Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

Division President Johanna Ali: "Profitability is central to all areas of Kesko’s car trade”

Johanna Ali has headed Kesko’s car trade division since April this year, having previously been in charge of the division’s Audi business. Ali sat down for an interview to discuss the business model and competitive advantages for Kesko’s car trade as well as the changing landscape, growth opportunities and the division’s plans for the future.

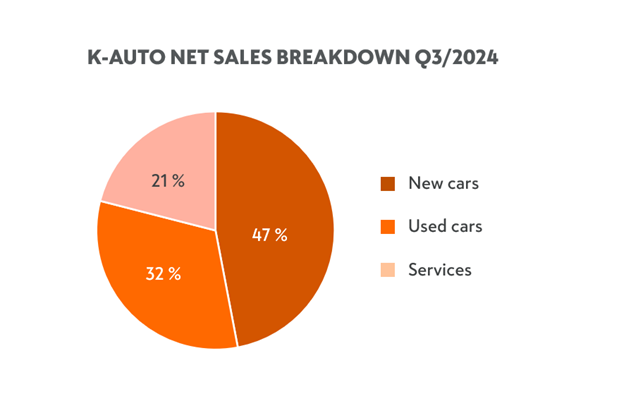

A balanced product and service portfolio across the car trade value chain

When asked about Kesko’s competitive advantages in car trade, Johanna Ali explains that K-Auto has a balanced business portfolio that covers different sections of the value chain:

-

The import and sales of new cars

-

Used car sales, and

-

Services, which consist of maintenance and damage repairs, sales of accessories, and Kesko’s own K-Lataus network for EV charging.

Kesko’s presence is strong across all three areas. Johanna Ali points out that one advantage of the three-pronged model is the balance it brings in adapting to market conditions, as some of the businesses are less susceptible to economic fluctuations than others. For example, new car sales in Finland have been low for the past few years, while the service business has held up better – buying a new car is usually a bigger financial commitment than servicing an existing one.

The used car market has also shown more resilience, and Kesko has managed to gain market share in that area in recent years, thanks to a purposeful and strategic push. “Operating under K Group’s well-established, trusted brand lends us another competitive advantage in the used car business, which is heavily based on trust,” says Ali.

Profit-forward, with high operational efficiency, skilled staff and fast digital development

Ali stresses that although market share development is one important indicator for success, K-Auto prioritises profitability over market share. Indeed, all three car trade business areas are profit-making, and the profitability of Kesko’s car trade overall is among the best in industry.

When asked how Kesko has managed such good profitability levels, Ali cites a combination of factors, including the skilled staff that handles customer interactions. The division’s operational efficiency has also risen in recent years thanks to an extensive transformation programme, in which all functions, operating practices and corporate culture where examined. “The programme led to a multitude of changes across the organisation – some big, some small, some even painful, but all aimed at enabling growth and profitability,” says Ali.

"We believe that the winning concept in car trade going forward will be the seamless combination of physical locations and digital services. We will be present in both, and meet the customer where they choose."

Another factor contributing to profitability is digitalisation, in which the division has invested heavily. The investment has resulted in better tools internally as well as better service for customers. According to Johanna Ali, car trade is an area where the customer journey can truly combine physical and online seamlessly, explaining that customers may compare car options online, come for a test drive at the dealership, and then make the final purchase online again, for example using the chat function. K-Auto’s approach is to offer alternatives and let the customer choose how they wish to engage.

Focus on organic growth – biggest growth potential in used cars

Going forward, Ali says that the division’s main objective is to grow profitably in all three business areas. Although there is a strong trend towards consolidation in Finnish car trade, according to Ali, K-Auto’s strategy for the next few years focuses primarily on organic growth. Should good acquisition opportunities arise, they will of course be considered, but acquisitions are not necessary for achieving strategic objectives.

Although Ali says that she obviously hopes that new car sales in Finland will pick up again, she does not expect this to happen quickly. The biggest growth potential for Kesko currently lies in used cars, where K-Auto has managed to outperform the market lately. Used cars for Kesko are a fairly recent focus area, and therefore there is more to gain there.

The decades long collaboration with the world’s biggest car manufacturer Volkswagen Group and Porsche will continue to lend Kesko a competitive advantage also going forward. Ali says she sees more benefits than risks for K-Auto in committing to one manufacturer, especially when the partner offers such strong car brands and high-quality products.

K-Auto will continue to invest in both digital development and its physical dealership network, for example by expanding and improving the facilities in the Greater Helsinki area, as recently announced.

“We believe that the winning concept in car trade going forward will be the seamless combination of physical locations and digital services. We will be present in both, and meet the customer where they choose,” says Johanna Ali.

A video version of the interview is available in Finnish here.

