Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

Kesko will publish its Q4/2022 report on Thursday, 2 February 2023, at around 8.00 am Finnish time. Below is a recap of key events and news for Kesko in the fourth and final quarter of 2022.

NEWS, FINANCIALS AND SHARES

-

Kesko hosted a Capital Markets Day on 7 December 2022 for investors, analysts and the media, discussing strategy execution in its three divisions and topical themes such as inflation, energy prices and the green transition as well as answering questions from the audience. Visit the event page for more information and materials

-

A change in the holding of Kesko’s treasury shares. (release)

-

Realisation of Kesko’s RSP 2021 share plan. (release)

SALES DEVELOPMENT

Sales figures for December will be released in mid-January.

SUSTAINABILITY

-

Kesko was again included in Dow Jones Sustainability Indices. In the DJSI Europe, Kesko ranked No. 1 in the sustainability assessment for its industry (Food & Staples Retailing), while in the global DJSI World, Kesko ranked 3rd highest in its industry. (release)

-

Kesko made the leadership level A- Climate List in CDP’s ranking.

-

K Group’s energy saving efforts are yielding results – energy consumption in October was down by 5%. (release)

GROCERY TRADE

-

K Group expands cooperation with the quick commerce pioneer Wolt for an efficient network for fast grocery deliveries across Finland, enabled by Kesko’s extensive network of local grocery stores. (release)

BUILDING AND TECHNICAL TRADE

-

Onninen is a great example of a successful acquisition. Kesko acquisition of Onninen’s technical wholesale in 2016 – driven by the need to focus more on B2B trade – has proven successful, with over 80% of the building and technical trade division’s sales now coming from B2B. (IR blog post)

CAR TRADE

-

Kesko’s forcefully growing K-Lataus EV charging network promotes the electrification of traffic in Finland. (investor event presentation)

K Group today is a leading operator in Northern European building and technical trade, with retail and B2B sales of over €6.5 billion. Onninen, the technical wholesale company acquired by Kesko in 2016 as part of Kesko’s building and technical trade division, is a valuable part of the equation, and will continue to play an important role in Kesko’s success also going forward.

Kesko acquired the Finnish technical wholesale company Onninen in 2016. Founded in 1913, Onninen today operates some 130 Onninen Express stores and Onninen points of sale in Sweden, Norway, Poland, Estonia, Latvia and Lithuania, and of course in Finland, where it is the clear market leader.

Onninen offers a wide selection of products and service packages to contractors, industry, infrastructure building, and retailers, but does not engage in B2C trade. Onninen’s business is fully Kesko’s and not run by retailer entrepreneurs.

Onninen has helped Kesko expand its B2B sales in building and technical trade

Kesko’s acquisition of Onninen in 2016 was motivated by the identified megatrend of building and construction becoming more and more technical and being increasingly outsourced to professionals. This trend is underpinned by other megatrends such as urbanisation, rising standard of living, and population ageing. Kesko saw the need to focus more on B2B trade aimed at building and construction sector professionals, and Onninen offered a great pathway to this.

The move has proven successful: before Kesko acquired Onninen, only 40% of the sales for the building and technical trade division came from B2B trade, while today the figure stands above 80%. Onninen offers products and solutions to various B2B customers,

Onninen offers products and solutions to various B2B customers,

including those working in HEPAC, electrical, refrigeration and energy

Onninen as part of Kesko has been a success story

Today, K Group is a leading operator in Northern European building and technical trade with retail and B2B sales of €6.5 billion. Onninen’s performance as part of Kesko has been solid and strong. In 2022, Onninen has gained market share in all seven operating countries and both Onninen’s net sales and comparable operating profit grew in all countries in 1-9/2022.

Renovation building, energy-efficiency and green transition underpinning performance going forward

In recent years, the pandemic, inflation and the war in Ukraine have increased the need for better energy-efficiency, self-sufficiency and ensuring security of supply. Onninen provides, for example, solar panels that enable emission-free energy, pumps for energy-efficiency improving heating renovation projects, products for infrastructure projects, and wide selections for EV charging. In the third quarter of this year, volumes grew the most in the heating and energy product categories.

Global events have also presented many challenges, with international issues with logistics impacting product availability and security of supply. Onninen has been able to tackle these issues with the strength of its procurement capabilities and long-standing relations with suppliers. Customers have also valued Onninen’s ability to offer services and warehousing in uncertain times. Onninen’s online store in Finland is the biggest and the best in the business.

Global events have also presented many challenges, with international issues with logistics impacting product availability and security of supply. Onninen has been able to tackle these issues with the strength of its procurement capabilities and long-standing relations with suppliers. Customers have also valued Onninen’s ability to offer services and warehousing in uncertain times. Onninen’s online store in Finland is the biggest and the best in the business.

”The fact that through acquiring Onninen, Kesko has become a significant player in technical wholesale, is important also for Kesko’s future,” noted Kesko’s President and CEO Mikko Helander at the third-quarter results briefing in October 2022. Kesko expects efforts to improve energy-efficiency, investments in the green transition, and the growing need for renovation building to underpin demand for technical wholesale also in 2023.

Kesko’s confidence in Onninen is also reflected in its investment decisions: in September, Kesko announced that between 2025 and 2030, it will build a new 82,000 square metre logistics centre for Onninen and K-Auto in Finland, costing over €300 million.

Kesko’s Q3 result in 2022 was the best quarter result in the company’s history. Our quarter-result has now improved on its comparison period for 14 consecutive quarters. Net sales grew by 3.4% in comparable terms, totalling €3,010 million. Our comparable operating profit totalled €243 million, representing an increase of €6.4 million. The results achieved act as strong proof of Kesko’s uniqueness as a trading sector operator and the effectiveness of our strategy also in a post-pandemic market.

In food trade, profit improved thanks to good performance in Kespro and our grocery stores. The division’s sales continued to grow, and its net sales totalled €1,574 million and operating profit €133.4 million. The operating profit improved thanks to sales growth in both Kespro and the grocery stores. Kespro’s performance was particularly strong, with sales growth of over 15%. Consumer online grocery sales also grew by 3.4%. Online growth is also supported by the extensive collaboration we have launched with Wolt. We have focused more on the price-competitiveness of our grocery stores and have ranked well in price comparisons in the media. K Group grocery stores are the only ones on the market that offer both bargains and premium under one roof.

