Sales grew in all car trade business areas. The division’s comparable operating profit was €24.3 million. The order book for new cars remains above normal levels. Sales development was also good in used car sales and services. Weakening demand has seen orders for new cars decrease clearly on the comparison period.

The current operating environment is challenging for companies due to, among other factors, rising inflation and interest rates. Kesko is in good shape to generate profits. We have a good strategy, which focuses on our own strengths. We respond quickly to changes in our operating environment, and have been able to constantly improve our efficiency. Kesko’s strong balance sheet enables investments in growth also in this economic cycle.

Kesko’s outlook for 2023 is positive. Transformation efforts and strategy execution have improved our ability to produce profit. We are specifying our profit guidance, and now estimate that our comparable operating profit in 2023 will be in the range of €680-760 million.

KEY FIGURES IN APRIL-JUNE 2023:

-

Group net sales in April-June totalled €3,104.7 million (€3,108.5 million). Net sales at the same level as the year before, in comparable terms down by 0.8%

-

Comparable operating profit totalled €207.6 million (€236.0 million)

-

Operating profit totalled €206.3 million (€238.3 million)

-

Cash flow from operating activities totalled €285.2 million (€262.4 million)

-

Comparable earnings per share €0.38 (€0.45), reported earnings per share €0.38 (€0.45)

Kesko will publish its 2023 half-year financial report on Thursday, 27 July 2023, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time. Registeration for the audiocast is available here.

NEWS, FINANCIALS AND SHARES

-

Kesko roadshow presentation for May 2023. (presentation)

-

Sports trade has been reported as part of Kesko’s car trade division as of 1 April. Sports trade was previously part of the building and technical trade division – comparison figures for the new segment structure were released in May. (release)

-

Change in the holding of Kesko's treasury shares. (release)

SALES DEVELOPMENT

Sales figures for June will be released in mid-July.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

K-Rauta was again named the best e-commerce operator (building and renovation) in Sweden. Decided by the public and a jury, K-Rauta’s online store was praised for its ability to make renovation projects fun and easy for consumers. This is the second year in a row K-Rauta has won the prize. (release in Swedish)

-

In an ongoing effort to support and facilitate the business operations of its customers, Kespro introduced a new data-based tool for restaurants and other foodservice wholesale customers that enables them to easily track and optimise their ingredient purchases. (release)

SUSTAINABILITY

-

Kesko and K Group are committed to facilitating choices that promote customer health and wellbeing – work to increase labelling for healthier own brand food products is proceeding at a good clip. (release)

-

Onninen offers a new carbon footprint report for its customers in Finland, detailing the environmental impact of its logistics operations. (release)

-

Kesko joins global climate collaboration with other leading building and home improvement trade operators in an effort to find new ways to reduce indirect Scope 3 emissions in its value chain. (release)

-

Onninen Norway has reduced its plastic consumption by 8.5 tonnes in just two years, while the Byggmakker chain is set to follow its example. (release in Norwegian)

GROCERY TRADE

-

Investor presentation by division President Ari Akseli, detailing recent performance and current focus areas. (presentation)

BUILDING AND TECHNICAL TRADE

-

Onninen’s sales of solar power systems in Finland quadrupled last year – products related to solar power becoming one of the main categories boosted by the green transition, with strong interest from both B2B customers and consumers. (release)

-

Investor presentation by division President Jorma Rauhala, with special focus on the impact of the green transition on Onninen’s business. (presentation)

-

The cornerstone was laid for the new Onnela logistics centre, which is the biggest construction project in Kesko’s history. The 85,000 square metre centre will serve both Onninen and K-Auto, and support Kesko’s growth strategy in Finland. (release)

CAR TRADE

-

New division President Sami Kiiski has vast experience of working in the B2C business and dealing with strong international brands. He believes that a multichannel approach is a winning recipe for building the best customer experience in the business. (blog post)

-

Sustainability is an increasingly important consideration for Finnish drivers when choosing their next car. According to a survey by K-Auto, when it comes to choosing their next car, over 60% of Finnish drivers are looking to reduce emissions, 76% to improve traffic safety, and 59% overall want a more environmentally friendly vehicle. (release in Finnish)

Sami Kiiski took over as the President of Kesko’s car trade division on 1 June 2023, as his predecessor Matti Virtanen retired. Kiiski has previously steered Kesko’s sports trade business, which is now part of the car trade division. In our IR blog, Kiiski explains what he can bring to the car trade business, and how he hopes K-Auto can create the best customer experience in the business by combining great digital services with the ability to see and experience the cars in person.

