Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

”A company like no other” – November roadshow gave us the chance to talk to investors in North America

Kesko’s Chief Financial Officer Jukka Erlund and Vice President of Investor Relations Hanna Jaakkola went on an investor roadshow to North America in early November. This gave the Kesko team a chance to meet investors in Toronto, Boston and New York face-to-face and answer a wide range of questions concerning the company.

Kesko's CFO Jukka Erlund, DNB analyst Miika Ihamäki, and Kesko's VP of Investor Relations Hanna Jaakkola in between meetings in New York

Roadshows are typically organised in collaboration with banks, which handle practical arrangements and the agenda. This roadshow was organised with the Norwegian DNB, with the bank’s analyst taking part in most meetings. As is typically the case with investor roadshows, the timetable was packed, with five to six meetings per day and daily changing locations.

Is there another company Kesko could be compared to? As it turns out, not really

Investors in North America were clearly pleased to meet with the Kesko team face-to-face, and it was evident that interest towards Kesko has grown. Most meetings were with institutional investors with a long-term value approach, and consequently discussion focused more on the company’s long-term plans and potential rather than financials for the next quarter.

The investors were very well prepared and clearly already knew a lot about Kesko. Nonetheless, Kesko is such a unique company on a global scale that its combination of businesses raised many questions. Investors often ask us which companies Kesko could be compared to, but no other company in the world really combines grocery trade, building and technical trade, and car trade operations to the same extent as Kesko. Thus our team went over the changes in Kesko’s structure over the years, and especially the tightened business focus since the current growth strategy was adopted in 2015, which has seen Kesko divest non-core operations while at the same time engaging in acquisitions that have boosted the company’s growth and market shares.

The investor meetings took place in Toronto, Boston and New York

The investor meetings took place in Toronto, Boston and New York

How would you describe the culture in Kesko? How is the company able to retain people for such long careers? What is the most exciting aspect of your job? What keeps you up at night? Such questions are typical for North American investors, who want to get to really know the management and understand the company beyond its reported financials. On the other hand, Kesko’s representatives need to be able to provide insight on aspects that investors back home in Finland already know: What are Kesko’s grocery stores like? How about the building and home improvement stores? What exactly is the role of K-retailers and what is the division of labour between them and Kesko when it comes to running stores in K Group store chains.

Investors were also interested in Kesko’s capital allocation, including dividend distribution, acquisition targets and other investments and motives behind them. There were also questions regarding share buy-backs, a typically North American approach to profit distribution. Two of the investors our team met in Boston were fully ESG-focused: their questions were related to topics such as Kesko’s climate targets and circular economy efforts.

Kesko’s has a well-balanced ownership structure

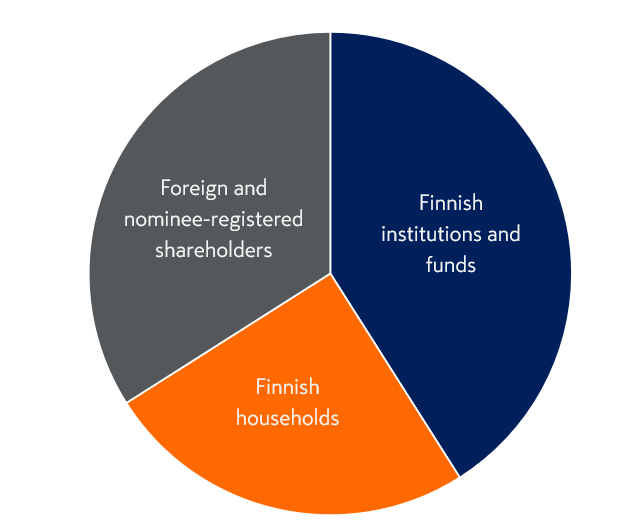

Kesko has a versatile, well-balanced ownership structure. At the end of October, Finnish institutions and funds held some 41% of all shares in Kesko, and Finnish households some 25%. Foreign and nominee-registered investors held some 34% of all shares and 49% of Kesko B shares.

Breakdown of Kesko ownership at the end of October 2023

Like many Finnish listed companies, Kesko has seen its foreign ownership decrease slightly this year. Foreign ownership is important for Kesko, as it supports the stock.

Foreign investors tend to appreciate both Kesko’s free float as well as the stable anchor investor the company has in K-Retailers’ Association. During the roadshow, we were also happy to be able to inform the investors that, for the first time ever, the number of Finnish retail investors owning shares in Kesko rose above 100,000 in October, proving that the people who shop at Kesko stores also have faith in the company’s success.

See the roadshow presentation!