President and CEO Rauhala: Q3 saw a positive turnaround in Kesko's building and technical trade

"Kesko’s performance in the third quarter of 2024 was good considering the market, which remained challenging," says President and CEO Jorma Rauhala.

"Kesko's net sales in the third quarter of 2024 totalled €3,027 million, up by 2.6% year-on-year, while in comparable terms net sales decreased by 0.8%. Our comparable operating profit totalled €201.5 million, and it was up in both building and technical trade and grocery trade.

In grocery trade division, net sales totalled €1,609 million, up by 1.0%, while the division’s comparable operating profit amounted to €118.8 million. K Group’s grocery sales were down by 0.1%, slightly underperforming the market. Online grocery sales increased by 13.9% thanks in particular to growth in express deliveries. Kespro’s net sales grew by 3.1%, exceeding market growth. Grocery price inflation slowed down notably and stood at 0.4%. Our customer flows continued to grow thanks to campaigns, while customers emphasise price. Our strategy execution in grocery trade is proceeding according to plans, focusing on strengthening store-specific business ideas, developing our store site network, and improving our price competitiveness.

"Kesko’s net sales and operating profit are estimated to remain at a good level in 2024 despite the challenges in our operating environment. We specify our profit guidance and estimate that our comparable operating profit in 2024 will amount to €630–680 million. We furthermore estimate that Kesko’s comparable operating profit will improve in 2025."

In the building and technical trade division, we can see a turn for the better: result for the division grew for the first time in eight quarters. Sales have picked up in both building and home improvement trade and technical trade, but the market remains challenging, The division’s net sales totalled €1,128 million, up by 7.4%, or down by 2.2% in comparable terms. Comparable operating profit for the division totalled €70.1 million, up by €0.2 million. In building and home improvement trade, net sales increased thanks to sales growth in K-Rauta Finland and the Davidsen acquisition in Denmark. Operating profit for Onninen Finland was nearly at last year’s level, and sales and profitability for solar power products have returned to normal levels. In Norway, there have been logistics-related delays in the Elektroskandia integration process, while Byggmakker’s sales slightly underperformed the market. In Sweden, our increased focus on B2B trade under the K-Bygg brand has proceeded according to plans.

In the car trade division, both net sales and profit decreased as the market remained challenging, but profitability stayed at a good level. Market demand for new cars was muted, but the market for used cars grew slightly. The division’s net sales totalled €295 million and comparable operating profit €17.8 million. New car sales decreased, but when it came to orders for new cars, the market share of car brands represented by Kesko increased. Our sales growth in used cars notably outpaced the market. Service sales also increased. In September, we completed the acquisition of Autotalo Lohja.

Kesko’s net sales and operating profit are estimated to remain at a good level in 2024 despite the challenges in our operating environment. We now specify our profit guidance and estimate that our comparable operating profit in 2024 will amount to €630–680 million. We furthermore estimate that Kesko’s comparable operating profit will improve in 2025."

KEY FIGURES FOR KESKO IN JULY-SEPTEMBER 2024:

-

Group net sales in July-September totalled €3,026.6 million (€2,949.1 million); reported net sales grew by 2.6% while comparable net sales were down by 0.8%.

-

Comparable operating profit totalled €201.5 million (€208.1 million)

-

Operating profit totalled €202.1 million (€206.6 million)

-

Cash flow from operating activities totalled €285.6 million (€394.9 million)

-

Comparable earnings per share €0.34 (€0.38); reported earnings per share €0.35 (€0.37).

Kesko will publish its Q3 interim report on Wednesday, 30 October 2024, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time, and can be accessed here.