The newly appointed division President is unlikely to experience any dull moments, as the whole automotive sector and forms of mobility continue to undergo a massive transformation. Cars are becoming increasingly electric, and digitalisation is changing the way people buy them. Kesko has also been transforming its car trade division heavily in recent years, which has been reflected in good profitability development for the division, even with issues with new car availability bogging down the business. While availability issues have begun to ease, weakening consumer purchasing power is a new cause for concern, as it affects people’s ability and eagerness to purchase cars.

Sami Kiiski says that Kesko will continue to actively develop and transform its car trade operations further, with focus firmly on the future. Previously identified potential will be developed and refined further. As stated in the division’s strategy, the business will comprise the sales of new and used cars as well as various car-related services, including Finland’s most extensive EV charging network K-Lataus.

Strong brands and increased importance of a multichannel approach something both car trade and sports trade share

Kesko’s sports trade comprises two store chains: Intersport and Budget Sport. Up until April this year, figures for sports trade were reported as part of Kesko’s building and technical trade division, but now sports trade operates under the car trade division. Kiiski has headed Kesko’s sports trade since 2020. He sees car trade and sports trade as a good fit, as both are consumer-driven businesses based in Finland, with a strong focus on international brands.

What has Kiiski learned in his years in sports trade that he can utilise in overseeing Kesko’s car trade?

“For one thing, the Volkswagen Group is an important partner for K-Auto, and in my years in sports trade, I’ve gained plenty of experience in collaborating with strong international brands. We have worked hard in sports trade on advancing digitalisation and a multichannel approach to customer service – both themes are very relevant also for car trade. I also see potential in concept development and in strengthening the K-Auto brand,” says Kiiski.

Aiming for the best customer experience in all car trade

One of the key strategic objectives for Kesko’s car trade is to be able to provide the best customer experience in the business. According to Kiiski, this means making the process of buying a car or related services as easy as possible for the customer. Key elements in this are advanced digital services combined with the expertise and customer service skills of K-Auto’s sales staff, which will be further developed going forward.

In practice, making car purchases easier might mean, for example, cutting down on unnecessary paperwork. K-Auto can also utilise its customer data to anticipate and proactively respond to customer needs, for example, by helping customers book servicing at the right time.

To ensure the best customer experience in the business, Kesko’s car trade relies heavily on a multichannel approach that combines advanced digital services with expert in-person customer service

Although digital services play an important role in modern car trade, Kiiski stresses the importance of combining them with a network of physical stores:

"Buying a car is a big investment – it is important that we have stores located in the right places so that our customers can come in, get a feel for the cars and take them for a spin.”

Updating the Finnish vehicle stock for safer and more sustainable driving

As with everything Kesko does, sustainability is an important theme also in the car trade division. As Kiiski notes, car trade is well-positioned to promote the green transition and e-mobility. Even for drivers who prefer the traditional combustion engine, modern car models offer notably lower emissions. On average, Finns drive much older cars than people elsewhere in Europe: updating the badly outdated vehicle stock would be beneficial for both the environment and for traffic safety.

And how does the newly appointed head of car and sports trade intend to get around this summer – will he opt for an electric car or an e-bike?

”Definitely both, depending on the weather,” says Kiiski with a smile.

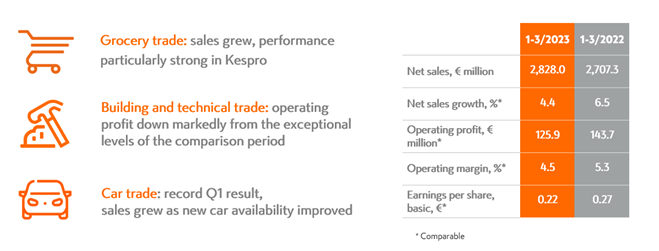

President and CEO: Kesko posted a good Q1 result in a weakened economic situation

Kesko’s result in the first quarter of 2023 was good despite a weaker operating environment. Our net sales grew by 4.4% in comparable terms, totalling €2,828.0 million. Our comparable operating profit totalled €125.9 million. Our good strategy and its successful execution in all business divisions as well as strong transformation are yielding results.

