Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

IR Blog - Recap of Kesko's key events in Q3/2024

Kesko will publish its Q3 interim report on Wednesday, 30 October 2024, at around 8.00 am Finnish time. An English audiocast/teleconference for investors and analysts will be held at 9.00 am Finnish time, and can be accessed here.

NEWS, FINANCIALS AND SHARES

-

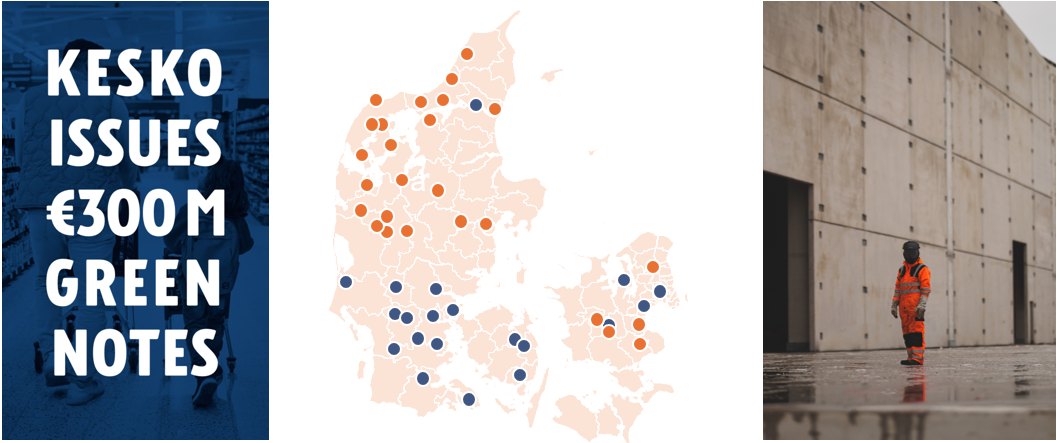

Kesko issues senior unsecured green notes of €300 million, with a maturity of approximately five years and four months (2 Feb. 2030). The notes carry a fixed annual interest of 3.500 percent, and the issue price is 99.317 percent. The issue date is expected to be 2 October 2024. The net proceeds are to be used for financing or refinancing eligible green projects or assets in accordance with the Green Finance Framework established by Kesko in May. (release)

-

Kesko agreed on a €150 million sustainability-linked loan with the Nordic Investment Bank (NIB), where the interest rate margin is tied to the attainment of specific sustainability targets. At the end of June 2024, over half of all Kesko loans were sustainability-linked. (release)

-

Composition of Kesko's Shareholders' Nomination Committee. (release)

-

Change in the holding of Kesko’s treasury shares. (release)

-

Presentation for Q3 investor roadshow meetings. (presentation)

SALES DEVELOPMENT

-

Kesko’s sales in July. (release)

-

Kesko’s sales in August. (release)

Sales figures for September will be released in mid-October.

SUSTAINABILITY

-

The new Onnela logistics centre in Finland is the biggest construction project in Kesko’s history and a key investment in future growth. Once completed, the 85,000 square metre facility will host Onninen's technical trade and K-Auto's spare parts logistics. As environmental aspects have been central to the project since the beginning, Kesko is able to use the green financing it has recently obtained to fund its €300 million investment. (blog post)

BUILDING AND TECHNICAL TRADE

-

Kesko is set to significantly increase its market share in Danish building and home improvement trade by acquiring three local operators. The combined net sales of the three companies total some €400 million, and once the acquisitions are completed, Kesko’s Danish subsidiary Davidsen will be a significant nationwide operator in Denmark’s builders’ merchant market with a total market share of some 20%. (release)

CAR TRADE

-

K-Auto completed the acquisition of Lohjan Auto. With net sales of €43.3 million in 2023, the company offers Volkswagen, Seat and Cupra sales, used car sales, and maintenance and body repair operations for Volkswagen Group car brands in Lohja and Tammisaari in Southern Finland. (release)