Building and technical trade strategy

The building and technical trade division operates in 8 countries: Finland, Sweden, Norway, Estonia, Latvia, Lithuania, Poland and Denmark*. In the Baltics and Belarus, building and home improvement trade operations are handled by the joint venture Kesko Senukai. The division has some 500 stores and offers extensive online services via its chains: Onninen serves technical trade customers, while K-Rauta, Byggmakker and K-Bygg and Davidsen serve professional builders and consumers.

* Davidsen acquisition was completed in January 2024.

Strategic focus areas

- Profitable growth both organically and through M&A. Winning market share in all operating countries.

- Due to the low cycle in the construction market, our focus is on securing profitability and cash flow generation. Improving profitability: the long-term strategic target of a 6-8% operating margin is still valid.

- Finland continues winning market share. Continue growing K-Rauta’s market share through store-specific business ideas, focusing on growth centres. Continue improving Onninen’s market share by increasing the sales of green transition products, growing the store network and improving customer-focused digital solutions.

- Sweden stabilising business performance: Execution of conversion of K-Rautas to K-Byggs to create a solid platform for profitable growth in building and home improvement trade. Looking for suitable acquisition targets to achieve economies of scale.

- Norway implementing business performance improvement programme: Boosting Byggmakker’s performance and growth to drive EBIT improvement. Finalising the Onninen-Elektroskandia integration and executing according to the business case.

- Denmark driving growth and improving margins: Organic growth as well as executing M&As and ensuring their successful integration.

- All countries: Proactive sales, margin and cost management, digital solutions to drive efficiency and customer experience.

Megatrends in operating environment

Economic cycle

- The cycle is expected to turn in 2025

- Interest rates and the ability to invest

- Market environment creates possibilities for industry consolidation

Green transition

- Growing demand for energy boosts the market for energy solutions

- Increasing investments in energy infrastructure

- Fast development of technologies related to the green transition

Renovation

- High underlying demand for renovation and technical infrastructure investments

- Need for renovation growing steadily

Urbanisation

- Urbanisation driving the need for construction

- Growing need for infrastructure investments, e.g. electric grid, water and sewage

Digitalisation and technologization

- Increasing use of smart technical solutions in building and construction

- Technological transformation

- Digitalisation and AI improving efficiency and customer service

Kesko organised an investor event on Tuesday, 4 June 2024. At the event, President and CEO Jorma Rauhala and other members of Kesko’s top management presented the company’s updated strategy and focus areas for the three business divisions. The event was held in English. Watch the recording and related materials here.

Read more about the country specific achievements and strategy in Kesko's Annual Report.

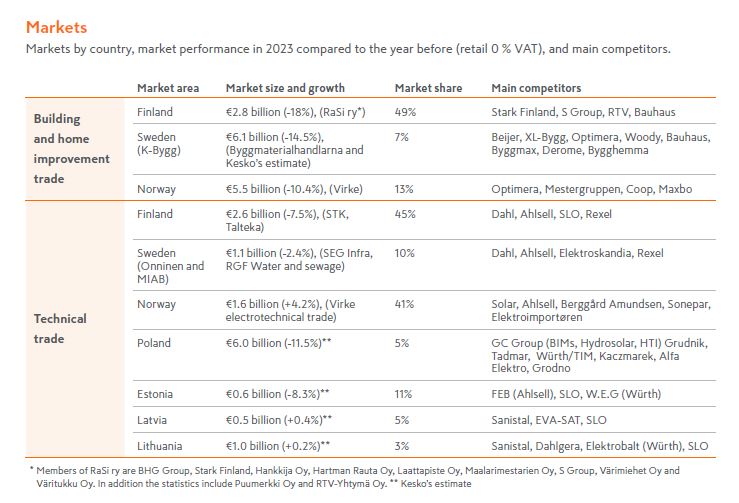

Markets

Outlook and activity for the building and technical trade division weakened markedly in 2023 due to inflation and rising interest rates. New residential building – which accounts for some 20-30% of the total construction market depending on the country – declined particularly significantly. The decline was softer for other forms of construction, such as renovation building. B2C trade declined less than B2B trade.

However, in the long term, the total construction market is supported by renovation building, construction related to energy efficiency and the green transition, urbanisation and changes in population structure in Northern Europe. Building and construction becoming increasingly technical, tightening requirements, and growing infrastructure investment debt will also support construction.

The total market for our current building and technical trade business in our market areas was some €32 billion in 2023.

Growth potential via acquisitions

The Northern European market continues to offer good possibilities for growth also in the form of acquisitions. The building and technical trade markets are fragmented in many of our Northern European operating countries, and thus there is excellent potential to continue active sector consolidation. Currently our market shares are still relatively low in e.g. Sweden and Poland, which means excellent potential for continued growth also via acquisitions in line with our strategy. Denmark also holds further potential for us in both building and home improvement trade and technical trade.

Data based on Kesko’s estimates.

|

K Group’s building and technical trade |

Number of stores |

Retail and B2B sales, VAT 0%, € million |

||

|

2024 |

2023 |

2023 |

Change, %* |

|

|

K-Rauta, Finland |

122 |

122 |

1,080.5 |

-3.1 |

|

K-Rauta B2B Service, Finland |

- |

- |

214.9 |

-16.2 |

|

Technical trade, Finland |

60 |

58 |

1,107.5 |

-8.3 |

|

Finland total |

182 |

180 |

2,402.9 |

-6.8 |

|

K-Bygg, Sweden |

56 |

50 |

348.7 |

-5.1 |

|

Technical trade, Sweden |

5 |

5 |

124.3 |

-7.0 |

|

Byggmakker, Norway |

90 |

90 |

602.0 |

-8.3 |

|

Technical trade, Norway |

26 |

29 |

537.6 |

-6.7 |

|

|

23 |

- |

414.0 |

-5.3 |

|

Technical trade, Baltia |

18 |

18 |

127.2 |

-1.5 |

|

Technical trade, Poland |

30 |

33 |

367.8 |

9.2 |

|

Other countries, total |

248 |

242 |

2,521.5 |

-4.4 |

|

Kesko Senukai |

61 |

61 |

1,194.1 |

1.5 |

|

Building and technical trade, total |

491 |

483 |

6,118.5 |

-4.3 |

|

In addition, building and technical trade stores offer e-commerce services to their customers. |

||||

|

Key figures |

|

2024 |

2023 |

|

|

Net sales, € million |

4,351.6 |

4,193.2 |

||

|

Building and home improvement trade |

2,160.7 |

1,912.1 |

||

|

Technical trade |

2,255.0 |

2,344.7 |

||

|

Operating profit, comparable, € million |

169.1 |

212.5 |

||

|

Building and home improvement trade |

57.9 |

65.0 |

||

|

Technical trade |

90.5 |

128.5 |

||

|

Kesko Senukai |

20.9 |

19.0 |

||

|

Operating margin, comparable, % |

3.9 |

5.1 |

||

|

Building and home improvement trade |

2.7 |

3.4 |

||

|

Technical trade |

4.0 |

5.5 |

||

|

Return on capital employed, comparable, % |

7.8 |

11.4 |

||

|

Capital expenditure, € million |

293.7 |

273.0 |

||

|

Personnel, average |

6,538 |

6,073 |

||

|

Properties |

|

2024 |

2023 |

|

|

Owned properties, capital, € million |

|

248 |

181 |

|

|

Owned properties, area, 1,000 m² |

|

356 |

242 |

|

|

Leased properties, area, 1,000 m² |

|

869 |

852 |

|