"The record Q3 result is strong proof of Kesko’s uniqueness as a trading sector operator and the effectiveness of our strategy also in the current market."

In the building and technical trade division, all businesses delivered good results. Growth continued and profit strengthened in B2B trade. The division’s net sales grew by €70 million and totalled €1,203 million. The growth was attributable to good performance in B2B trade. Sales growth was particularly strong in technical wholesale, where volumes grew especially robustly in the heating and energy product categories. In Finland, both Onninen and K-Rauta recorded strong results. In Norway, profitability was good for both Onninen and Byggmakker. The result in Sweden was good thanks to B2B-focused K-Bygg, Onninen and MIAB. B2B trade now accounts for over 80% of the division’s sales.

In the car trade division, profitability remained good despite availability issues. Net sales decreased due to issues with new car deliveries. Profitability was at a good level thanks to better sales margins and efficiency measures, and the operating margin stood at 5.5%. The share of electric cars is growing forcefully in passenger car sales. Our K Charge EV charging network is expanding, and charging has more than doubled in a year.

”We estimate that the outlook for Kesko’s business will be positive also in 2023. All three business divisions are making a good profit.”

We estimate that the outlook for Kesko’s business will be positive also in 2023. All three business divisions are making a good profit. Kesko has an exceptionally strong position in all areas of Finnish food trade, and we are doing well also in a price-driven market. K Group is the leading operator in technical wholesale and building and home improvement trade in Northern Europe, with total retail and B2B sales of over €6.7 billion. The green transition, efforts to improve energy-efficiency, and growing renovation building are set to keep up demand also going forward. Kesko estimates that its comparable operating profit in 2022 will be in the range of €790 – 840 million. Kesko’s net sales and operating profit are expected to remain at a good level also in 2023 despite the challenges in our operating environment.

KESKO'S Q3/2022 PERFORMANCE IN BRIEF:

-

Group net sales in July-September totalled €3,009.8 million (€2,902.4 million), an increase of 3.4% in comparable terms, reported net sales grew by 3.7%

-

Comparable operating profit totalled €242.8 million (€236.4 million), up by €6.4 million

-

Operating profit totalled €242.4 million (€236.5 million)

-

Comparable earnings per share €0.47 (€0.43)

-

Reported Group earnings per share €0.47 (€0.43)

Kesko will publish its Q3/2022 report on Thursday, 27 October 2022, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time and can be accessed here.

Below is a recap of Kesko's key events and news in Q3/2022.

NEWS, FINANCIALS AND SHARES

-

Change in Kesko’s Group Management Board – Anni Ronkainen steps down as Chief Digital Officer. (release)

-

Kesko invests over €300 million in a new logistics centre for Onninen and K-Auto in Finland to prepare for growth in technical wholesale and the car spare parts business. (release)

-

The composition of Kesko’s Shareholders’ Nomination Committee. (release)

-

Change in the holding of Kesko’s treasury shares. (release)

SALES DEVELOPMENT

Sales figures for September will be released in mid-October.

SUSTAINABILITY

-

At the virtual Kesko Sustainability Hour investor event in August, members of Group Management Board explained how the company’s recently updated sustainability strategy is reflected in its business operations, and how sustainability can create new business opportunities. (blog post, webcast recording, presentation materials)

-

K Group has mapped out proactive measures to reduce electricity use in its stores, offices and warehouses this autumn and winter and help prevent potential electricity shortages in Finland. (release)

GROCERY TRADE

-

Finland’s first automated in-store collection system for online grocery orders is now up and running in K-Citymarket Ruoholahti in Helsinki. Increased collection efficiency means lower delivery prices for customers, who can still choose from the store’s extensive selection of as many as 40,000 products. (release)

BUILDING AND TECHNICAL TRADE

-

Kesko agreed to acquire XL-BYGG Bergslagen as part of its K-Bygg chain for professional builders in Sweden. (release)

-

Survey shows that Finnish consumers are looking to improve energy-efficiency in their homes with products sold in K-Rauta stores. (release)

-

Finnish Competition and Consumer Authority suspects Onninen of violation of competition law – Onninen denies the claims as unfounded. Kesko is not suspected of participation in the alleged infringement, which concerns almost in its entirety a period before Kesko acquired Onninen on 1 June 2016. (release)

CAR TRADE

-

A record summer for electric cars: Volkswagen was the most registered brand of all-electric passenger cars in Finland in Jan-July, demand for electric cars now exceeds that of traditional models in K-Auto stores, and charging at our K Charge stations more than doubled in July compared to the year before. (release)

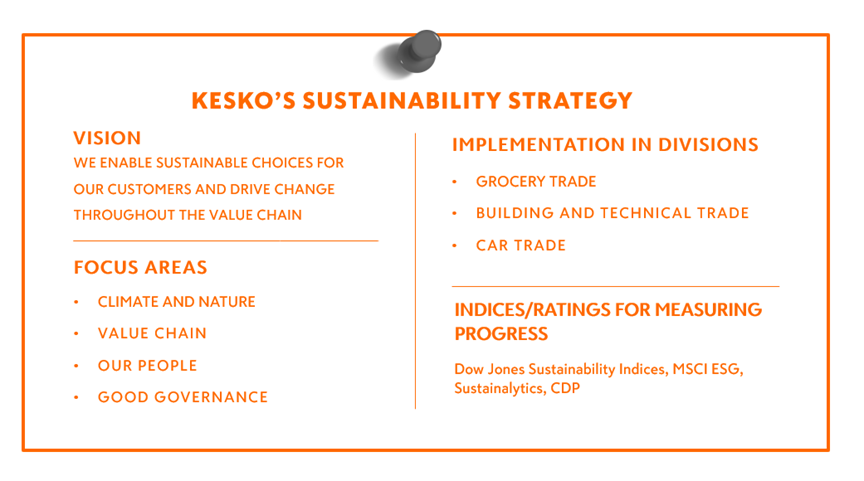

Kesko updated its sustainability strategy earlier this year. On 29 August 2022, we hosted Kesko Sustainability Hour, a sustainability-themed virtual investor event where Kesko’s management shed light on how sustainability action impacts the Group’s operations, and how it can also translate into cost-savings and business opportunities.