NEWS, FINANCIALS AND SHARES

-

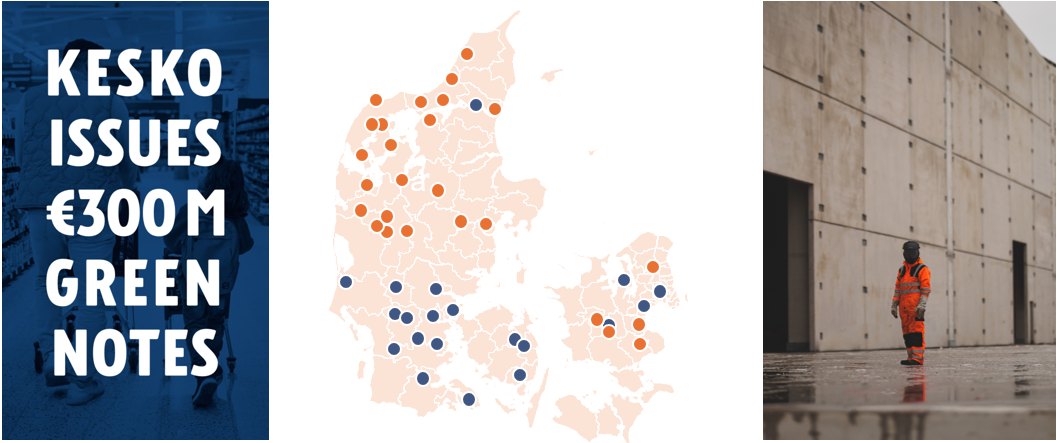

Kesko issues senior unsecured green notes of €300 million, with a maturity of approximately five years and four months (2 Feb. 2030). The notes carry a fixed annual interest of 3.500 percent, and the issue price is 99.317 percent. The issue date is expected to be 2 October 2024. The net proceeds are to be used for financing or refinancing eligible green projects or assets in accordance with the Green Finance Framework established by Kesko in May. (release)

-

Kesko agreed on a €150 million sustainability-linked loan with the Nordic Investment Bank (NIB), where the interest rate margin is tied to the attainment of specific sustainability targets. At the end of June 2024, over half of all Kesko loans were sustainability-linked. (release)

-

Composition of Kesko's Shareholders' Nomination Committee. (release)

-

Change in the holding of Kesko’s treasury shares. (release)

-

Presentation for Q3 investor roadshow meetings. (presentation)

SALES DEVELOPMENT

-

Kesko’s sales in July. (release)

-

Kesko’s sales in August. (release)

Sales figures for September will be released in mid-October.

SUSTAINABILITY

-

The new Onnela logistics centre in Finland is the biggest construction project in Kesko’s history and a key investment in future growth. Once completed, the 85,000 square metre facility will host Onninen's technical trade and K-Auto's spare parts logistics. As environmental aspects have been central to the project since the beginning, Kesko is able to use the green financing it has recently obtained to fund its €300 million investment. (blog post)

BUILDING AND TECHNICAL TRADE

-

Kesko is set to significantly increase its market share in Danish building and home improvement trade by acquiring three local operators. The combined net sales of the three companies total some €400 million, and once the acquisitions are completed, Kesko’s Danish subsidiary Davidsen will be a significant nationwide operator in Denmark’s builders’ merchant market with a total market share of some 20%. (release)

CAR TRADE

-

K-Auto completed the acquisition of Lohjan Auto. With net sales of €43.3 million in 2023, the company offers Volkswagen, Seat and Cupra sales, used car sales, and maintenance and body repair operations for Volkswagen Group car brands in Lohja and Tammisaari in Southern Finland. (release)

Kesko is currently constructing a large, modern logistics centre in Hyvinkää, some 50 kilometres north of Helsinki. Once completed, the centre – called Onnela – will host both Onninen's technical trade and K-Auto's spare parts business. Kesko is investing some 300 million euros in the project. As special attention has been paid to environmental aspects in the design and construction of the centre, green financing obtained by Kesko can be used to cover the investment.

Kesko's new Onnela logistics centre will be operational in the autumn of 2025. The entire 85,000-square metre construction project will be completed in phases by 2030. (Images by Haahtela)

The new Onnela logistics centre is an investment that brings together Kesko's divisions, and enables the company to prepare for future growth. It will serve Kesko’s technical trade company Onninen, which is expected to continue its strong growth going forward. The new centre’s high level of automation and centralised storage enable more efficient packaging and labelling of orders as well as faster deliveries, thus helping Onninen's customers and construction sites to operate more efficiently. The centre will also house K-Auto's growing spare parts business, improving its logistics efficiency and reliability of product deliveries. In total, the centre will host 400-500 Kesko professionals working in logistics.

Onnela is the biggest construction project in Kesko's history, and the biggest ongoing construction project in all of Finland measured in cubic metres. Once completed, the centre will total 85,000 square meters (approx. 915,000 square feet) in size. The centre will be operational by the end of 2025, and the entire construction project will be completed in phases by year 2030.

Careful consideration of environmental aspects lends the project eligible for green financing

Kesko announced earlier this week that it would be issuing senior unsecured green notes totalling 300 million euros, with net proceeds used to finance or refinance eligible green projects or assets in accordance with the Green Finance Framework established by Kesko in May.

Environmental and nature values have been at the forefront for the Onnela project from the start, extending from design to construction. Kesko will be applying for a “Very Good” BREEAM certification for the building.

In project design, special attention has been paid to reducing energy consumption and carbon footprint, thus reducing costs and emissions over the property’s long life cycle. Low-carbon concrete has been used in on-site concrete casting, and special attention has been paid to the insulation and sealing of the building's walls and roofs. Additionally, the building's heating, cooling, and lighting systems utilise as much energy-saving automation as possible.

