Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

President and CEO: Kesko posted a good Q1 result in a weakened economic situation

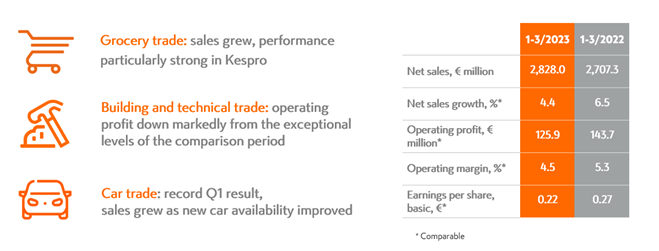

Kesko’s result in the first quarter of 2023 was good despite a weaker operating environment. Our net sales grew by 4.4% in comparable terms, totalling €2,828.0 million. Our comparable operating profit totalled €125.9 million. Our good strategy and its successful execution in all business divisions as well as strong transformation are yielding results.

Profitability for the grocery trade division was good in the first quarter. The division’s net sales totalled €1,495.0 million, growing by 8.2%, while the comparable operating profit rose by €3.6 million to €83.9 million. Profit improved especially due to good progress in the foodservice business: Kespro’s net sales grew by 28.0%. The division’s profitability was good, with a comparable operating margin of 5.6%. Rising food prices are impacting customers’ shopping, as reflected in e.g. the growing popularity of private label and campaign products. Customer flows have grown. The basis for good progress in our grocery trade division is our strong position in all areas of Finnish food trade.

In the building and technical trade division, net sales decreased by 4.4% in comparable terms, totalling €1,074.7 million. The division’s comparable operating profit amounted to €32.6 million, down by €29.0 million from the very exceptional levels of the comparison period. In spring 2022, customers stockpiled products due to availability concerns caused by Russia’s offensive war and rapidly rising prices. However, results for the building and technical trade division have multiplied since 2019, i.e. the last regular year before the pandemic and war in Ukraine. In technical trade, Onninen’s sales were at a good level. Demand was particularly strong for products related to the green transition and to improving energy efficiency. In building and home improvement trade, sales declined especially in B2C trade, with demand decreasing also in B2B trade. During the quarter, we continued acquisitions in line with our strategy by acquiring Elektroskandia Norge AS, thus strengthening Onninen’s market leading position in the Norwegian utility wholesale sector. In Sweden, we acquired the solar power system wholesaler Zenitec Sweden AB.

In the car trade division, sales grew in all business segments. The division’s net sales were up by 27.2% as the availability of new cars improved, and totalled €264.8 million. The division’s comparable operating profit totalled €16.9 million, representing an increase of €7.0 million. The operating margin was 6.4%, thanks to growth in sales and the transformation and efficiency improvement measures taken. Sami Kiiski was appointed as the new division President and a member of Group Management Board as of 1 June 2023.

Kesko’s outlook for 2023 is positive. Transformation and strategy execution have improved our profit-making ability. We repeat our profit guidance and estimate that Kesko’s comparable operating profit in 2023 will be in the range of €680-800 million.

KEY FIGURES IN 1-3/2023:

-

Group net sales in January-March totalled €2,828.0 million (€2,707.3 million), an increase of 4.4% in comparable terms, reported net sales grew by 4.5%

-

Comparable operating profit totalled €125.9 million (€143.7 million), Comparable operating profit decreased by €17.9 million.

-

Operating profit totalled €122.6 million (€144.6 million)

-

Comparable earnings per share €0.22 (€0.27)

-

Reported Group earnings per share €0.21 (€0.26)