Kesko Sustainability Hour included presentations by Riikka Joukio, EVP, Sustainability and Public Affairs; Jorma Rauhala, President of the building and technical trade division; Ari Akseli, President of the grocery trade division; and Matti Virtanen, President of the car trade division

Kesko has engaged in sustainability work for decades. The updated sustainability strategy adopted in March 2022 placed stronger focus on climate and nature, value chains, people, and good governance as the four central strategic themes. Riikka Joukio, EVP, Sustainability and Public Affairs, noted that the updated strategy also shifted the focus of sustainability work more firmly to everyday business operations and the business divisions, and introduced tangible targets and metrics for sustainability work.

Driving change throughout the value chain

Riikka Joukio stressed the importance of collaboration and engaging other parts of the value chain – including suppliers and consumers – in sustainability work. For example, when it comes to emissions, the biggest impacts in Kesko’s value chain are caused by the production and use of the products it sells. For example, the emissions from Kesko’s own operations (94,000 tCO2e) pale in comparison to emissions from the production of products sold (5,600,000 tCO2e) and emissions from the use and end-of-life treatment of the products (1,900,000 tCO2e). This is why it is important for Kesko to, for example, encourage its suppliers to report and reduce their emissions.

Sustainability does not necessarily lead to higher costs – it can actually help save money and create new business opportunities

Some people may have the impression that sustainability work inevitably leads to higher costs for the company. Riikka Joukio refuted the claim and noted that in fact bigger focus on sustainability can in fact be good for business, as it can help mitigate various risks, save costs, increase labour productivity, and create new business opportunities.

"Sustainability can be good for business and help mitigate various risks, save costs, increase labour productivity, and create new business opportunities"

Riikka Joukio, EVP, Sustainability and Public Affairs

In his presentation Ari Akseli, the President of Kesko’s grocery trade, offered some tangible examples of sustainability-related cost savings in his division: reducing the amount of food waste in grocery stores can save millions of euros, recyclable packaging can reduce recycling fees by up to 75%, and optimising transports reduces both emissions and logistics costs. Measures taken to improve energy efficiency in grocery trade operations become increasingly important as energy prices rise.

Meanwhile, Jorma Rauhala, President of the building and technical trade division, noted that the ongoing green transition is boosting the sales of products related to solar power, EV charging, different types of heat pumps and infrastructure products as well as of products related to their installation and use. Consumers are also eager to save energy, which is growing the sales of insulation products and energy-saving lighting solutions, for example. According to Rauhala, the total impact of the green transition on the division is difficult to quantify, as so many aspects of construction and renovation these days involve related elements.

In car trade, division President Matti Virtanen pointed out that the market for electric cars and other lower-emission vehicles is growing at a pace even the car industry could not have anticipated just a few years ago. Kesko represents the best-selling brand of electric cars in the country, and electric cars already account for 30% of our new car sales. K Group also offers EV charging, with a nationwide network set to double in size by the end of the year.

Different sustainability focus and actions for each of the three business divisions

Sustainability is a very wide ranging concept that entails a multitude of complex areas, stressed Riikka Joukio. Moreover, the emphasis of sustainability work differs between Kesko’s three business divisions.

The grocery trade division is an important part of the Finnish food chain and plays a vital role in ensuring security of supply for food. The division can also help promote healthier lifestyles in terms of nutrition.

As noted, the building and technical trade division plays an important role in driving forward the green transition. The division operates in 7 countries, and the main emphasis of sustainability work varies depending on the country.

In the car trade division, the focus is especially on updating the vehicle stock in Finland, which is one of the oldest in Europe, and consequently on helping reduce traffic emissions and improve traffic safety.

All in all, the event participants concluded that Kesko engages in sustainability action on a wide scale, and hoped that going forward, we would be able to communicate those actions and involve our partners and customers in them to an even larger extent.

The second quarter of 2022 gave the best Q2 result in Kesko’s history, as good development continued in all divisions. Our net sales grew by 3.9% in comparable terms, totalling €3,108.5 million. The Q2 comparable operating profit totalled €236 million, representing an increase of €16.6 million. Our quarter-result has improved on its comparison period for 13 consecutive quarters. Although the pandemic is not over, its impact on Kesko’s businesses has clearly diminished. This and the record result achieved act as strong indication that Kesko’s strategy is working and that people in K Group are doing an excellent job under changing circumstances.

Our strong position in all areas of food trade helped our performance in a changing market. Profit for the grocery trade division improved thanks to good development in Kespro and our grocery stores. The division’s net sales grew by 5.1%. Operational efficiency improved further. Kespro’s net sales grew by nearly 30% as post-pandemic consumption shifted increasingly towards restaurants. Sales to K Group grocery stores grew by 1%. Rising food prices mean that the whole food trade market is growing, but they also have an impact on consumer behaviour. Interest towards high-quality food has grown, and the popularity of eating out and quality ready meals has continued to grow. At the same time, price has become an increasingly important consideration for many consumers. Our stores are able to offer customers both premium and bargains, all under one roof.

In the building and technical trade division, our focus on B2B trade resulted in a record result of €109.5 million. Net sales for the division grew by €106 million. Net sales grew thanks to good performance in B2B trade, sales growth was particularly strong in technical wholesale in all operating countries. B2B sales also grew in building and home improvement trade in Q2, but the pace slowed down. Meanwhile, sales in B2C trade came down from the exceptionally high levels seen in the comparison period. Construction and renovation activity remained high in Northern Europe, with green transition also underpinning demand. Increased prices are also causing the building and technical trade market to grow. Construction and renovation are increasingly being outsourced to professionals. B2B trade now accounts for some 80% of the division’s sales.

In the car trade division, the transformation of our operations and active measures in all areas resulted in improved profitability in a difficult market. The division’s profitability improved and operating margin strengthened and stood at 5.6% despite the fact that net sales decreased due to car availability issues. New car sales have, however, continued strong, raising our order book to a record level. Sales margin growth and cost-efficiency improved profitability. The share of electric and hybrid cars is growing strongly in passenger car sales, with tax breaks and the rise in fuel prices in particular accelerating their demand. The car trade division has significant profit improvement potential once the availability of cars returns to normal levels.

The outlook for Kesko’s businesses is positive. We estimate that Kesko’s 2022 comparable operating profit will be in the range of €750 – 840 million. Before, we estimated that the comparable operating profit would be in the range of €730 – 840 million. In 2021, our operating profit totalled €775.5 million.