The most advanced solutions on the market are also used when it comes to energy production. The primary heating method for the new centre is geothermal energy: about a hundred geothermal wells will be drilled on the site. Geothermal energy will cover the centre’s heating needs almost entirely, with district heating needed only on the coldest winter days and to support the production of hot water. The total power offered by the heat pump system is 1.2 MW.

All electricity used in the logistics centre will be renewable, and the site will host its own solar power plant. The estimated annual production of the plant is 630 MWh. As Onninen offers the widest range of solar power systems in Finland, all the solar panels and other related equipment – as well as the equipment required for the geothermal system – are supplied from Onninen's selections.

Onnela’s own solar power plant began operating in the summer of 2024, and on sunny days it was already able to produce all the electricity needed on the construction site during the workday.

The recycling of materials and reduction of waste have been central themes in the project construction. The project has also appointed an ecologist, who has inventoried the natural values of the site, and is now reviewing options for offsetting them at a location to be determined later.

More information on the environmental and sustainability aspects of the Onnela project can be found here.

President and CEO Rauhala: Kesko's Q2 result in line with expecations

"The second quarter of the year came in line with expectations, and Kesko again managed a good performance in a challenging market. Our net sales totalled €3,093.4 million, representing a decrease of 0.4% year-on-year, or 4.1% in comparable terms. Our comparable operating profit totalled €178.3 million. The cash flow from operating activities was strong at €309.0 million, and our cost-efficiency remained good," notes Kesko's President and CEO Jorma Rauhala.

KESKO KEY FIGURES FOR APRIL-JUNE 2024:

-

Group net sales in April-June totalled €3,093.4 million (€3,104.7 million); reported net sales were down by 0.4%, and comparable net sales by 4.1%

-

Comparable operating profit totalled €178.3 million (€207.6 million)

Operating profit totalled €159.2 million (€206.3 million)

Cash flow from operating activities totalled €309.0 million (€285.2 million) -

Comparable earnings per share €0.30 (€0.38); reported earnings per share €0.26 (€0.38)

"Net sales for the grocery trade division totalled €1,596.5 million, representing a decrease of 1.7% year-on-year, while the comparable operating profit stood at €114.5 million. K Group grocery sales were down by 1.1%. Online grocery sales grew by 13.5%, driven especially by express deliveries. Net sales for the foodservice business decreased by 1.3%, but still exceeded market growth. Price inflation in groceries has clearly slowed down, and stood at 0.1%. Our customer flows have continued to grow thanks to campaigns, while price is an important consideration for customers. In June, legislative changes enabled the sales of beverages with an alcohol content of at maximum 8% in grocery stores: we introduced new products in a responsible manner, and have seen that wines are typically acquired alongside food.

In the building and technical trade division, profitability weakened as expected due to the weak construction cycle in the Nordic countries. In Poland and the Baltic countries, the cycle has turned, leading to an upturn in Onninen’s sales in those markets. The division’s net sales totalled €1,203.7 million, and were up thanks to the Davidsen acquisition, while the comparable operating profit totalled €56.1 million. The sales and profit of solar power products in particular fell short of the levels of the comparison period, which impacted Onninen’s relative performance. Inventories are now at a healthier level in both building and home improvement trade and technical trade. The market is showing signs of picking up in all our operating countries, even though the cycle continues to be weak.

In the car trade division, net sales and profit decreased in the second quarter as expected. The market demand for new cars was muted, while the market for used cars grew slightly. The division recorded net sales of €298.7 million and a comparable operating profit of €14.9 million. Although new car sales were down, customer demand for new models was at a good level. Growth in used car sales outpaced the market notably, and growth in service sales also continued strong. In May, we announced that we would be acquiring the operations of Autotalo Lohja to strategically strengthen our car dealership network in Southern Finland.

In June, Kesko published a strategy update. The main pillars of the strategy remain intact, while each division’s competitive advantages and objectives have been refined. Kesko’s growth strategy continues to centre around profitable growth in three selected divisions, namely grocery trade, building and technical trade, and car trade. We seek sales growth, improved customer experience, and profitability and efficiency in all businesses, with the help of e.g. digital services and artificial intelligence. Kesko’s financial targets remain unchanged.

Kesko’s net sales and operating profit are estimated to remain at a good level in 2024 despite the challenges in our operating environment. We are specifying our profit guidance, and now estimate that the comparable operating profit in 2024 will amount to €620–680 million."

Kesko will publish its Q2 interim report on Tuesday, 23 July 2024, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time, and can be accessed here.

Below is a recap of key events and news for the quarter.