Profitability for the grocery trade division was good in the first quarter. The division’s net sales totalled €1,495.0 million, growing by 8.2%, while the comparable operating profit rose by €3.6 million to €83.9 million. Profit improved especially due to good progress in the foodservice business: Kespro’s net sales grew by 28.0%. The division’s profitability was good, with a comparable operating margin of 5.6%. Rising food prices are impacting customers’ shopping, as reflected in e.g. the growing popularity of private label and campaign products. Customer flows have grown. The basis for good progress in our grocery trade division is our strong position in all areas of Finnish food trade.

In the building and technical trade division, net sales decreased by 4.4% in comparable terms, totalling €1,074.7 million. The division’s comparable operating profit amounted to €32.6 million, down by €29.0 million from the very exceptional levels of the comparison period. In spring 2022, customers stockpiled products due to availability concerns caused by Russia’s offensive war and rapidly rising prices. However, results for the building and technical trade division have multiplied since 2019, i.e. the last regular year before the pandemic and war in Ukraine. In technical trade, Onninen’s sales were at a good level. Demand was particularly strong for products related to the green transition and to improving energy efficiency. In building and home improvement trade, sales declined especially in B2C trade, with demand decreasing also in B2B trade. During the quarter, we continued acquisitions in line with our strategy by acquiring Elektroskandia Norge AS, thus strengthening Onninen’s market leading position in the Norwegian utility wholesale sector. In Sweden, we acquired the solar power system wholesaler Zenitec Sweden AB.

In the car trade division, sales grew in all business segments. The division’s net sales were up by 27.2% as the availability of new cars improved, and totalled €264.8 million. The division’s comparable operating profit totalled €16.9 million, representing an increase of €7.0 million. The operating margin was 6.4%, thanks to growth in sales and the transformation and efficiency improvement measures taken. Sami Kiiski was appointed as the new division President and a member of Group Management Board as of 1 June 2023.

Kesko’s outlook for 2023 is positive. Transformation and strategy execution have improved our profit-making ability. We repeat our profit guidance and estimate that Kesko’s comparable operating profit in 2023 will be in the range of €680-800 million.

KEY FIGURES IN 1-3/2023:

-

Group net sales in January-March totalled €2,828.0 million (€2,707.3 million), an increase of 4.4% in comparable terms, reported net sales grew by 4.5%

-

Comparable operating profit totalled €125.9 million (€143.7 million), Comparable operating profit decreased by €17.9 million.

-

Operating profit totalled €122.6 million (€144.6 million)

-

Comparable earnings per share €0.22 (€0.27)

-

Reported Group earnings per share €0.21 (€0.26)

Kesko will publish its Q1/2023 report on Friday, 28 April 2023, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time.

NEWS, FINANCIALS AND SHARES

-

Kesko’s 2022 Annual Report was published, comprising multiple sections and detailing the company’s progress in, for example, strategy execution, financial performance, sustainability work, and data utilisation. (See full report)

-

Kesko’s Annual General Meeting was held on 30 March, and it resolved, among other things, to distribute dividends of €1.08 per share for 2022, to be paid in four instalments. (AGM resolutions).

-

Sami Kiiski was appointed as President of Kesko’s car trade division and a member of Group Management Board as of 1 June as Matti Virtanen retires. Kiiski currently heads Kesko’s sports trade. Sports trade will become part of Kesko’s car trade division. (release)

-

Establishment of new share-award plans. (release)

-

Realisation of Kesko’s existing share award plans. (release)

-

Change in the holding of Kesko’s treasury shares. (release)

-

Kesko’s Investor Relations received multiple awards thanks to focused efforts to offer the best possible investor service to all investor groups, including the rapidly growing number of Finnish retail investors. (blog post)

SALES DEVELOPMENT

Sales figures for March will be released in mid-April.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

Kesko combines its Finnish customer loyalty programme with share ownership in a ground-breaking new model. (release)

-

Kesko published its second Data Balance Sheet report as part of its annual reporting, expanding the scope to cover the business-driven utilisation of data and digitalisation in all three business divisions. (blog post)

SUSTAINABILITY

-

Kesko ranked as the most sustainable grocery trade company in Europe and third highest in its sector globally on the 2023 ‘Global 100 Most Sustainable Corporations in the World’ listing issued by Corporate Knights. Kesko is the only company in the world to have made the list every year since its inception in 2005. (release)

-

The global environmental organisation CDP named Kesko a ‘Supplier Engagement Leader’ in recognition of Kesko’s exemplary encouragement of suppliers to take climate action. (release)

-

See also the ‘Sustainability’ section of Kesko’s 2022 Annual Report for a comprehensive review of sustainability strategy execution.

