Building and technical trade strategy

The building and technical trade division operates in 8 countries: Finland, Sweden, Norway, Estonia, Latvia, Lithuania, Poland and Denmark*. In the Baltics and Belarus, building and home improvement trade operations are handled by the joint venture Kesko Senukai. The division has some 500 stores and offers extensive online services via its chains: Onninen serves technical trade customers, while K-Rauta, Byggmakker and K-Bygg and Davidsen serve professional builders and consumers.

* Davidsen acquisition was completed in January 2024.

Strategic focus areas

Our strategic objective is to gain an even stronger position in building and technical trade in Northern Europe, especially in B2B trade.

Business environment in Northern Europe

-

Market consolidation

-

Growing need for renovation and infrastructure investment debt

-

Green transition and energy-efficiency requirements growing the market

-

Outsourcing construction to professionals

-

Technology and digital becoming increasingly important for the customer journey

Strategic objectives

-

Our strategic objective is to gain an even stronger position in building and technical trade in Northern Europe, especially in B2B trade

-

Country focus with country-specific strategic actions, serving three customer segments according to their specific needs

-

Proactive sales work and sales management

-

Improving the digital customer experience

-

Utilising synergies within and between countries

-

Organic growth and profitability improvement, targeted acquisitions

-

Measures to meet our ambitious sustainability goals

Year 2023

Construction activity weakened

Kesko continues to strengthen its leading position in building and technical trade in Northern Europe through executing country-specific strategies.

The business is divided into technical trade and building and home improvement trade. In 2023, demand for both decreased in all operating countries as construction volumes declined. Net sales decreased by 8.7% to €4,193.2 million. The division’s comparable operating margin was 5.1%. Of the net sales, 50% came from outside Finland. Profitability remained good despite the weakened market.

Net sales for technical trade totalled €2,344.7 million, and operating profit decreased in all operating countries apart from Norway. Technical trade, i.e. Onninen, is 100% directed at professionals: technical contractors, industry, infrastructure builders, and retailers. Onninen’s business is Kesko’s own retailing.

Combined, B2B customers in technical trade and building and home improvement trade accounted for over 80% of the division’s sales. Sales in B2B trade decreased as especially new building construction activity weakened during the year. Decline in renovation building was less pronounced, and renovation building accounted for over half of the division’s sales. A considerable share of the decrease in sales was attributable to solar power products, which saw a significant sales uptick in the comparison period due to a rapid rise in electricity prices.

Net sales for building and home improvement trade totalled €1,912.1 million, comparable operating profit decreased. Building and home improvement trade serves both B2B customers (two-thirds of retail sales) and consumers (one-third). Kesko’s building and home improvement chains are K-Rauta, K-Bygg and Byggmakker. In the Baltics and Belarus, building and home improvement trade operations are handled by the joint venture Kesko Senukai. The K-Rauta stores in Finland are run by K-retailer entrepreneurs.

The key to our strategy execution is to address the differing needs of our three customer segments: B2B customers in technical trade, and B2B and B2C customers in building and home improvement trade. We strive to offer a seamless customer experience in all channels. We actively seek synergies within and between our operating countries, for example, in purchasing and concept, digital service and own brand development.

We continued acquisitions in line with our strategy in 2023. In August, we announced the acquisition of one of Denmark’s leading building and home improvement trade operators Davidsen Koncernen A/S. The deal was completed on 31 January 2024. We will thus be expanding our operations to Denmark, and gaining a solid foothold on the local building and home improvement trade market. In spring 2023, we completed the acquisition of Elektroskandia Norge AS, strengthening Onninen’s leading position on the Norwegian electrical wholesale market. We also acquired the builders’ merchant Geitanger Bygg AS in Norway, and the Swedish solar power system wholesaler Zenitec Sweden AB. We continue to see growth potential especially in B2B trade in Scandinavia.

Read more about the country specific achievements and strategy in Kesko's Annual Report.