KESKO'S Q2/2022 PERFORMANCE IN BRIEF:

-

Group net sales in April-June totalled €3,108.5 million (€2,988.2 million), an increase of 3.9% in comparable terms, reported net sales up by 4.0%

-

Comparable operating profit totalled €236.0 million (€219.4 million), up by €16.6 million

-

Operating profit totalled €238.3 million (€218.1 million)

-

Comparable earnings per share €0.45 (€0.40)

-

Reported Group earnings per share €0.45 (€0.41)

IR blog: recap of Q2/2022

Kesko will publish its Q2/2022 report on Tuesday, 26 July 2022, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time.

Below is recap of Kesko's key events and news in Q2/2022.

NEWS, FINANCIALS AND SHARES

-

Kesko’s 2022 Annual General Meeting was held on 7 April 2022. The meeting decided, among other things, to distribute a dividend of €1.06/share for 2021, to be paid in 4 instalments. (Annual General Meeting resolutions)

-

Kesko issued a positive profit warning due to better-than-anticipated market development in building and technical trade. (release)

-

Changes in the holding of Kesko’s treasury shares. (release 2 May, release 20 May)

-

The number of registered Kesko shareholders in Finland stood record-high at 73,159 at the end of May.

SALES DEVELOPMENT

Sales figures for June will be released in mid-July.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

Advanced digital services support Kesko’s success story in building and technical trade. (blog post in English, podcast in Finnish)

-

K-Rauta’s online store in Sweden named best in its category. (release in Finnish and in Swedish)

SUSTAINABILITY

-

In an effort to prevent deforestation and loss of biodiversity, Kesko updated its sustainable sourcing policies and introduced a new ‘No deforestation’ policy. Kesko will only accept 100% sustainably produced wood, paper, palm oil, soy, cocoa, coffee and tea in its own brand product ranges. (release)

-

K Group commits to halving its food waste by 2030 and introduces new products made from edible food waste. (release)

GROCERY TRADE

-

According to Nielsen, K Group’s market share of Finnish grocery trade in 2021 was 36.6%. We estimate that Kesko was the leading operator in online grocery, with a market share of some 45%. (release)

-

Presentation on online grocery given by division President Ari Akseli at an analyst meeting on 5 May. (presentation)

BUILDING AND TECHNICAL TRADE

-

Interview with division President Jorma Rauhala: “Growth in building and technical trade comes from all countries”. (blog post)

-

Investor presentation by division President Jorma Rauhala on 6 June. (presentation)

-

Kesko agreed to acquire Djurbergs Järnhandel, a building and home improvement store with net sales of some €11.3 million in 2021, and Föllinge såg, a company with net sales of some €6.3 million in 2021, for its K-Bygg chain in Sweden. (acquisition summaries)

CAR TRADE

-

Kesko is set to double its K Charge EV charging station network this year. By year-end, the network will comprise 200 charging stations, with focus on fast and high-power charging (HPC). In addition to K Group grocery stores, new stations will be located at K-Rauta building and home improvement store properties. Electric cars already account for one-third of new cars sold by K-Auto. (release in Finnish)

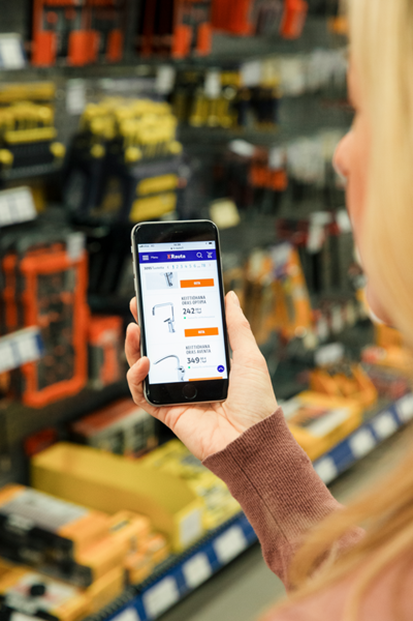

Kesko’s building and technical trade division has been very successful in recent years. This is mainly due to the growth strategy specified in 2018, which has proven successful under varying operating conditions. Advanced digital services and solutions support the division’s success story by enabling better customer experiences and by making operations more efficient. They must cater to the differing needs of three customer segments, but can be developed and leveraged for use in all of the division’s seven operating countries.

Kesko’s Vice President of Investor Relations Hanna Jaakkola discussed growth and digital service development in building and technical trade with Johanna Kontio, who is the division’s Senior Vice President of Concepts, Stores, Digital Services & Sales Support. The discussion is available as a podcast in Finnish.

Digital services and solutions in building and technical trade extend beyond online shopping

Kesko’s building and technical trade chains have their own online stores, and Kesko is a significant player in digital sales in the sector. However, Johanna Kontio notes that the division’s selection of digital services extends far beyond just selling products online.

Kesko’s building and technical trade chains have their own online stores, and Kesko is a significant player in digital sales in the sector. However, Johanna Kontio notes that the division’s selection of digital services extends far beyond just selling products online.

In addition to digital services and solutions that make shopping easier for customers by e.g. allowing them to scan the products themselves at the store, there are also solutions that help the sales staff in their work, thus allowing them to focus more on customer service. Digital solutions have also been developed to make logistics processes more efficient.

The share of B2B trade constantly growing: digital services must cater to the very differing needs of both construction professionals and consumers

The building and technical trade division serves three customer segments: consumers account for some 20% of the division’s sales, while professional builders and technical wholesale professionals account for nearly 80% of the sales. The needs of the three customer groups differ considerably, and this must be acknowledged in both physical stores and digital services. For example, professionals value efficient logistics and invoicing processes, while consumers seek inspiration for decorating and renovation. All customer groups value wide selections and having product information and instructions accessible online.

Johanna Kontio notes that digital development in Kesko’s building and technical trade division is based on in-depth research on customer needs and priorities. Customer satisfaction is systematically monitored, and the results have been very positive. For example, the NPS indicator for Onninen’s online store was 75.5 at the end of 2021, and overall, customers see good digital services as a strength for K Group’s building and technical trade.