NEWS, FINANCIALS AND SHARES

-

Growth strategy updated:

-

The main pillars of Kesko’s strategy remain intact, with profitable growth in three selected divisions – grocery trade, building and technical trade, and car trade – at the core. Each division’s competitive advantages and objectives were refined. (release)

-

Kesko hosted a briefing on the updated strategy for investors, analysts and the media on 4 June 2024, with presentations by the President and CEO and the CFO as well as all three division heads. See the event site (with webcast recording and presentations) and blog post.

-

-

Changes in Group Management Board:

-

-

Anu Hämäläinen was appointed as Kesko’s new Chief Financial Officer as of 1 June 2024. Hämäläinen first joined Kesko in 2020 as Vice President, Group Finance and Treasury. Kesko’s previous CFO Jukka Erlund announced earlier this year that he would be leaving the company. (release)

-

Lasse Luukkainen was appointed as Executive Vice President, Legal and Sustainability as of 1 June 2024. Luukkainen has held various legal positions in Kesko since 2010, most recently that of Group General Counsel. (release)

-

Johanna Ali was appointed as the President of Kesko’s car trade division as of 4 June 2024, having held the position in an acting role since 1 April. Ali has previously worked as Vice President of Audi Finland within Kesko’s car trade division. (release)

-

-

The composition of Kesko’s Shareholders’ Nomination Committee was changed, with Pauli Jaakola, appointed by K-Retailers' Association, included as a new member and Committee Chair. (release)

-

Shares: Changes in the holding of Kesko’s treasury shares. (release 26 April, release 18 June)

SALES DEVELOPMENT

Sales figures for June will be released in mid-July.

SUSTAINABILITY

-

Kesko ranked highest in it sector in Finland and 10th highest globally in a large-scale sustainability assessment carried out by Time Magazine and the research company Statista, in which 5,000 leading companies around the world were assessed against more than 20 environmental and social responsibility criteria. (release)

-

Kesko established a Green Finance Framework applicable for the issuance of green debt instruments to further integrate its ambitious sustainability targets into its financing. The company established a Green Finance Committee to evaluate and select eligible Green Projects and allocate net proceeds to such assets, and will provide annual reporting (Green Finance Report) on the allocation of proceeds and the environmental impact of the Green Projects. (release)

-

Kesko intends to electrify its grocery trade logistics by investing nearly €10 million in electric trucks and vans and charging points for heavy vehicles. Kesko expects EV transports to reduce emissions significantly while improving efficiency. (release)

GROCERY TRADE

-

Kesko continues investments in its grocery store network by beginning construction on a new 8,000 square-meter K-Citymarket hypermarket store in Porvoo. The store is expected to open in spring 2027. (release)

CAR TRADE

-

K-Auto announced it will acquire Lohjan Auto, a dealer for Volkswagen, Seat and Cupra cars operating in Southern Finland. The company has two dealerships and engages in the sales of new and used cars, servicing and repairs. In 2023, Lohjan Auto recorded net sales of some €43 million. (release)

Kesko has completed its strategy review process and presented an updated strategy for 2024–2026. The main pillars of Kesko’s strategy remain unchanged, with focus on profitable growth in the three selected business divisions, namely grocery trade, building and technical trade, and car trade.

ach of the three divisions continues to offer good growth potential for Kesko. During the strategy review process, the objectives and competitive advantages of each division were thoroughly examined and refined to ensure success in the current operating environment, which is in many ways challenging. Kesko’s medium-term financial targets were kept unchanged.

Below is a summary of Kesko’s updated strategy and objectives:

Targeting sales growth and improved customer experience, profitability and efficiency

In all businesses, Kesko seeks to grow its sales, offer a better customer experience, and improve profitability and efficiency, aided by digital services and artificial intelligence. Although there are larger megatrends affecting the whole Group – such as urbanisation, digitalisation and the green transition – the situation and operating conditions for the divisions differ somewhat.

In the grocery trade division, the aim is to strengthen Kesko’s market position while maintaining good profitability, with an operating margin that stands clearly above 6%. Strategic focus is on relevant store-specific business ideas, the development of the grocery store network, opening of new stores especially in growth centres, and actions to improve price competitiveness. In the foodservice business, the focus is on ensuring continued good performance for Kespro.

The building and technical trade division will continue to seek profitable growth both organically and through acquisitions, with country-specific strategies. Key focus areas include securing profitability and generating cash flow. The long-term operating profit margin target is still 6-8%. In Finland, the goal is to continue growth and further strengthen market positions; in Sweden and Norway, to improve profitability for all businesses and complete the integration of acquired companies; in Denmark, to complete the integration of the first acquired company Davidsen, and to improve profitability through sales growth.

In the car trade division, the major transformation carried out in recent years means that there was no need for significant changes to the strategy this time around. The three car trade businesses – new cars, used cars, and services – form a balanced portfolio, and the objective is to outperform the market in each area. Being present in the whole value chain maximises lifecycle profitability and reduces the impact of business-specific negative market cycles.