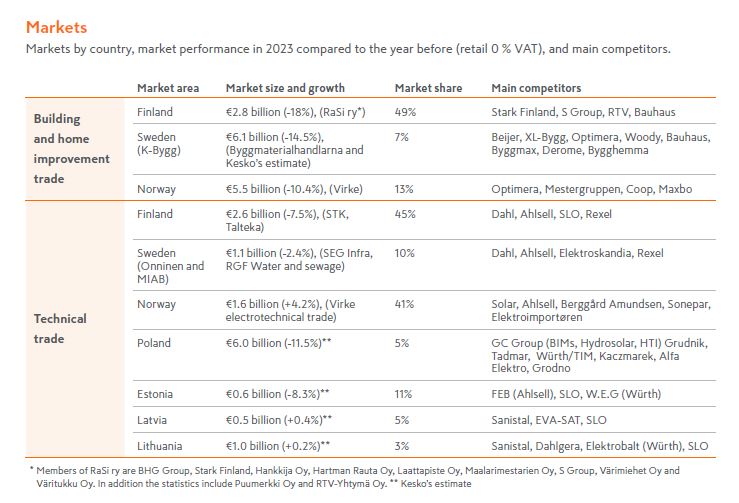

Markets

Outlook and activity for the building and technical trade division weakened markedly in 2023 due to inflation and rising interest rates. New residential building – which accounts for some 20-30% of the total construction market depending on the country – declined particularly significantly. The decline was softer for other forms of construction, such as renovation building. B2C trade declined less than B2B trade.

However, in the long term, the total construction market is supported by renovation building, construction related to energy efficiency and the green transition, urbanisation and changes in population structure in Northern Europe. Building and construction becoming increasingly technical, tightening requirements, and growing infrastructure investment debt will also support construction.

The total market for our current building and technical trade business in our market areas was some €32 billion in 2023.

Growth potential via acquisitions

The Northern European market continues to offer good possibilities for growth also in the form of acquisitions. The building and technical trade markets are fragmented in many of our Northern European operating countries, and thus there is excellent potential to continue active sector consolidation. Currently our market shares are still relatively low in e.g. Sweden and Poland, which means excellent potential for continued growth also via acquisitions in line with our strategy. Denmark also holds further potential for us in both building and home improvement trade and technical trade.

Data based on Kesko’s estimates.

|

K Group’s building and technical trade |

Number of stores |

Retail and B2B sales, VAT 0%, € million |

|

|

2023 |

2023 |

Change, %* |

|

|

K-Rauta, Finland |

122 |

1,114.9 |

-12.9 |

|

K-Rauta B2B Service, Finland |

- |

256.3 |

-22.8 |

|

Technical trade, Finland |

58 |

1,207.8 |

-6.3 |

|

Finland total |

180 |

2,579.0 |

-11.1 |

|

K-Rauta, Sweden |

17 |

149.9 |

-21.0 |

|

K-Bygg, Sweden |

50 |

284.8 |

-25.5 |

|

Technical trade, Sweden |

5 |

133.7 |

-14.2 |

|

Byggmakker, Norway |

90 |

656.3 |

-21.3 |

|

Technical trade, Norway |

29 |

594.5 |

-9.9 |

|

Technical trade, Baltia |

18 |

129.1 |

-1.2 |

|

Technical trade, Poland |

33 |

336.8 |

-3.8 |

|

Other countries, total |

242 |

2,285.2 |

-15.4 |

|

Kesko Senukai |

61 |

1,176.9 |

-3.6 |

|

Building and technical trade, total |

483 |

6,041.1 |

-11.5 |

|

In addition, building and technical trade stores offer e-commerce services to their customers. Three Onninen stores in Finland operate on the same store premises with K-Rauta. |

|||

|

Key figures |

2023 |

2022 |

|

|

Net sales, € million |

4,193.2 |

4,591.1 |

|

|

Building and home improvement trade |

1,912.1 |

2,377.2 |

|

|

Technical trade |

2,344.7 |

2,286.2 |

|

|

Operating profit, comparable, € million |

212.5 |

323.8 |

|

|

Building and home improvement trade |

65.0 |

127.5 |

|

|

Technical trade |

128.5 |

173.7 |

|

|

Kesko Senukai |

19.0 |

20.9 |

|

|

Operating margin, comparable, % |

5.1 |

7.1 |

|

|

Building and home improvement trade |

3.4 |

5.4 |

|

|

Technical trade |

5.5 |

7.6 |

|

|

Return on capital employed, comparable, % |

11.4 |

19.1 |

|

|

Capital expenditure, € million |

273.0 |

108.2 |

|

|

Personnel, average |

6,073 |

5,871 |

|

|

Properties |

2023 |

2022 |

|

|

Owned properties, capital, € million |

181 |

175 |

|

|

Owned properties, area, 1,000 m² |

242 |

252 |

|

|

Leased properties, area, 1,000 m² |

852 |

883 |

|