Digital and concept development enable synergies between the operating countries

Building and technical trade is the most international of Kesko’s three divisions: while grocery trade and car trade operate in Finland, building and technical trade operates in Finland, Sweden, Norway, Poland, Estonia, Latvia and Lithuania. Net sales from operations outside Finland totalled some €2 billion in 2021. Expansion in Northern Europe is also the biggest potential growth driver for the division. Each of the operating countries has its own growth strategy, but Kesko also seeks synergies both within and between the countries. According to Kontio, synergies are sought in areas such as concept and digital service development. This involves, for example, using the same e-commerce platforms in different countries. Another important source of synergies across countries are the division’s own brand products.

Each of the operating countries has its own growth strategy, but Kesko also seeks synergies both within and between the countries. According to Kontio, synergies are sought in areas such as concept and digital service development. This involves, for example, using the same e-commerce platforms in different countries. Another important source of synergies across countries are the division’s own brand products.

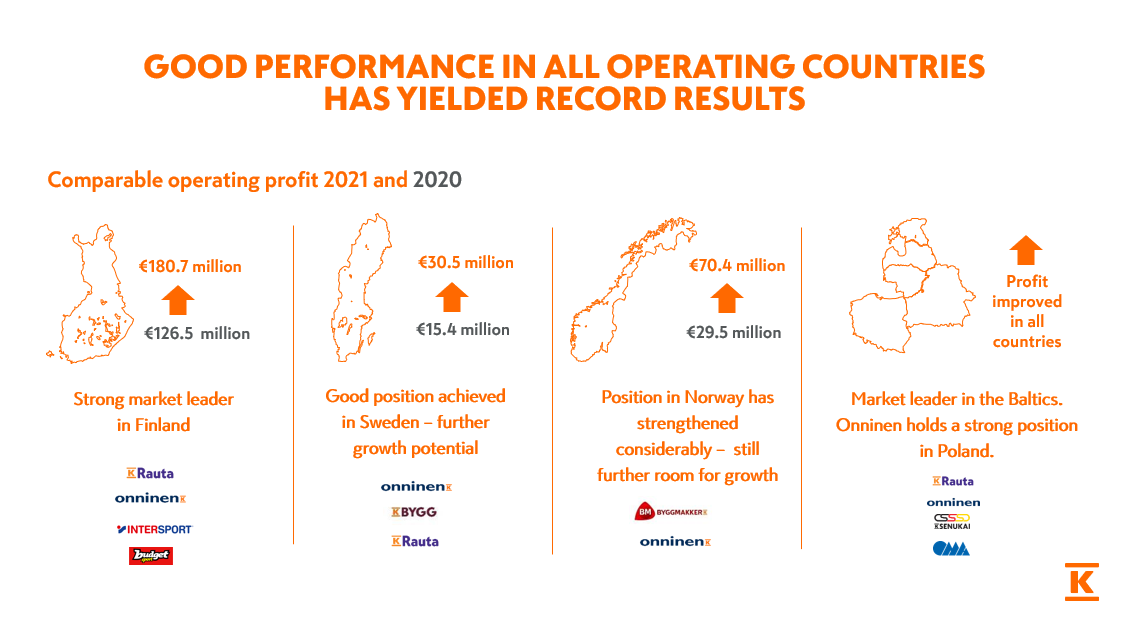

Kesko’s building and technical trade has become international business. In 2021, operations outside Finland accounted for nearly half of the division’s net sales, which grew by 14.7% and totalled almost €4.4 billion.

“The most significant thing is that all of the division’s operating countries and businesses made a profit last year, with considerable improvements. Kesko is now the leading operator in building and technical trade in Northern Europe,” says the division President Jorma Rauhala.

“The most significant thing is that all of the division’s operating countries and businesses made a profit last year, with considerable improvements. Kesko is now the leading operator in building and technical trade in Northern Europe,” says the division President Jorma Rauhala.

The division’s results surged during the pandemic as homebound consumers began to do renovations around the house with unpresented enthusiasm. Consumer sales have since come down from those record levels, but B2B trade – which accounts for nearly 80% of the division’s sales – has continued strong. The acquisitions made in Sweden and Norway have also boosted results, while the rise in prices has also had an impact.

Building and technical trade's international journey began decades ago

The first K-Rauta building and home improvement store opened in Sweden in 1996. Success outside Finland has varied over the years, but now everything appears to be on the right track. According to Rauhala, today’s success is founded on the adoption of country-specific and business-specific strategies a few years ago.

The first K-Rauta store opened in Sweden in 1996. Success outside Finland has varied over the years, but now everything is on track, thanks to the country-specific strategies adopted a few years ago.

Performance in 2021 was also supported by the market, but Rauhala stresses the importance of long-term committed background work based on customer insight, which has led to better customer experiences: “We have engaged in active sales work, developed our selection and pricing management, improved efficiency in logistics, and established online stores.”

Onninen is a great example of Kesko’s country-specific approach in action: in Finland, it is the market leader in HPAC and electricity, in Norway it is strong in electricity, while in Sweden it focuses on customers in the infrastructure segment.

Positives in every operating country

In 2021, the division's result grew by €130 million, half of which came from outside Finland. Operating profit in Finland rose to €181 million, in Norway to €70 million, and in Sweden to €30 million. Results grew also in the Baltic countries and Poland. Indeed, positives can be found in all operating countries.

In Finland, both K-Rauta and Onninen increased their sales and profit further in 2021, underpinned by strong B2B demand. Both chains were able to increase their market share to an all-time high of some 44%.

Turnaround in Sweden took some time, but multiple acquisitions have put the operations on the right track. Kesko is moving forward on three lanes: K-Bygg, which focuses on serving professional builders, is the biggest chain in terms of net sales, while the K-Rauta chain serves both B2B and B2C customers. Onninen offers technical wholesale solutions to, for example, windfarms and water and sewage systems.

In Norway, operating profit more than doubled in 2021. The Byggmakker chain is now number 3 on the Norwegian market, and Onninen’s market share has grown. In the Baltic markets, Onninen is the growing market leader in technical wholesale. The market in Poland is developing well and holds plenty of potential, though Kesko has decided to focus only on technical wholesale via Onninen, with great results.

In addition to country-specific actions, Kesko has also sought synergies between the operating countries, for example, in own brand products and shared online sales platforms.

Promising outlook

Rauhala considers the division’s outlook promising. The first months of 2022 have exceeded expectations, leading Kesko to issue a positive profit warning in April due, in particular, to stronger than anticipated demand and prices in the building and technical trade division.