GROCERY TRADE

-

In an effort to steer Finnish eating habits in a healthier direction, K Group is reducing the amount of salt, sugar and saturated fats in its own brand products, promoting the use of more fruit and vegetables, and increasing the use of labelling for healthier food options. (release)

BUILDING AND TECHNICAL TRADE

-

Kesko subsidiary Onninen acquired Elektroskandia Norge AS, one of the main distributors of electrical products in Norway. The acquisition will strengthen Onninen’s position in Norwegian technical trade. Following the acquisition, Kesko's sales in Norway approach €1.5 billion. (release)

-

Onninen also agreed to acquire Zenitec, a Swedish solar power system wholesaler. (release)

-

Building and technical trade update by division President Jorma Rauhala. (presentation)

CAR TRADE

-

Volkswagen continues to be the market leader in electric cars in Finland, with a 13.4% market share of full electric car registrations in 2022. Overall, Volkswagen was the second most registered brand of passenger cars in Finland in 2022. (release in Finnish)

In early March, Kesko published its second-ever Data balance sheet report as part of its Annual Report. Kesko remains the only Finnish listed company to issue a voluntary report detailing how it is utilising the data it possesses to drive business. Data and digitalisation were once again highly important for Kesko in 2022, as they helped the company navigate in a rapidly changing operating environment.

Data plays a central role in aspects such as creating a good customer experience, managing stores, online sales operations and supply chains, and also in improving profitability. Our report provides more information on how this is done, with interesting case studies. We explain, for example, how we are utilising and upgrading the digital ecosystem in our grocery trade division, to create value to various stakeholders such as customers, K-retailers, suppliers of goods and services, and other partners.

Data and digitalisation are crucial for all three business divisions

Kesko’s first-ever Data balance sheet report was published last year. That report focused mainly on our grocery trade division. The second report has a wider scope, expanding the point of view also to building and technical trade and car trade. For example, one key element in digital services in building and technical trade is offering extensive product information, images and instructions for installation. The division has also used digitalisation to provide smooth and convenient purchase processes for its customers. In car trade, an AI based tool developed by Kesko determines the correct price for each used car, based on regional data concerning current trends in e.g. demand and sales completed.

In addition to offering benefits for business and customers, data also involves threats and risks, which Kesko actively manages. Robust data protection, cyber security and a modern, continuously evolving technological infrastructure form a strong foundation for everything else. Transparent communication about data management and utilisation and sustainable data-driven value creation are in line with data economy that values the rights of the individual.

See Kesko’s Data balance sheet report as part of our Annual Report!

The Finnish Foundation for Share Promotion handed out awards for outstanding Finnish listed companies at the end of January. Kesko’s investor relations were honoured with awards for best investor web pages and best head of investor relations for Hanna Jaakkola. The achievements are based on determined work over the years to offer the best possible investor service to all investor groups in all channels.

Kesko’s Vice President of Investor Relations Hanna Jaakkola got to collect two awards at the gala event hosted by the Finnish Foundation for Share Promotion

The Finnish Foundation for Share Promotion is a neutral foundation that aims to promote retail investment and develop the securities markets in Finland. To promote best practices in e.g. investor relations and sustainability reporting, the foundation hands out awards to listed Finnish companies that excel in these areas.

Kesko’s investor webpages ranked No 1 among Finnish large caps

The Finnish Foundation for Share Promotion and the Finnish Society of Financial Analysts have been handing out awards for the best investor web pages since 1999 in an effort to promote best practices. A key criterion for the best investor web pages is that they enable investors to find all relevant information as easily as possible.