At the investor strategy briefing, focus was on operating margins, the M&A market, and the use of AI

To expand on the strategy and its focus areas, Kesko hosted an event for investors, analysts and the media on 4 June 2024. The agenda comprised presentations by the President and CEO, the CFO and the three division Presidents, as well as an extended Q&A session. As four of the five speakers had assumed a new role in Kesko’s Group Management this spring, the event also offered a good chance to present them to investors.

All five speakers had the chance to elaborate on their presentations and answer questions from investors in the Q&A section of the event (from the right: President and CEO Jorma Rauhala, grocery trade division President Ari Akseli, building and technical trade division President Sami Kiiski, car trade division President Johanna Ali, CFO Anu Hämäläinen, and head of investor relations Hanna Jaakkola)

Below are some highlights of the investor questions submitted and answers provided at the event:

-

Q: How do you expect to improve your operating margin in grocery trade while also increasing your market share, investing in stores, and improving price competitiveness?

A: We have made calculations on how much we can invest in new stores and price perception while still keeping the grocery trade margin at the targeted level. There will also be some new earnings sources related to data and media sales. Once the market improves, it offers more opportunities for a quality player such as Kesko.

-

Q: Can building and technical trade reach its operating margin target of 6-8% during the 2024-2026 strategy period?

A: It will likely take longer than that, but it might be possible to get close to the target level, depending on how the construction markets recover.

-

Q: Has the M&A environment changed and are you still be able to make acquisitions at attractive multiples in building and technical trade?

A: It’s a good time for finding suitable acquisition targets. At the moment there are great companies available at reasonable prices, and good companies at a better price. We are happy we did not make too many acquisitions in the peak times for construction. Right now, we do not need to compete with private equity buyers. -

Q: How do maximise benefits from data and AI in each division?

A: In grocery trade, the cost of targeted advertising to individual customers has been reduced significantly, by as much as 90%, thanks to digital solutions. In building and technical trade, 80% of Onninen’s orders come from digital channels, and we have used machine learning and AI to improve those processes. In car trade, AI is used, for example, in establishing the right prices for used cars. -

Q: Recent appointments to Kesko’s top management have come from within the company – are you not looking for external candidates and new ideas?

A: Various great external candidates have been considered for each of the top level positions filled this year. However, we’ve had top quality internal candidates, and we’ve chosen the best person for each job. Choosing internal candidates also sends a message to all Kesko employees that the company can offer good career paths. (It is also worth noting that Ali, Hämäläinen and Kiiski are fairly new to the company, as Ali joined Kesko in 2021 and Hämäläinen and Kiiski in 2020).

Visit our dedicated event page to see a recording of the webcast and access all presentations

President and CEO: Kesko's Q1 result was good considering the challenging market

Kesko’s first quarter of 2024 was in line with expectations, and the result was good considering the challenging market. Our net sales totalled €2,759.5 million, which represented a decrease of 2.4% year-on-year, or 5.5% in comparable terms. Our comparable operating profit amounted to €99.5 million. Kesko’s cost efficiency remained good, and our cash flow from operating activities was strong at €112.6 million. At the end of January, we completed the acquisition of one of Denmark’s leading building and home improvement trade operators Davidsen Koncernen A/S, thus expanding our operations to Denmark and gaining a solid foothold on the Danish building and home improvement trade market.

In the grocery trade division, net sales grew and operating profit was at a good level despite our actions towards favourable price levels. Net sales totalled €1,515.1 million, and the comparable operating profit amounted to €82.5 million. K Group's grocery sales grew by 3.3%. Online grocery sales grew by 19.9%, and accounted for some 4.1% of K Group’s grocery sales. Sales for the foodservice business grew by 0.7%, outpacing the market. Price inflation for groceries slowed down markedly in Finland, and stood at 0.6%. Consumption has become more polarised: on the one hand, price continues to be an important criterion, but on the other, consumers also emphasise quality and convenience. Our customer flows continued to grow thanks to campaigns.

In the building and technical trade division, operating profit declined as expected due to the weak cycle in construction in all our operating countries. Net sales totalled €963.6 million and the comparable operating profit amounted to €6.8 million. Overall, the development in net sales and operating profit was in line with expectations. In addition to the weak construction cycle, sales were impacted by the lower number of delivery days year-onyear, due to the timing of Easter, which had a negative impact of over €3 million on operating profit. The sales and profit of solar power products in particular fell short of the exceptional levels seen in the comparison period as a result of the energy crisis. The integration of Elektroskandia, acquired in Norway a year ago, has proceeded according to plans and will be completed this spring. In Sweden, the conversion of K-Rauta stores into K-Bygg stores is proceeding as planned, and will be completed by the end of the year. In Denmark, Davidsen has been part of Kesko since 1 February 2024. Kesko’s objective is to be among the leading sector operators not only in Finland and Norway, but also in Sweden and Denmark.