"There is still plenty of further potential on the markets. Building and technical trade is a growth sector of the future."

Division President

Jorma Rauhala

“Although volumes in consumer trade are coming down somewhat, we do not expect a crash. Prolonged inflation could impact demand, but people have been very busy buying and building new homes and cottages in recent years: there is still plenty of work and renovation that needs doing, while in the longer term our outlook is underpinned by megatrends.”

According to Rauhala, the availability issues that have plagued the industry have hardly slowed down Kesko’s pace.

“Delivery times can be long for specific products and categories, such as air source heat pumps, and of course this may cause delays in renovation projects, which is unfortunate for individual customers and sales staff. However, thanks to our extensive selections, we are usually able to offer the customer an alternative product. When earlier this year we discontinued our – already very minor – imports of wood, steel and cable products from Russia and Belarus, we were quickly able to obtain alternative products in Finland and Western Europe."

Performance in upcoming years will also be boosted by the green transition and related new solutions for generating and storing energy.

“The technology will continue to develop and digital solutions increase, boosting the demand for Kesko’s building and technical trade division for years to come. As stated in our growth strategy, we continue to seek growth also via acquisitions, with main focus on Scandinavia and B2B. As a stable wealthy country, Denmark is one interesting market, but if and when we enter the Danish market, we need to acquire a sufficiently significant local operator,” says Rauhala.

Text: Kirsi Suurnäkki-Vuorinen

Summary of an article first published in Kehittyvä kauppa in May 2022

Kesko’s first-quarter result in 2022 was the best Q1 result in the company’s history, thanks to the strong performance of the building and technical trade division. Our quarter-result has improved on its comparison period for 12 consecutive quarters. Our net sales grew by 6.5% in comparable terms, totalling €2,707 million. Our comparable operating profit totalled a record €144 million, representing an increase of some €28 million. Kesko’s profitable growth is based in particular on the right strategic choices and their successful execution.

In the building and technical trade division, good performance in all operating countries resulted in a record Q1 result. Net sales grew by €200 million and profit doubled year-on-year. Sales and profitability improved significantly thanks to the good performance in B2B trade, which now accounts for nearly 80% of the division’s sales – the figure has quadrupled since 2014. Construction activity is high in Northern Europe. Increased price inflation has caused the building and technical trade market to grow. Prolonged price inflation could cause delays in construction starts.

Our result in food trade was also good in Q1. The total food trade market in Finland amounts to some €20 billion: some 88% of the market is grocery store sales and some 10% foodservice sales. Consumer online grocery sales account for some 2% of the total market. In food trade, we have the most extensive network of grocery stores in Finland, Kespro’s market-leading foodservice business, and leading online grocery trade operations. Together, these form a versatile combination in food trade and Kesko is the only operator that is strong in all three areas. New players entering the Finnish food trade have not had a noticeable impact on Kesko’s grocery trade business. The development of our online grocery business does not differ between the Helsinki region and the rest of Finland despite new players entering the market in the Helsinki region. Consumption growth in foodservice has been fast as the pandemic has eased. Kespro’s net sales grew by over 27% and rose to a new record. Kespro has continued to significantly increase its market share.

In the car trade division, profitability improved despite availability issues. Profit improved thanks to sales margin growth and cost savings. Net sales were down due to delays in new car deliveries. The division’s operating margin improved and stood at 4.8%. The order book for new cars is record-high. We will continue to develop and transform our car trade operations in line with our strategy.

In March, Kesko’s Board of Directors approved a new ambitious sustainability strategy for the company, and tied management compensation to sustainability targets. The new strategy sets clear sustainability targets for the operations of Kesko and its three divisions, focusing on climate and nature, value chain sustainability, responsibility for people, and good governance.

As a response to Russia’s offensive war in Ukraine, we made the decision in February to discontinue the purchases of Russian products and the export of food products to Russia. Our purchases from Russia have been very minor in recent years. The war and the sanctions imposed will have a significant impact on the global economy. We are actively monitoring the situation and will adjust our management and operations as necessary.

The outlook for Kesko’s business operations has improved. Consequently, Kesko estimates that its comparable operating profit in 2022 will be in the range of €730-840 million, while our previous estimate was €680-800 million.

KESKO'S Q1/2022 PERFORMANCE IN BRIEF:

-

Group net sales in January-March totalled €2,707.3 million (€2,539.4 million), an increase of 6.5% in comparable terms, reported net sales grew by 6.6%

-

Comparable operating profit totalled €143.7 million (€116.2 million), up by €27.6 million

-

Operating profit totalled €144.6 million (€115.7 million)

-

Comparable earnings per share €0.27 (€0.20)

-

Reported Group earnings per share €0.26 (€0.20)

IR blog: Recap of Q1/2022

Kesko will publish its Q1/2022 report on Friday, 29 April 2022, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time.

Below is recap of Kesko's key events and news in Q1/2022.

NEWS, FINANCIALS AND SHARES

-

Kesko’s 2021 Annual Report – which comprises 5 sections – was published in March. Although the report covers the events and key figures of last year, it also provides plenty of general information on, for example, Kesko’s strategy, business models, operating environment and reasons to invest in our shares, as well as descriptions of our sustainability work and its targets and results. (summaries and links)

-

Kesko’s 2022 Annual General Meeting will be held on 7 April 2022. The meeting will decide, among other things, on the distribution of profits: Kesko’s Board has proposed that Kesko will pay a dividend of €1.06/share for 2021 and that it be paid in 4 instalments. (release)

-

Kesko decided to discontinue the purchase of Russian products and export of food products to Russia as a response to the situation in Ukraine. Kesko withdrew from the Russian grocery and building and home improvement trade markets in 2016-2018, and since then, Kesko’s purchases from Russia have been very minor. (release)

-

Share plans: Kesko's share-based commitment and incentive plans for 2022-2025 (release) and the realisation for the 2020 and 2021 performance periods of the 2020-2023 Performance Share Plan (release)

-

Changes in the holding of Kesko’s treasury shares (release 17 February, release 15 March, release 18 March)

SALES DEVELOPMENT

Sales figures for March will be released in mid-April.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