Kesko has done well in the competition over the years, and is in fact the only company in its category to have made the Top 3 for six consecutive years. This year, Kesko received the highest overall score of all reviewed companies, and was awarded as best in the large cap category.

In all investor communications, Kesko aims to present relevant information succinctly and effectively, in a manner that is easy to understand. The same principles apply to its investor web pages.

We constantly develop and add new topical content to the web pages. In recent years, our particular focus has been on ensuring that investors can find information on how exceptional circumstances, such as the pandemic and the war in Ukraine, may impact Kesko’s business.

Typically the same themes and issues interest both big international investors and Finnish retail investors, which is why another key priority with our investor web pages is ensure all investors have equal access to relevant information.

Hanna Jaakkola named IRO of the Year

For the first time ever, an award was also given in the category of best head of investor relations. The competition jury selected four finalists, and the winner was chosen by public vote, with Kesko’s Hanna Jaakkola winning the title.

Jaakkola joined Kesko as Vice President of Investor Relations in autumn 2019. The competition jury noted that since then, Kesko’s shareholder base has more than doubled, which is an extraordinary achievement.

Jaakkola was thrilled and proud to receive such recognition:

”My work is made easier by the fact that everyone in Finland knows and has shopped at K-stores. Kesko also pays good dividends. This is my dream job and I’m passionate about it. While investor communication is mandatory and strictly regulated, when it comes to promoting investor relations, the sky is the limit! And you can have fun and make friends along the way, too.”

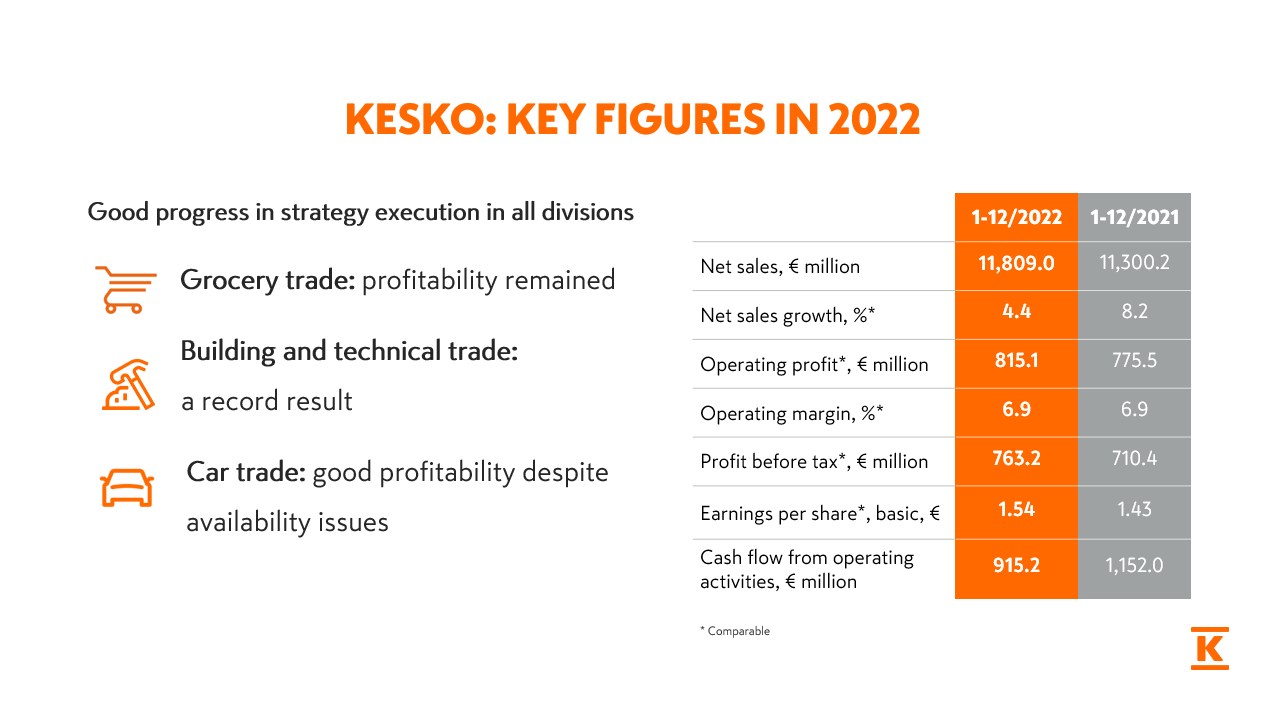

All Kesko divisions generated a good result in 2022. Our annual result has now improved for eight consecutive years. The result we achieved is strong proof that Kesko is a unique trading sector operator whose strategy works in a rapidly changing operating environment.