In the car trade division, net sales and profit were at a good level in the first quarter. Net sales totalled €286.2 million and the comparable operating profit amounted to €16.4 million. The order book for new cars grew from the end of 2023. Used car sales grew and our market share in used cars continued to strengthen. Development in service sales was also positive, and strong growth continued in our K-Lataus EV charging business.

Kesko’s net sales and operating profit are estimated to remain at a good level in 2024 despite the challenges in the company’s operating environment. We specify our profit guidance for the year, and now estimate that Kesko’s comparable operating profit in 2024 will be €620–700 million. The operating profit guidance adjustment is related to the weaker-than-anticipated outlook for construction in 2024.

KEY FIGURES IN JANUARY-MARCH:

-

Group net sales in January-March totalled €2,759.5 million (€2,828.0 million); reported net sales were down by 2.4%, comparable net sales by 5.5%

-

Comparable operating profit totalled €99.5 million (€125.9 million)

-

Operating profit totalled €97.2 million (€122.6 million)

-

Cash flow from operating activities totalled €112.6 million (€27.0 million)

-

Comparable earnings per share €0.16 (€0.22); reported earnings per share €0.15 (€0.21)

Kesko will publish its Q1/2024 interim report on Thursday, 25 April 2024, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time.

Below is a recap of key events and news for the quarter.

NEWS, FINANCIALS AND SHARES

-

Jorma Rauhala took over as Kesko’s new President and CEO on 1 February 2024.

-

Sami Kiiski was appointed as the new President of Kesko’s building and technical trade division as of 1 April 2024. Kiiski is currently the President of Kesko’s car trade division – Johanna Ali will assume the role of acting President of that division on 1 April, also joining the Group Management Board. (release)

-

Kesko’s CFO Jukka Erlund announced he would be leaving the company to join another employer. Erlund will exit the company by August at the latest. (release)

-

Kesko’s Annual General Meeting was held on 26 March. The AGM resolved to distribute dividends of €1.02 per share for 2023, to be paid in four instalments, and elected grocery retailer Pauli Jaakola as a new member of the Board of Directors. The Annual General Meeting was in favour of all proposals submitted by the Shareholders’ Nomination Committee and the Board of Directors. (release)

-

Kesko’s 2023 Annual Report – comprising a strategy and business review section, a sustainability section, financial statements and Review by the Board of Directors, a Corporate Governance Statement and Remuneration Report, and a data balance sheet section, was published on 1 March. (report)

-

Shares: Share-based commitment and incentive plans for Kesko’s management and key employees (new plan and realisation of old plans 30 Jan. and 8 Feb.), and changes in the holding of Kesko’s treasury shares (releases 15 March and 20 March).

SALES DEVELOPMENT

Sales figures for March will be released in mid-April.

DIGITALISATION AND CUSTOMER EXPERIENCE

-

Kesko’s Data Balance Sheet report for 2023 was published as part of Kesko’s Annual Report. The report details how Kesko utilises data and digitalisation to gain a competitive advantage, with focus on new digital services, infrastructure renewals, analytics and AI capabilities, and robotics. (report)

-

Kesko’s K-Hyvinvointi service, which utilises the customer’s grocery purchase data and AI to offer suggestions on healthier choices, received the GrandOne award in the ’Best use of data’ category. (more on the service)

SUSTAINABILITY

-

Kesko was ranked the best company in its sector on the 2024 ‘Global 100 Most Sustainable Corporations in the World’ listing by Corporate Knights. Overall, Kesko ranked 29th on the list, making a significant leap upward. Kesko is the only company in the world to have made the list every year since its inception in 2005. (release)

-

Kesko published an extensive Sustainability report as part of its 2023 Annual Report. Kesko is currently in the process of preparing for the shift in sustainability reporting brought on by the introduction of the EU Corporate Sustainability Reporting Directive. Kesko will be reporting under the CSRD framework from 2024 onwards. (report)

GROCERY TRADE

-

Kesko continues investments in its grocery store network by opening new K-Citymarket hypermarket stores in Kuopio and in Lempäälä near Tampere. (release)

-

Kesko also acquired two store site properties where it has previously been the main tentant. (release)

-

Kesko announced plans to withdraw from operating the Neste K service stations by the end of the year, as the role of grocery sales at the stations has diminished in recent years. The net sales for Kesko’s grocery trade division totalled €6,125 million in 2022, of which the 64 Neste K service stations accounted for €56 million. (release)