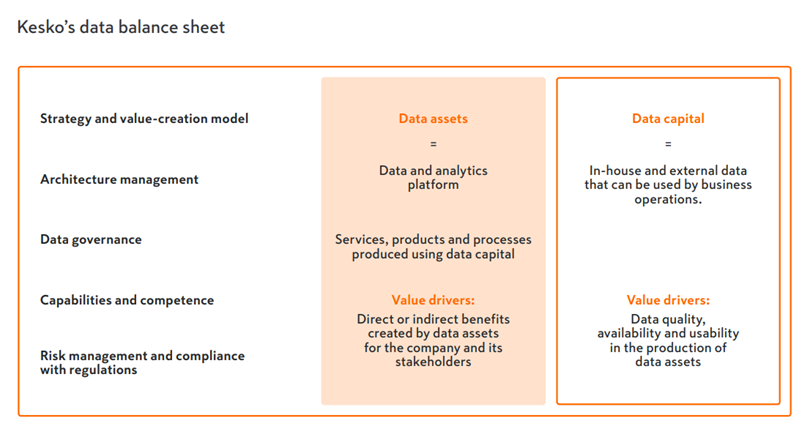

Kesko is the first listed Finnish company to publish a Data Balance Sheet report detailing its sustainable use of data for value creation. See the report and our investor blog post on the subject.

SUSTAINABILITY

-

Kesko’s sustainability strategy was updated: the focus areas for the updated strategy are climate and nature, sustainable value chains, responsibility for people, and good governance. The remuneration of Kesko’s top management is now linked to sustainability targets, such as emission reductions and international sustainability indices and assessments. (release)

-

Kesko once again made the Global 100 Most Sustainable Corporations in the World list by Corporate Knights, ranking 69th. Kesko is the only company in the world to have made the list every year since it was first established in 2005. (release)

-

For the second year in a row, Kesko was one of the companies recognised as a Supplier Engagement Leader by the CDP, thanks to our success in committing suppliers to take action to mitigate climate change. (release)

-

Kesko’s 22nd Sustainability report was published in March, detailing the objectives and progress made in our sustainability work, and providing key indicators in accordance with GRI standard. (report)

GROCERY TRADE

-

Construction on the first in-store online grocery order collection system is proceeding in Ruoholahti, Helsinki. (release)

-

We introduced a new and improved version of our K-Ruoka mobile app for online grocery shopping. The app already has 1 million registered users, and one-fifth of our online grocery customers use the mobile app for making their purchases. (release in Finnish)

-

K Group achieved its objective of reducing food waste by 13% compared to 2016 with the help of systematic selection management and various innovative solutions. (release)

BUILDING AND TECHNICAL TRADE

-

Kesko launched a new K-RautaPRO online store in Finland, specifically tailored to the needs of B2B customers. B2B online sales are increasingly important in building and technical trade: for example, some 25% of Onninen’s sales in Finland now come through digital channels. (release in Finnish)

CAR TRADE

-

Kesko plans to open more new EV charging stations in 2022 than it did in 2021: 22 new stations were opened last year, bringing the number of K Charge stations above 100. Kesko intends to focus on fast and high-power charging. EV charging increased by 131% y/y in 2021, exceeding expectations. (release in Finnish)

Kesko is the first listed company in Finland – possibly even the world – to publish a Data Balance Sheet report as part of its Annual Report. We want to provide investors and other stakeholders with open and transparent information on how we currently utilise Kesko’s vast data assets to benefit our business, our customers, and our partners and retailers, and how we do this in a sustainable manner that ensures all data is protected and secure.

Digitalisation is a key focus area in Kesko’s strategy. We see the impact of data comparable to that of our financial and human capital. Up until now, however, corporate reporting has mostly presented data-related issues from a risk management perspective, notes Hanna Jaakkola, Kesko’s Vice President of Investor Relations:  “With the new Data Balance Sheet report, we want to expand the point of view to cover the opportunities and value creation potential data and its utilisation can offer. There is no established framework for this type of reporting yet: by being the first listed company in Finland to publish a Data Balance Sheet, we lead the way in more open and transparent corporate communication also in this area.”

“With the new Data Balance Sheet report, we want to expand the point of view to cover the opportunities and value creation potential data and its utilisation can offer. There is no established framework for this type of reporting yet: by being the first listed company in Finland to publish a Data Balance Sheet, we lead the way in more open and transparent corporate communication also in this area.”

Kesko to double its data utilisation by 2025

Kesko has at its disposal vast data assets: in Finland alone, of a population of 5.5 million people, some 3.3 million are active members of our K-Plussa customer loyalty scheme. In total, our digital services have some 25 million visits per month. We see further untapped and constantly growing potential in data use: we estimate that we are currently utilising some 25% of our data capital, and aim to double the figure by 2025.

“The Data Balance Sheet report is a big and important package, which provides extensive information on Kesko’s relationship to data,” says Minna Vakkilainen, Vice President of Analytics and Customer Data, who had an integral role in the development of the report. “The report explains what Kesko’s data balance sheet is, what our data capital comprises, and what services we’ve built on the data and what value we’ve derived from it,” says Vakkilainen.

Using data to make our own operations more efficient and our customers’ lives easier

The Data Balance Sheet report contains many practical case examples of the ways in which Kesko uses data to benefit both its customers and its business, from utilising software robotics to handle product complaints by retailers, to the K-Valikoima selection tool that helps retailers fill their shelves with the right products, thus improving customer satisfaction and reducing food waste.

Data is also used to create services that make life easier for Kesko’s customers, such as the K-Ostokset service that enables customers to track the nutritional values and carbon footprint of their grocery purchases, and digital shopping lists, which can automatically include your favourite products and can be easily shared between family members.

Data sustainability and security crucial aspects in Kesko’s data utilisation

The report also details Kesko’s approach to data sustainability. According to Minna Vakkilainen, this means that when we create value using data, we do so in a manner that is sustainable and fair. This entails transparent and open communication on data so that customers are able to trust that their data is collected and handled in a responsible manner.

Data sustainability also entails ensuring appropriate information security, data protection, and customer privacy. Kesko is proactively developing its capacity to respond to data security threats and cyberthreats and to ensure the resilience and continuity of its operations in various fault situations. Rapidly developing technologies and changing regulations challenge us to stay one step ahead in protecting our customers, partners and operations.

What is a Data Balance Sheet report?