Kesko’s Board proposes to the Annual General Meeting a dividend of €1.08 per share for 2022, to be paid in four instalments

In 2022, our net sales grew by 4.3% in comparable terms and totalled €11,809 million. Our comparable operating profit amounted to €815 million, representing an increase of €40 million. Good progress was made in strategy execution in all areas. Our good ability to produce a profit and strong financial position enable investments in growth and good dividend capacity. Kesko’s Board proposes to the Annual General Meeting a dividend of €1.08 per share, which totals nearly €430 million, proposed to be paid in four instalments.

In the grocery trade division, profitability was good also in 2022. Profitability improved thanks to good performance by Kespro. The division’s net sales grew by 3.6%, and its comparable operating profit rose to €460 million. Profitability for the division was good, with a comparable operating margin of 7.5%. The basis for good profitability in the grocery trade division is our strong position in all areas of Finnish food trade. Our strength in food trade lies in our extensive network of physical grocery stores combined with efficient online sales and our foodservice business, as well as our well-functioning retailer business model. Our strategic goal is to continue to grow sales and improve customer experience.

The building and technical trade division posted its all-time best result in 2022. The division’s net sales grew by 9.4% in comparable terms and totalled €4,805 million. The comparable operating margin for the division was 7.1%. Strong performance continued for Onninen and K-Rauta in Finland. In Norway and Sweden, sales development was good in the B2B segment in both technical trade and building and home improvement trade. Onninen’s sales continued to grow also in Poland and the Baltic countries. B2B trade now accounts for over 80% of the division’s sales. Sales growth in B2B trade continued strong, underpinned by good construction activity. Demand was very strong especially in products related to the green transition and to improving energy efficiency. Good demand in renovation building also underpinned the positive performance. Renovation building accounts for over half of the division’s sales. During the year, we continued acquisitions in line with our strategy and the integration of the acquired businesses.

Our transformation process in the car trade division is proceeding well and yielding results. The division’s net sales totalled €911 million, and its comparable operating margin was 5.3%. Availability issues with cars caused net sales to decrease in 2022, but profitability remained at a good level thanks to improved sales margins and transformation measures and efficiency improvements. Kesko’s car trade is No 1 in Finland when it comes to the sales of electric cars and the EV charging network.

Kesko’s long-standing work for sustainability and corporate responsibility brings results that gather also international recognition. The most recent examples are the assessments for the Dow Jones Sustainability Indices and the Global 100 listing of the most sustainable companies in the world: Kesko ranked among the best in its sector in both.

Kesko’s outlook for 2023 is also positive. We estimate that our comparable operating profit will be in the range of €680-800 million.

I want to thank all our customers, shareholders, Kesko employees, K-retailers and their staff, as well as our partners for their trust and collaboration in 2022.

KESKO'S FULL-YEAR 2022 FINANCIAL PERFORMANCE IN BRIEF:

-

Group net sales in January-December totalled €11,809.0 million (€11,300.2 million), an increase of 4.4% in comparable terms, reported net sales grew by 4.5%

-

Comparable operating profit totalled €815.1 million (€775.5 million), an increase of €39.6 million

-

Operating profit totalled €816.5 million (€775.2 million)

-

Comparable earnings per share €1.54 (€1.43)

-

Reported Group earnings per share €1.53 (€1.44

KESKO'S Q4/2022 PERFORMANCE IN BRIEF:

-

Group net sales in October-December totalled €2,983.4 million (€2,870.3 million), an increase of 4.3% in comparable terms, reported net sales grew by 3.9%

-

Comparable operating profit totalled €192.6 million (€203.5 million), a decrease of €10.9 million

-

Operating profit totalled €191.2 million (€204.9 million)

-

Comparable earnings per share €0.36 (€0.40)

-

Reported Group earnings per share €0.36 (€0.41)

See our Q4 and full-year 2022 results release and presentation materials