BUILDING AND TECHNICAL TRADE

-

Kesko completed the acquisition of Davidsen Koncernen A/S, the third biggest operator in the Danish building materials market, at the end of January 2024. Davidsen’s figures will be consolidated into Kesko’s reporting as of 1 February 2024. (release)

CAR TRADE

-

Used car sales growing, K-Auto to introduce many new all-electric models in 2024. Although the car trade market is expected to remain challenging in Finland in 2024, there are also positives for K-Auto. Used car sales continue to grow, and the service business is on a solid foundation. In the new car business, models coming out in Finland this year will include the all-electric Volkswagen ID.7 Tourer, Audi Q6 e-tron, CUPRA Tavascan and Porsche Macan, as well as an updated range of rechargeable hybrids. (release in Finnish)

All Kesko divisions generated good results in 2023. Our net sales for the year totalled €11,783.8 million, and our comparable operating profit €712.0 million. Our strong profitability shows that Kesko’s growth strategy and its successful execution in all three divisions have managed to yield results also in a more challenging operating environment. Our good ability to generate profits and our strong financial position enable investments in growth and also good dividend capacity. Kesko’s Board of Directors proposes to the Annual General Meeting that a dividend of €1.02 per share, in total nearly €406 million, be paid in four instalments.

In the grocery trade division, sales grew in both the grocery store business and the foodservice business. The good performance was based on our strong position in all areas of Finnish food trade. Kespro’s performance in 2023 was particularly strong. Improved purchasing power and slowing inflation have begun to have a positive impact on the market. Demand for premium products recovered in the second year-half. Campaigns and other marketing efforts strengthened our customer flows and sales. Tight price competition continued in Finnish grocery trade. Net sales for the division totalled € 6,351.6 million, up by 3.7%, and the comparable operating profit amounted to €444.8 million.

In the building and technical trade division, profitability remained good even though it declined year-on-year as construction activity and cycle weakened. Construction activity declined in all our operating countries due to inflation and rising interest rates. In the longer term, however, the outlook for building and technical trade is positive. Urbanisation, repair and infrastructure investment debt, infrastructure projects and the green transition sustain construction across cycles. We continued the determined execution of our growth strategy also in 2023, for example, by acquiring Elektroskandia in Norway and agreeing to acquire Davidsen, one of Denmark’s leading building and home improvement operators, thus expanding our operations to Denmark. The division’s net sales totalled €4,193.2 million, down by 8.7%, and its comparable operating profit amounted to €212.5 million.

In the car trade division, new car sales and the transformation of our operations have led to markedly improved profitability. Sales grew in all car trade business areas. New car deliveries grew clearly on the comparison period, and sales of used cars and services also increased markedly. Kesko’s car trade division today is a leading operator in the electrification of transport in Finland. The division’s net sales totalled €1,262.3 million, up by 13.9% in comparable terms, while the comparable operating profit totalled €82.6 million.

Kesko today is an efficient, profitable trading sector operator. Our good success acts as strong proof of the effectiveness of our strategy, which yields results also in a changing operating environment. Throughout the history of Kesko and K Group, our strength has been our ability to quickly adapt to our surroundings as necessary. A key objective for a listed company is to generate value for its shareholders. Over the past ten years, shareholder return – including the dividend suggested to be paid for 2023 – is approximately €8.3 billion. At the same time, we have paid total performance bonuses of some €308 million to our personnel.

I have had the privilege of leading Kesko for over nine years. My successor Jorma Rauhala will be heading a strong and modern international trading sector company that is set to continue to grow profitably also in years and decades to come. Kesko’s success has been built together. As I retire, I want to express my gratitude to all our customers, shareholders, the people of K Group, and our partners for their trust and collaboration over these past nine years.

FINANCIAL PERFORMANCE IN BRIEF - Q4:

-

Group net sales in October-December totalled €2,902.0 million (€2,983.4 million); reported net sales were down by 2.7%, or by 3.7% in comparable terms

-

Comparable operating profit totalled €170.5 million (€192.6 million)

-

Operating profit totalled €159.8 million (€191.2 million)

-

Cash flow from operating activities totalled €342.4 million (€263.0 million)

-

Comparable earnings per share €0.31 (€0.36); reported earnings per share €0.28 (€0.36

FINANCIAL PERFORMANCE IN BRIEF - FULL-YEAR 2023:

-

Group net sales in January-December totalled €11,783.8 million (€11,809.0 million); reported net sales were flat year-on-year, while in comparable terms net sales decreased by 0.8%

-

Comparable operating profit totalled €712.0 million (€815.1 million)

-

Operating profit totalled €695.4 million (€816.5 million)

-

Cash flow from operating activities totalled €1,049.5 million (€915.2 million)

-

Comparable earnings per share €1.28 (€1.54); reported earnings per share €1.25 (€1.53