For Kesko, data plays a key role in creating positive customer experiences, improving operational efficiency, and managing our physical and online stores and supply chains. The Data Balance Sheet report describes in detail – with multiple practical case examples – Kesko’s data strategy, i.e. how Kesko utilises data sustainably to benefit both its business and its customers. The first report focuses mainly on our consumer grocery trade operations in Finland.

The report also details how Kesko proactively manages data-related risks and how we ensure our data use is responsible and sustainable.

Read Kesko's Data Balance Sheet report

Kesko’s 2021 Annual report comprises five sections and over 300 pages. Although the report covers the events and key figures of last year, it also provides plenty of general information on, for example, Kesko’s strategy, business models, operating environment and reasons to invest in our shares, as well as descriptions of our sustainability work and its targets and results. Kesko is also the first listed company in Finland to issue a Data Balance Sheet report, which details how we use our data capital sustainably to create value for both Kesko and our key stakeholders.

Below you will find more detailed descriptions of the report sections as well as links to all the reports.

This report section presents Kesko as a company and as an investment. The section offers information on Kesko’s strategy – which was updated in spring 2021 – the three business divisions and their operating environment. It also presents, for example, Kesko’s business models.

See full report

The Financial Review section comprises Kesko’s 2021 key performance indicators, the Report by the Board of Directors, financial statements, and the Auditor’s Report. The report also details the extent of which Kesko’s operations are taxonomy-eligible under the new EU taxonomy.

See full report

Kesko is the first listed company in Finland to publish a Data Balance Sheet. The report details how Kesko uses its data capital in a sustainable manner to create value for both Kesko and its key stakeholders, such as customers, retailers and partners.

Our first Data Balance Sheet focuses mainly on the grocery trade consumer business, and offers many tangible case studies on how we utilise data in our business operations.

See full report

The section on Sustainability details the objectives and progress made in Kesko’s sustainability work, and provides key indicators in accordance with GRI standards.

It provides information on the climate impacts of Kesko’s operations and how we intend to reach carbon neutrality by 2025 and zero own emissions by 2030, while also encouraging our stakeholders to cut their emissions.

The Corporate Governance section comprises the Corporate Governance Statement the Remuneration Report for Governing Bodies, and details on the members of Kesko’s Board of Directors and Group Management Board.

President and CEO Mikko Helander: Kesko posted its 7th consecutive record annual result in 2021

Kesko recorded the best result in the company’s history in 2021 and its Q4 result was also record-high.This was the seventh consecutive year that Kesko’s annual result improved, and 11th consecutive quarter where profit was up on the comparison period. Our sales and profit have been growing for several years, which is a strong indication that our growth strategy is working and being successfully executed. In 2021, our net sales grew by 8.2% in comparable terms, totalling €11,300 million. Our comparable operating profit amounted to a record €776 million, representing an increase of €208 million.

Our good ability to produce a profit and strong financial position enable investments in growth and good dividend capacity. Kesko’s Board proposes to the Annual General Meeting a dividend of €1.06/share, totalling nearly €421 million, proposed to be paid in four instalments.

We made a record result in the grocery trade division in 2021. We managed to grow sales and improve customer satisfaction and profitability. The division’s net sales grew by 3.1%, and its comparable operating profit rose to €443 million. Profitability in grocery trade is among the best in the world, with a comparable operating margin of 7.5%. Net sales and sales continued to grow in both grocery stores and foodservice. Online grocery sales grew by 14.2% despite the strong comparison figures. Our strength in grocery trade lies in our extensive network of physical grocery stores combined with efficient online sales and our foodservice business as well as our well-functioning retailer business model. Our strategic objective is to grow sales and improve customer experiences further.

We also achieved a record result in the building and technical trade division, where sales and profitability improved in all business operations. The success is based on the successful execution of our country-specific strategies, combined with good demand. Strong growth continued, driven in particular by B2B trade. Net sales in 2021 grew by 14.7% and totalled €4,388 million. The comparable operating margin for the division rose to a new level of 7.2%. The growth has been underpinned by the good development of the construction markets and high product price levels. In Finland, performance continued strong for Onninen and K-Rauta. Sales and profitability developed well also in Norway and Sweden, in both technical trade and building and home improvement trade. Profitability was also supported by the changes made in recent years, and the acquisitions completed and their successful integration. In line with our strategy, we have focused on B2B trade, which now accounts for 75% of the division’s sales. International operations account for an increasing share of the division’s net sales, now totalling 46%.

Our transformation process in the car trade division is proceeding well and yielding results. Net sales for the division in 2021 grew by 15.2% and totalled €1,028 million. The division’s profitability improved, and the comparable operating margin rose to 5.1%. All operations within the division – new cars, used cars, and services – were profitable. Measures conducted to restructure operations and improve their efficiency, a competitive range, and the growing demand for new and used cars resulted in growth in sales and profitability. Demand for all-electric cars and rechargeable hybrids grew in particular. The global component shortage limited the availability of new cars.

Overall, the outlook for Kesko's business in 2022 is positive. Kesko estimates that its comparable operating profit in 2022 will be in the range of €680-800 million. We will continue our efforts to grow our sales and improve profitability.

I want to thank all our customers, shareholders, employees, K-retailers and their staff, and our partners for the valuable work you did towards Kesko’s and our shared success in 2021.

KESKO'S 2021 FINANCIAL PERFORMANCE IN BRIEF:

- Group net sales in January-December totalled €11,300.2 million (€10,669.2 million), an increase of 8.2% in comparable terms, reported net sales grew by 5.9%

- Comparable operating profit totalled €775.5 million (€567.8 million),

- Comparable operating profit grew by €207.7 million.

- Operating profit totalled €775.2 million (€600.2 million)

- Comparable earnings per share €1.43 (€0.97)

- Reported Group earnings per share €1.44 (€1.09)

KESKO'S Q4/2021 PERFORMANCE IN BRIEF:

- Group net sales in October-December totalled €2,870.3 million (€2,662.3 million), an increase of 7.2% in comparable terms, reported net sales grew by 7.8%

- Comparable operating profit totalled €203.5 million (€165.6 million), comparable operating profit grew by €37.9 million.

- Operating profit totalled €204.9 million (€155.6 million)

- Comparable earnings per share €0.40 (€0.31)

- Reported Group earnings per share €0.41 (€0.29)